TruCrowd Real Estate: History, Failures, Lessons & Modern Crowdfunding Insights

The phrase “TruCrowd real estate” refers to real estate deals that once used TruCrowd’s crowdfunding portal as a launchpad. TruCrowd, a U.S. equity crowdfunding platform, had allowed real estate issuers to raise capital from investors through its marketplace. Over time, TruCrowd faced serious regulatory, operational, and reputational challenges ultimately ceasing operations.

In this article, we will examine in depth: how TruCrowd operated with real estate offerings; the controversies and legal challenges; what led to its shutdown; lessons for investors and sponsors; modern real estate crowdfunding alternatives; real-world use cases; benefits of technology in this context; and finally FAQs. By understanding the full arc of “TruCrowd real estate,” you gain insight into both pitfalls and possibilities in real estate crowdfunding.

The Origin and Operation of TruCrowd in Real Estate

How TruCrowd Functioned as a Funding Portal

TruCrowd was a registered funding portal in the United States, operating under the regulatory regime for equity crowdfunding (often under Regulation Crowdfunding). The platform enabled startups, real estate projects, and other venture-type issuers to present securities offers to a broad set of investors (including non-accredited investors, subject to rules).

Real estate developers could use TruCrowd to host offerings where they would offer equity or membership interests in companies owning or acquiring property. Investors would review offering materials, financial projections, property details, and risk disclosures on the TruCrowd interface. The portal facilitated the investor-issuer connection, document storage, permissions, and compliance mechanics.

TruCrowd also ran a vertical called Fundanna (a cannabis / real estate related portal). Some real estate deals tied to cannabis or hemp real estate were also hosted via this channel.

TruCrowd claimed to provide features like virtual data rooms, intellectual property protection layers, investor verification, and campaign tools to issuers. However, the platform’s practical execution and oversight became controversial in later years.

Real Estate Projects via TruCrowd: Structure and Features

In real estate offerings on TruCrowd, the basic structure was:

- A developer or sponsor forms an entity (LLC, limited partnership, or special purpose vehicle) which would own or develop property.

- That entity issues securities—equity shares or membership units—to investors via the crowdfunding portal.

- Investors gain rights proportionate to their investment: such as shares of income (if distributable), share in proceeds at exit, voting or governance rights (depending on the offering documents).

- Project documentation would include: property description, location, market analysis, rental or income assumptions, cost estimates, expense projections, timeline, exit assumptions, and risk disclosures.

- The sponsor handles property acquisition, construction or rehabilitation, leasing and operations, then eventual exit through sale, refinancing, or restructuring, distributing returns to investors.

Because the portal was open to non-accredited investors (within limits), real estate issuers could access a wider investor base than traditional private equity models. But that openness also introduced higher regulatory scrutiny and enforcement risk.

The Regulatory Troubles and Decline of TruCrowd

SEC Enforcement and Fraud Allegations

One of the key turning points for TruCrowd was its entanglement with U.S. Securities and Exchange Commission (SEC) enforcement actions. In 2021, the SEC charged TruCrowd and its CEO with involvement in fraudulent offerings tied to two entities: Transatlantic Real Estate LLC and 420 Real Estate LLC. The complaint alleged that these offerings raised nearly $2 million from investors but were not used for the purposes described. Instead, funds were allegedly diverted for personal use.

The SEC further asserted that TruCrowd failed to properly vet these offerings, ignored red flags such as the criminal history of one principal involved, and did not act to reduce risk or remove offerings once concerns were evident. TruCrowd and its CEO settled, paying disgorgement, interest, civil penalties, and consenting to restrictions without admitting or denying allegations. (References: SEC press release)

These enforcement actions damaged TruCrowd’s credibility. Investors and regulators began to question whether the portal had functioned adequately as a gatekeeper, or whether it had allowed misleading or fraudulent real estate offerings to persist.

Shutdown and Cessation of Operations

By January 2025, TruCrowd announced that it would formally cease operations. The platform posted a notice apologizing to users, stating that it could no longer continue offering its services. Existing investors were told to contact the individual issuers of their investments, as those issuer entities retained their investor records and ongoing responsibilities.

Part of the reason for shutdown included that TruCrowd had been under a statutory disqualification by FINRA, limiting its ability to perform certain functions. Coupled with regulatory burdens and reputation damage, the portal reached a critical impasse. (Sources: media coverage, Crowdfund Insider)

The closure of TruCrowd underscores a harsh reality: crowdfunding portals, particularly those hosting real estate or complex deals, operate in a fragile environment of regulation, reputation, and operational risk.

Lessons Learned from the TruCrowd Real Estate Experience

Platform Risk Is Real

One of the primary lessons is that the platform itself constitutes a risk. Even if an individual real estate project is well-conceived, if the platform fails, becomes non-functional, or faces enforcement, investors may lose visibility, support, and recourse. The collapse or shutdown of a portal can leave investors scrambling to communicate with issuers and retrieve information.

Need for Rigorous Due Diligence on Issuers and Projects

TruCrowd’s downfall partly resulted from insufficient scrutiny: red flags were ignored, principals with criminal backgrounds participated, and offerings lacked transparency. For modern investors, this reinforces that due diligence must go beyond surface documentation. Look for independent vetting, historical performance, financial conservatism, disclosure of potential conflicts, and stress testing of assumptions.

Regulatory Compliance Must Be a Core Pillar

Crowdfunding portals must maintain strong compliance with securities laws, disclosure rules, “bad actor” provisions, audit frameworks, and investor protection mandates. TruCrowd’s regulatory failures demonstrated how noncompliance can trigger enforcement, penalties, and irreversible damage.

Transparency, Reporting, and Communication Are Essential

A key failure in many troubled platforms is lack of ongoing updates, weak reporting, and hiding negative developments. Real estate crowdfunding must commit to frequent investor communication: monthly or quarterly reports, variance explanations, tenant occupancy rates, expense overrun warnings, timeline delays, etc.

Diversification as a Protection Mechanism

Given the possibility of issuer or platform failure, investors should spread risk across multiple projects, issuers, property types, geographies, and platforms. This way, the failure of one project or portal has less devastating impact on overall portfolio.

Modern Real Estate Crowdfunding Alternatives & Examples

Though TruCrowd is defunct, the concept of real estate crowdfunding is alive though in more robust and regulated forms. Below are example platforms or models (not as “products” but as use-case analogues), and how they address challenges that TruCrowd faced.

Example 1: Crowded Real Estate (U.S.)

Crowded Real Estate focuses exclusively on real estate projects, offering equity crowdfunding for property ventures. It allows both accredited and (in some offerings) non-accredited investors to participate. The platform provides project listings with documentation, due diligence support, and structured investor relations.

This platform addresses the TruCrowd weakness by specializing strictly in real estate, developing domain expertise, and focusing on deeper vetting of property issuers and project metrics. It aims for greater transparency, better matching of investor expectations, and stricter issuer onboarding than generalist portals.

Example 2: Exporo (Germany)

Exporo is a European real estate crowdfunding portal that allows investors to support development or acquisition projects in Germany and other European markets. Investors receive return projections, project updates, and dashboards tracking progress.

Exporo’s model highlights how regional focus, regulatory alignment, and local real estate expertise can create a more stable and trusted platform unlike TruCrowd’s more scattershot approach across sectors like cannabis and real estate.

Example 3: Prodigy Network (International Real Estate Crowdfunding)

Prodigy Network has enabled small investors to take part in large real estate ventures hotels, co-working, luxury residential projects in the U.S. and globally. Its model requires strict sponsor screening, financial commitments, and legal structuring.

Prodigy’s model shows how real estate crowdfunding can scale when standards, legal frameworks, and sponsor accountability are strong. It contrasts with cracks in the TruCrowd model where oversight and sponsor integrity were weaker.

Example 4: RealtyMogul / CrowdStreet (U.S. Institutional Crowdfunding)

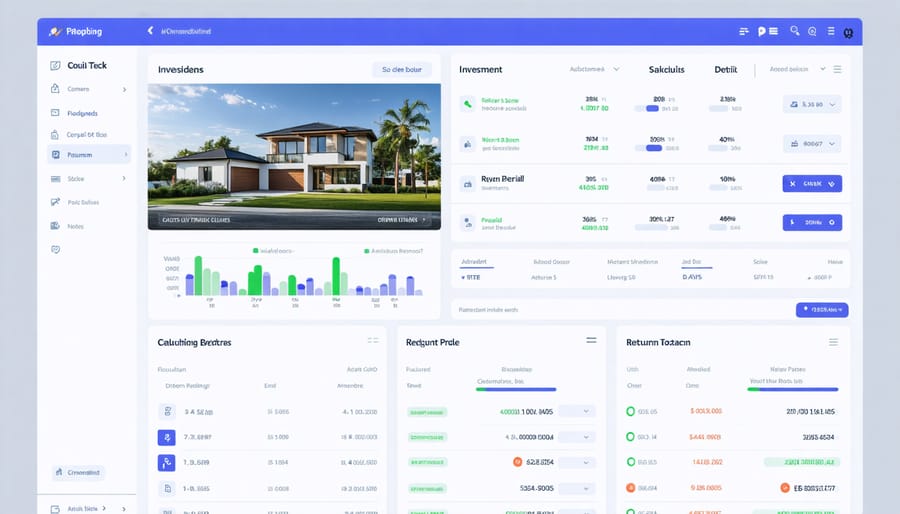

Insert image of a commercial real estate deal page

Platforms like RealtyMogul or CrowdStreet operate in a more institutional style of real estate crowdfunding, focusing on accredited investors and larger projects. They emphasize deep due diligence, robust sponsor reviews, transparency, reporting, and legal investor protections.

These platforms illustrate the path forward: real estate crowdfunding that leans toward institutional rigor, risk controls, and sustainable models rather than the more margin-pressured, generalist approach that TruCrowd had attempted.

Benefits of Using Technology in Real Estate Crowdfunding Models

Digital Access and Scalability

Technology allows real estate crowdfunding platforms to scale operations, hosting many projects, managing investor onboarding, documentation, and compliance in digital formats. Platforms can support hundreds or thousands of deals across geographies, with centralized data, rather than manual processes.

Investors can browse offerings, download investor packets, watch video presentations, and submit documentation entirely online. This lowers friction, increases accessibility, and expands reach.

Automated Screening, Analytics & Risk Tools

Modern platforms embed automated systems: scoring models, risk flagging, fraud detection, issuer background checks, financial modeling tools, and data validation. This helps reduce human error, speed up due diligence, and improve selection of higher-quality projects.

Analytical dashboards allow investors to stress-test assumptions (e.g. vacancy, cost overruns, rent shortfalls) and simulate downside scenarios. Real-time updates—tenant changes, expense variances, timeline shifts—can be tracked.

Portfolio Aggregation & Diversification Tools

Technology supports portfolio-level management: aggregating multiple project investments, analyzing allocations, visualizing concentration risks, calculating internal rates of return (IRR) and cash-on-cash returns across holdings. Investors can see which sectors or geographies they are overweight in and rebalance.

Some platforms offer “automated portfolios” or allocation engines that distribute funds across multiple projects to diversify risk, without requiring manual selection.

Enhanced Investor Communication & Transparency

Because all documentation and reports are digital, investors can frequently receive updates, performance metrics, variance reports, photos, video walkthroughs, and audited results. Platforms can push alerts and communicate quickly when a project faces issues (e.g. delays, cost overruns).

This continuous communication mitigates the information asymmetry issue that was a weakness in intermediaries like TruCrowd.

Lower Costs and Efficiency Gains

Automating compliance, document handling, investor record-keeping, and accounting reduces operational overhead. Platforms can operate leaner while maintaining regulatory guardrails. This makes crowdfunding real estate more economically viable, especially for smaller deals that previously would have been unprofitable to manage manually.

Use Cases: Problems Solved & Real-Life Applications

Use Case A: Small Investors Seeking Exposure to Commercial Real Estate

Many small investors lack capital, expertise, or ability to manage property themselves. Real estate crowdfunding enables them to invest modest sums into commercial projects (e.g. $1,000 to $50,000), spreading risk over multiple deals rather than putting all in one property.

Use Case B: Developers Seeking Capital Flexibility

Real estate developers often struggle to secure enough equity or debt financing, especially for niche or experimental projects. Crowdfunding gives them access to a broader pool—retail, accredited, or semi-retail investors—to raise capital outside traditional channels.

Use Case C: Geographic and Sector Diversification

Investors confined to local markets can use crowdfunding to invest in high-growth markets elsewhere. For example, someone in Southeast Asia could invest in U.S. logistics properties, beachfront hotels, or European redevelopment projects diversifying their portfolio.

Use Case D: Income Generation & Passive Cash Flow

Investors looking for alternative income sources beyond equities or bonds can gain from periodic distributions from property operations (rent, lease income). This helps build passive income streams.

Use Case E: Tactical Sector Exposure

If one believes, for instance, that demand for industrial logistics or self-storage will rise, crowdfunding allows targeted exposure to that sector via select deals instead of general real estate funds.

How to Safely Evaluate Real Estate Crowdfunding Projects (Lessons from TruCrowd)

To avoid pitfalls similar to TruCrowd’s, follow these evaluation strategies:

- Platform Due Diligence: Verify regulatory registration, enforcement history, compliance records, and how rigorously the platform vets issuers.

- Sponsor & Issuer Track Record: Look for experienced developers, completed projects, financial transparency, and clean backgrounds.

- Detailed Financial Modeling: Evaluate assumptions for rent growth, expense escalation, vacancy risk, capital budgets, and sensitivity analyses across downside scenarios.

- Clear Exit Strategy: Ensure the offering includes a realistic path to liquidity (sale, refinancing, disposition) and time horizon.

- Investor Protection Provisions: Check for priority rights, preferences, clawbacks, audit rights, and governance structures.

- Transparency & Reporting Commitments: The project should commit to regular updates, audited reports, and open communication when things deviate from plan.

- Diversification Strategy: Avoid putting a large portion of capital into single projects or a single platform. Spread across sectors, geographies, and deal types.

- Stress Testing Downside Outcomes: Ask how returns look in pessimistic scenarios (e.g. rent drops, cost overruns, delays) and whether the sponsor or platform still stands behind capital protection mechanisms.

Summary & Final Reflections

TruCrowd real estate serves as a cautionary tale in the evolution of crowdfunding and property investing. Although the platform once enabled issuers to host real estate deals for broader investor participation, regulatory challenges, fraud allegations, platform risk, and operational fragility led to its collapse.

From TruCrowd’s story, modern investors and platforms can learn critical lessons: the importance of platform integrity, rigorous due diligence, regulatory compliance, transparency, and diversification. Today, real estate crowdfunding still holds strong promise when executed responsibly. Platforms dedicated exclusively to property, leveraging technology, rigorous screening, and stakeholder accountability represent the next generation of opportunity.

If you like, I can rework this article into a version ready for publication (with subheads, shorter paragraphs, meta tags), or I can craft a version tailored to real estate crowdfunding in your country/context. Would you like me to do that?

FAQ

Q1: Is TruCrowd still operating real estate crowdfunding deals today?

No, TruCrowd formally ceased operations as of early 2025. The platform no longer hosts new offerings or maintains active investor services. Investors are advised to contact issuers directly regarding past investments. (Source: closure announcement)

Q2: What were the main failures that led to TruCrowd’s collapse?

Key failures included weak vetting of issuers, ignoring red flags (such as criminal histories), regulatory noncompliance, litigation and SEC enforcement, reputational damage, platform disqualification, and inability to sustain trust and operational viability.

Q3: Can modern real estate crowdfunding succeed where TruCrowd failed?

Yes—if platforms emphasize strict compliance, strong vetting, transparency, regular reporting, robust platform governance, and risk mitigation tools. Lessons from TruCrowd’s mistakes can guide better design of future platforms.