Understanding ETRADE Instant Deposit: How It Works, Benefits, and Real Use Cases

E*TRADE Instant Deposit has become one of the most convenient features for traders and investors who need immediate access to their funds. In a world where timing can determine success or loss, this feature ensures that users can start trading without waiting for traditional bank transfers to clear.

This article provides an in-depth understanding of what E*TRADE Instant Deposit is, how it functions, its technological advantages, and practical use cases that demonstrate its value to modern investors.

What Is E*TRADE Instant Deposit?

E*TRADE Instant Deposit is a financial feature that allows users to access a portion of their deposited funds immediately after initiating a transfer. Instead of waiting two to three business days for bank transfers to settle, eligible users can use these instant funds to start trading stocks, ETFs, or options right away.

This functionality is particularly useful for active traders who want to seize market opportunities as they arise. It bridges the gap between depositing money and executing trades, giving users a crucial time advantage. E*TRADE provides instant deposit capabilities depending on the user’s account type, transaction history, and available balance.

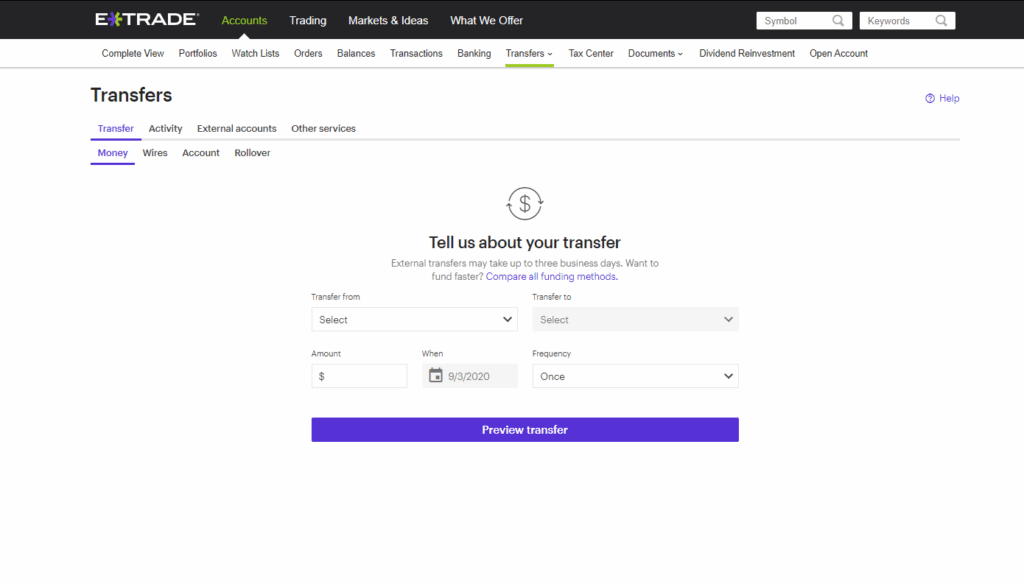

How E*TRADE Instant Deposit Works

The instant deposit process is designed to be straightforward. When a user initiates a transfer from their linked bank account, E*TRADE immediately credits a portion of that amount into their trading account. The rest of the funds will appear once the transfer is fully settled.

For example, if a user initiates a $5,000 transfer, E*TRADE may provide immediate access to $1,000 or more for trading purposes. The specific limit depends on the user’s account status, transaction history, and the overall relationship with the platform.

This system relies on E*TRADE’s internal risk management algorithms and banking network integrations to ensure safe, quick transactions. These algorithms analyze factors like deposit frequency, account balance, and creditworthiness to determine the eligible instant deposit amount.

The Technology Behind E*TRADE Instant Deposit

E*TRADE’s instant deposit feature leverages real-time payment processing technology and automated verification systems. This technology ensures that transactions are secure and efficient. The platform integrates advanced encryption methods, instant fund verification protocols, and fraud-prevention mechanisms to minimize risks.

The real-time system communicates with both the user’s bank and E*TRADE’s trading network to confirm the deposit request. Once verified, the funds are temporarily credited to the trading account. This process, which typically takes seconds, represents a significant advancement over traditional ACH (Automated Clearing House) transfers that require 2–5 days to settle.

E*TRADE also utilizes predictive analytics to manage liquidity and prevent overdraft or unverified fund usage. This ensures both the platform and its users remain protected while maintaining fast accessibility to capital.

Benefits of Using E*TRADE Instant Deposit

1. Faster Market Access

The most significant benefit of E*TRADE Instant Deposit is speed. Traditional deposits can delay trading activity, but instant deposits eliminate this waiting period. Investors can immediately respond to breaking market news, price drops, or sudden stock surges without financial delays.

2. Increased Flexibility

E*TRADE’s instant funding gives traders greater flexibility in managing their portfolio. It enables them to reallocate capital, diversify investments, or purchase time-sensitive opportunities. This flexibility can be crucial during market volatility.

3. Improved Trading Efficiency

Having immediate access to trading funds means fewer missed opportunities. This improves portfolio efficiency and allows investors to make the most of their financial strategies. E*TRADE’s system also ensures that even during high-demand trading hours, deposits are processed without lag.

4. Enhanced User Experience

The instant deposit feature aligns with E*TRADE’s broader commitment to providing a seamless digital investing experience. It reduces friction between depositing and trading, creating a more fluid interaction between user funds and the stock market.

Real-World Use Cases and Examples

Example 1: Day Traders Responding to Market Volatility

Active traders, often called day traders, rely heavily on quick access to funds. Suppose the market experiences a sudden drop due to an economic announcement. A trader might want to buy undervalued shares quickly. With E*TRADE Instant Deposit, they can fund their account and execute trades immediately without waiting for the deposit to clear.

This capability allows them to take advantage of short-term price fluctuations that could yield profitable returns. Without instant deposits, such traders might miss out on these rapid opportunities.

Example 2: Long-Term Investors Adjusting Their Portfolio

Long-term investors sometimes need to rebalance their portfolios after a major shift in market sectors. For instance, when the technology sector dips, an investor may wish to buy additional shares to maintain their target allocation.

E*TRADE Instant Deposit enables this investor to transfer funds and invest immediately, ensuring they can maintain their strategy without delay. The convenience of instant liquidity supports more consistent portfolio management and alignment with long-term goals.

Example 3: New Investors Entering the Market

For beginners just starting their investment journey, E*TRADE Instant Deposit helps ease the process of entering the market. Imagine a new investor who decides to buy their first ETF after following financial news. Instead of waiting days for funds to settle, they can deposit and invest immediately.

This accessibility encourages engagement, reduces friction, and helps new users learn trading faster by interacting directly with live market conditions.

Example 4: Emergency Market Reactions

In times of economic uncertainty, such as sudden interest rate announcements or political developments ,investors often need to make quick financial moves. For instance, an investor may want to sell certain assets and reinvest in defensive sectors like utilities or consumer staples.

Instant deposit ensures they can move funds efficiently between accounts, preserving liquidity and maintaining financial control during unpredictable market conditions.

Practical Benefits of E*TRADE Instant Deposit in Modern Trading

E*TRADE’s instant funding system represents a modern solution for real-time financial management. Investors can take advantage of multiple benefits beyond convenience:

- Reduced Opportunity Cost: Immediate access to funds ensures no delay in capturing potential profits.

- Liquidity Management: Users can manage multiple accounts or rebalance portfolios efficiently.

- Stress-Free Execution: The system removes the anxiety of waiting for deposits to settle, which can be crucial during volatile periods.

- Integration with Digital Tools: E*TRADE’s mobile app supports instant deposit functionality, making it accessible from anywhere, anytime.

The feature not only saves time but also empowers traders to make informed and strategic decisions with confidence.

Common Challenges and Limitations

While E*TRADE Instant Deposit offers numerous advantages, there are a few limitations to consider:

- Deposit Limits: Not all deposits qualify for instant access. The limit is based on account status, funding method, and user history.

- Temporary Credit: The credited amount is provisional until the transfer clears. If a transfer fails, E*TRADE may reverse the funds.

- Eligibility Requirements: Instant deposit is typically available only to verified accounts with consistent funding records.

These restrictions are standard across financial institutions and exist primarily to mitigate risks associated with fraud or insufficient funds.

How E*TRADE Instant Deposit Improves Financial Agility

Instant funding has revolutionized how retail investors manage their portfolios. The ability to move funds instantly provides greater financial agility and the power to adapt quickly to changing market conditions.

For both short-term traders and long-term investors, this agility can mean the difference between capturing gains and missing out. Moreover, as more trading platforms integrate similar features, instant deposit access is becoming a standard expectation in modern digital investing.

E*TRADE’s execution of this feature is particularly notable for its reliability, speed, and integration with other account services such as margin trading and cash management accounts.

Future Outlook: The Evolution of Instant Funding in Trading Platforms

The rise of instant deposits reflects a broader industry shift toward real-time finance. As technology continues to evolve, investors can expect even faster processing, AI-based risk management, and seamless integration across different financial tools.

E*TRADE’s system is likely to expand further, offering larger instant limits and faster verifications as consumer demand for speed and flexibility continues to grow. The goal is a financial ecosystem where capital movement happens at the same pace as decision-making, instantly.

Frequently Asked Questions

1. Is E*TRADE Instant Deposit available to all users?

Not all users automatically qualify for instant deposits. Eligibility depends on account verification, funding history, and deposit method. Verified accounts with consistent activity are more likely to access this feature.

2. How long does E*TRADE Instant Deposit take to appear?

The credited funds usually appear within seconds of initiating the transfer. However, the remaining balance will settle once the bank transfer is fully processed.

3. Are there fees associated with E*TRADE Instant Deposit?

E*TRADE typically does not charge a separate fee for instant deposits. However, users should review their account terms to ensure they meet eligibility requirements and avoid overdraft risks from failed transfers.