Top Sites Like Fundrise: Best Real Estate Crowdfunding Alternatives in 2025

Many investors look for sites like Fundrise platforms that let individuals invest in real estate projects with lower capital, either through equity, debt, or hybrid offerings. In this article, we explore how Fundrise works briefly, then dive into top alternative platforms, compare their features, examine real examples, explain technology’s role, review benefits, use cases, and answer frequently asked questions. This comprehensive guide will help you evaluate which platform might suit your real estate investing goals.

Why Look for Sites Like Fundrise?

Fundrise is among the most recognized real estate crowdfunding platforms, especially because it allows non-accredited investors to access private real estate opportunities. Its low minimums, fund structures, and easy user interface make it a benchmark. However, it is not perfect for everyone. Some reasons investors search for alternatives include:

- Desire for different property types or geographies than what Fundrise currently offers

- Interest in higher control or selection of individual projects

- Differences in fees, liquidity, or payout structures

- Preference for platforms specialized in debt, development, or niche real estate verticals

- Need for platforms that accept only accredited investors with more sophisticated deals

By comparing other platforms, you can diversify risk and pick features that align with your strategy.

Key Alternatives to Fundrise

Here are real platforms that serve as alternatives to Fundrise. Each has unique strengths, target audiences, and investment models.

RealtyMogul

RealtyMogul is a long-standing real estate crowdfunding platform that offers both real estate funds and individual property investments. It supports both accredited and non-accredited investors, depending on the offering. It functions as a hybrid between a marketplace and managed funds.

Key details:

- Offers REITs or private individual deals

- Minimum investments often start higher than Fundrise’s low threshold

- Emphasizes commercial real estate office, multifamily, industrial

Why relevant: RealtyMogul gives investors access to more project variety. If Fundrise’s offerings don’t match your preferences, RealtyMogul may provide better fit in particular sectors or deal structures (e.g. preferred equity, equity splits).

CrowdStreet

CrowdStreet is focused on commercial real estate and typically works with accredited investors. It lists individual commercial deals rather than pooled funds, giving more control to investors who want selectivity.

Key details:

- Sophisticated commercial deals in office, industrial, multifamily

- Higher minimums and more rigorous qualification

- Transparent data and sponsor performance metrics

Why relevant: For investors seeking access to institutional-quality commercial real estate and who meet accreditation thresholds, CrowdStreet offers deals that may deliver higher yield potential than general platforms like Fundrise. It’s a complement or alternative for those scaling up.

EquityMultiple

EquityMultiple specializes in commercial real estate opportunities and tends to cater to accredited investors. It offers various structures such as equity, preferred equity, and debt.

Key details:

- Focus on deal underwriting and risk control

- Projects in development, value-add, and stabilized real estate

- Transparent reporting and deal documentation

Why relevant: EquityMultiple is an option for investors who want deeper underwriting rigor, diversified commercial project exposure, and advanced deal types beyond simple fund models.

DiversyFund

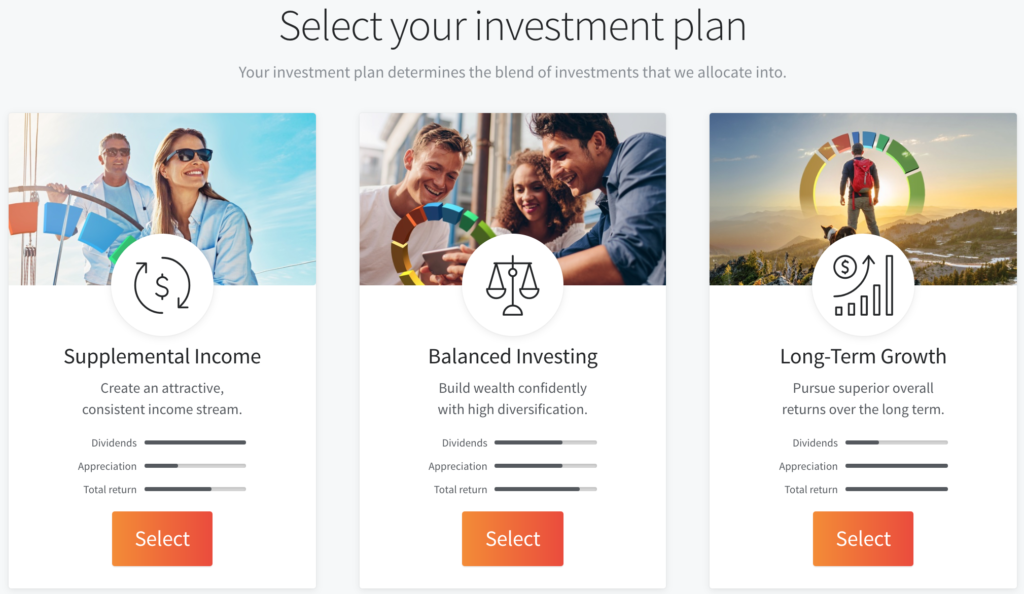

DiversyFund is more accessible to non-accredited investors and aims to make real estate investing simpler. It emphasizes growth-oriented real estate funds.

Key details:

- Lower minimums, accessible for a broader range of investors

- Offers growth and dividend funds

- Targets longer hold periods for appreciation

Why relevant: If your priority is ease of access, lower barrier, and simplified investment structure, DiversyFund may be among the more approachable alternatives to Fundrise.

Groundfloor

Groundfloor differs in that it emphasizes real estate debt investing instead of equity. Investors essentially fund short-term real estate loans.

Key details:

- Debt-based structures (first-lien loans)

- Shorter loan terms (6 to 24 months)

- Fixed interest returns from borrower payments

Why relevant: If you prefer lower exposure to real estate upside risk and want more predictable cash returns, Groundfloor offers a different risk/return profile compared to equity models like Fundrise.

How These Platforms Differ: Structure, Fee, Access, Liquidity

Understanding how they differ helps you choose wisely:

- Access / Investor Type: Some platforms (like Fundrise, DiversyFund) accept non-accredited investors. Others (CrowdStreet, EquityMultiple) are restricted to accredited investors.

- Minimum Investment: Fundrise is known for very low entry thresholds. Alternatives vary widely—some require thousands or tens of thousands.

- Structure: Some platforms use pooled funds (eREITs, real estate funds), others list individual deals.

- Fee Models: Look for management fees, acquisition fees, sponsor promote, platform fees. These eat into returns.

- Liquidity / Exit Strategy: Many investments are illiquid until property sale or refinancing. Some platforms offer periodic redemption windows, but often at a discount.

- Type & Risk: Debt vs equity; development vs stabilized vs value-add deals; geographic concentration risk.

- Transparency & Reporting: How much insight you get into property performance, occupancy, financials impacts oversight and trust.

Because platforms differ, many investors use more than one to diversify exposure.

Benefits Driven by Technology in Real Estate Crowdfunding

Platforms like Fundrise and its alternatives succeed largely due to technological enablement. The following are advantages that technology brings:

Efficient Deal Sourcing and Vetting

Algorithms, data scraping, market analytics, and underwriting tools help platforms source projects that meet certain financial criteria. Technology speeds up due diligence, automates risk checks, and filters out weaker opportunities more effectively than purely manual systems.

Digital Investor Onboarding and Verification

Platforms use identity verification, accreditation validation, electronic signatures, and compliance checks through digital infrastructure. This reduces friction and operational cost, letting more investors onboard faster.

Real-Time Reporting and Dashboards

Investors get dashboards showing performance metrics, distributions, occupancy changes, cost overruns, and project updates. Transparent reporting is a key competitive advantage and builds confidence.

Automated Capital Flows and Administration

Escrow systems, automated capital calls, distribution scheduling, K-1 tax generation, investor accounting — all are handled via software, minimizing manual error, cost, and delay.

Scalability and Global Reach

Because the infrastructure is digital, platforms can invite capital from many users simultaneously and handle many projects without proportional increase in overhead. Some platforms also cross borders, allowing international real estate access (pending regulation).

Risk Modeling and Scenario Simulations

Sophisticated platforms simulate multiple outcomes (e.g. vacancy rates, rent growth, interest rate rises) to stress-test projections. Those models help refine underwriting, disclosure, and deal terms.

Technology is the backbone that enables real estate investing at scale to ordinary investors rather than only institutions.

Use Cases: When Sites Like Fundrise Solve Investor Challenges

Looking at real-life scenarios illustrates why investors turn to platforms like Fundrise alternatives:

Use Case 1: Beginner Investor Seeking Real Estate Exposure

A young investor has limited capital but wants exposure to real estate. With just a few hundred dollars or a low threshold, they can invest in real estate funds via platforms like DiversyFund or Fundrise. This solves the barrier of needing tens or hundreds of thousands for property ownership.

Use Case 2: Accredited Investor Scaling to Larger Deals

An investor who previously invested small amounts now meets accreditation requirements wants access to commercial real estate projects. They move into CrowdStreet or EquityMultiple to participate in higher-yield deals. This solves the need for growth and more sophisticated asset exposure.

Use Case 3: Income-Focused Investor Preferring Debt Over Equity

Some investors prefer steady income over market upside. A platform like Groundfloor lets them invest in real estate loans, earning interest payments instead of waiting for property sale gains. This use case solves the need for more predictable cash flows.

Use Case 4: Geographic Diversification

An investor in one city wants exposure to real estate in growing growth markets in different states or regions. These platforms allow remote investment in markets they can’t access locally, solving the problem of localized real estate risk.

Use Case 5: Portfolio Hedging and Alternative Asset Allocation

A portfolio heavy in stocks and bonds may suffer high correlation during downturns. By allocating a slice to real estate via crowdfunding alternatives, the investor adds diversification, tangible asset exposure, and potential non-correlated return streams.

Evaluating Sites Like Fundrise: What to Look For

When comparing platforms, focus on:

- Track record and transparency of past investments

- Sponsor quality and experience

- Fee structure breakdowns (acquisition, management, disposition, promote)

- Liquidity terms and exit clauses

- Deal types (equity, debt, fund) aligned with your risk appetite

- Minimums and whether you qualify as accredited or non-accredited

- Reporting and investor communication

- Geographic and property-type diversification options

- Platform stability, regulatory compliance, and investor protection

Each investor’s priorities differ, so weigh them relative to your goals.

Risks and Limitations

No platform is risk-free. Be aware of:

- Illiquidity: Many investments lock your capital for years.

- Sponsor execution risk: Poor management, construction delays, vacancy issues.

- Market cycles: Real estate is exposed to macro factors like interest rates, supply, demand.

- Overly optimistic projections: Forecasts often assume best-case scenarios.

- Fee drag: Many layers of fees reduce net returns.

- Platform failure risk: If a platform goes bankrupt or mismanages funds, investor recourse may be complex.

- Concentration risk: Over-investing in one deal or platform raises exposure to specific failure.

Mitigating these risks requires due diligence, diversification, realistic assumptions, and cautious allocation.

Frequently Asked Questions

Q1: Which platform is best for non-accredited investors?

Platforms like Fundrise, DiversyFund, and some offerings on RealtyMogul and Arrived accept non-accredited investors. They offer lower minimums and pooled funds. For more sophisticated or direct deals, accreditation is often required on sites like CrowdStreet or EquityMultiple.

Q2: How do these platforms make money?

They typically earn via fees: acquisition/sourcing fees, management or annual asset management fees, disposition or sale fees, promote or performance sharing. Some also charge platform or investor servicing fees. These fees are disclosed in offering documents.

Q3: Can I redeem or exit early?

Redemption often depends on the platform. Some allow limited quarterly redemptions, sometimes at a discount or capped amount. Many investments remain locked until property sale or refinancing. Always review exit policies before investing.