Cadre vs CrowdStreet: Which Real Estate Investment Platform Is Better?

The real estate investment world has changed dramatically in the last decade. Thanks to technology, individuals now have access to commercial real estate deals that were once reserved for institutional investors and wealthy families. Two of the most recognized names in this new era of online real estate investing are Cadre and CrowdStreet.

Both platforms allow accredited investors to participate in high-quality commercial properties, but they differ in philosophy, structure, fees, and investment accessibility. Understanding these differences can help you make smarter, more confident investment choices.

This article breaks down everything you need to know about Cadre vs CrowdStreet, including how they work, their benefits, how technology shapes their value, and real-world examples that show what kind of investor might prefer each platform.

Understanding the Platforms

What Is Cadre?

Cadre was founded in 2014 with the goal of making institutional-quality real estate investments more accessible. It uses a highly selective and data-driven approach to identify properties in sectors such as multifamily, industrial, office, and hospitality.

Unlike traditional real estate funds, Cadre allows investors to participate directly in single properties or through Cadre Funds, which offer diversified exposure to multiple assets. The company also introduced a secondary market, a unique feature that gives investors a potential way to sell their investments before a property is fully exited.

Cadre focuses on transparency, rigorous due diligence, and co-investment. It often invests its own capital alongside investors, aligning incentives and increasing accountability.

What Is CrowdStreet?

CrowdStreet was launched to connect accredited investors directly with real estate developers and sponsors. It functions as a marketplace for commercial real estate investments, hosting deals from sponsors across the United States.

The platform gives investors access to individual projects or pooled funds, allowing them to choose investments that match their goals and risk tolerance. CrowdStreet’s strength lies in its variety and deal flow there are usually many active opportunities available at once, covering sectors like industrial, multifamily, retail, and mixed-use developments.

CrowdStreet has gained a strong reputation for providing transparency, education, and direct access to deal documents, webinars, and detailed financial projections.

Comparing Cadre vs CrowdStreet

Investment Minimums and Accessibility

Both platforms cater primarily to accredited investors, but their minimum investment requirements differ.

Cadre generally requires a higher minimum investment. It focuses on fewer, larger deals that attract investors with substantial capital. This makes it ideal for high-net-worth individuals seeking quality over quantity.

CrowdStreet, on the other hand, tends to have slightly lower minimums. Many of its deals start around $25,000, which makes it somewhat more accessible to a wider audience of accredited investors.

Investment Approach and Deal Selection

Cadre uses a curated, selective model. Out of hundreds of opportunities it reviews, only a small fraction make it onto the platform. The company’s internal team performs rigorous due diligence, market research, and financial modeling before presenting a property to investors.

CrowdStreet takes a marketplace approach. It lists projects from many independent sponsors and developers. While it performs background checks and quality control, investors are expected to do much of their own research before committing to a deal.

This distinction is important:

- Cadre’s deals are fewer but more tightly controlled.

- CrowdStreet offers a broader selection but requires more self-evaluation.

Diversification and Fund Options

Cadre offers two main investment paths:

- Individual Property Investments – investors can choose specific deals.

- Cadre Funds – pooled investments that spread risk across multiple assets.

CrowdStreet also offers two paths:

- Direct Investments – picking individual properties from the marketplace.

- CrowdStreet Funds – diversified options managed by the platform’s investment team.

If you prefer a hands-off, diversified strategy, Cadre’s fund model or CrowdStreet’s pooled funds can provide exposure to multiple properties with one investment.

Liquidity and Exit Options

One of the major differences between the two platforms is liquidity.

Cadre introduced a secondary market that allows investors to sell their stakes in certain properties, typically during quarterly windows. While liquidity is not guaranteed, this feature provides a unique level of flexibility compared to traditional real estate holdings.

CrowdStreet investments are generally illiquid until the project reaches completion, refinance, or sale. Investors should expect to hold their investment for the full term, which often ranges from 3 to 10 years.

Fees and Costs

Both platforms charge fees, though the structure varies depending on the deal.

Cadre’s fees generally include asset management and performance fees, while also investing alongside clients to show alignment of interest. Its technology-driven process aims to reduce unnecessary overhead.

CrowdStreet typically does not charge a direct platform fee to investors. Instead, fees are embedded within the sponsor’s deal structure usually acquisition or management fees charged by the real estate operator.

Overall, CrowdStreet may appear slightly more cost-efficient for investors comfortable analyzing sponsor terms, while Cadre focuses on added value through selectivity and co-investment.

Market Focus and Strategy

Cadre primarily targets middle-market properties assets large enough to attract institutional interest but small enough to offer inefficiencies that create value. These are often located in growing urban or suburban markets with strong fundamentals.

CrowdStreet, due to its open marketplace, spans a much wider range. You can find everything from stabilized core assets to opportunistic developments in secondary markets.

If you want deeply vetted, institutional-quality deals, Cadre might appeal more. If you value variety and control, CrowdStreet provides the flexibility to tailor your own portfolio.

Technology and Platform Innovation

Data-Driven Decision Making

Cadre differentiates itself through its proprietary data analytics. Its investment team combines market research with technology-based screening tools to evaluate property fundamentals, demographics, and risk metrics. This data-centric approach aims to improve returns and reduce downside exposure.

CrowdStreet also uses technology extensively, though in a different way. It focuses on creating a digital marketplace where investors can review deals, filter opportunities, and access performance reports. The emphasis is on usability and transparency rather than predictive analytics.

User Experience and Automation

Both platforms use technology to streamline the investor experience.

Cadre’s interface provides a sleek, professional environment where investors can review detailed reports, track their portfolio, and access updates in real time. The inclusion of a liquidity window adds an extra layer of convenience and control.

CrowdStreet’s platform shines in its interactive investor dashboards, sponsor webinars, and document management system. Everything from deal screening to investment closing is handled online, reducing friction and paperwork.

In short, Cadre leverages technology for deal quality and data analytics, while CrowdStreet focuses on accessibility and investor engagement.

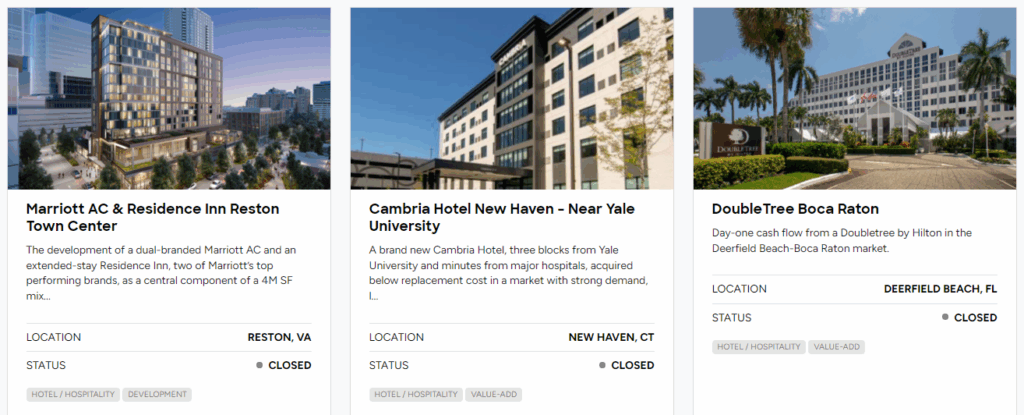

Real-World Examples

Example 1: Cadre Direct Access Fund

The Cadre Direct Access Fund offers diversified exposure to multiple real estate sectors, including multifamily, industrial, and hospitality. Investors benefit from professional management and broad asset diversification, reducing the risk associated with single property investments.

This type of fund is ideal for investors who prefer a hands-off approach but still want institutional-level exposure. It reflects Cadre’s commitment to combining human expertise with data-driven decision making.

Example 2: Cadre Single-Asset Investment

In one example, Cadre offered a value-add multifamily project located in a major growth city. The investment thesis centered on improving operations, upgrading amenities, and increasing occupancy rates.

Cadre co-invested alongside clients in this project, showing confidence in its analysis. This structure provides investors with direct ownership in a single property and potential for higher targeted returns.

Example 3: CrowdStreet Industrial Warehouse Project

CrowdStreet frequently lists industrial projects, such as logistics centers or last-mile delivery facilities. These assets benefit from the growing demand for e-commerce infrastructure and can generate steady income through long-term leases.

Investors can review detailed underwriting documents, tenant information, and location analyses. This level of transparency allows them to make informed, independent investment decisions.

Example 4: CrowdStreet Multifamily Redevelopment

Another typical CrowdStreet deal is a multifamily value-add redevelopment—acquiring an underperforming apartment complex, upgrading interiors, and increasing rents.

These projects appeal to investors seeking higher yield potential, but they carry greater risk compared to stabilized assets. CrowdStreet’s platform enables investors to compare several such projects side by side, something Cadre’s more curated system doesn’t emphasize.

Benefits of Using These Platforms

Access to Institutional-Quality Deals

Before the rise of online platforms, individual investors rarely had access to commercial real estate of this caliber. Cadre and CrowdStreet both open that door, allowing investors to participate in professionally managed, large-scale assets.

Transparency and Control

Both companies prioritize transparency. Investors can see detailed financial models, sponsor backgrounds, market research, and ongoing performance updates—something that was difficult to access in traditional real estate syndications.

Diversification Opportunities

Real estate provides portfolio diversification away from stocks and bonds. Both platforms make it easier to spread risk across multiple property types, markets, and investment strategies.

Technology-Driven Efficiency

Technology reduces costs, speeds up transactions, and simplifies reporting. Instead of lengthy paper contracts and opaque updates, investors enjoy digital dashboards, automatic statements, and periodic performance reviews.

Liquidity Innovation

Cadre’s secondary market, though limited, is a notable advancement in an industry where real estate investments are typically locked in for years. This added layer of flexibility gives investors confidence in managing their liquidity needs.

Use Cases: Who Should Choose Which Platform?

For Hands-Off Investors Seeking Diversification

Cadre’s fund products may be more appealing for those who prefer professional management and diversification without the need to choose individual properties.

For Active Investors Who Want Deal Selection

CrowdStreet is ideal for investors who enjoy reviewing deals, comparing markets, and selecting projects that fit their risk and return preferences.

For Those Concerned About Liquidity

Cadre’s partial liquidity feature through its secondary market makes it more suitable for investors who may want to access capital before a full project exit.

For Experienced Real Estate Professionals

If you already understand commercial real estate underwriting and want to analyze deals independently, CrowdStreet offers more autonomy and opportunity variety.

For Conservative, Data-Driven Investors

Cadre’s tight screening process and institutional co-investment model may provide additional comfort for those prioritizing risk management and data-backed decision making.

Potential Drawbacks and Risks

- Both platforms primarily cater to accredited investors, limiting access for the general public.

- Investments are illiquid; even with Cadre’s secondary market, quick exits are not guaranteed.

- Real estate projects carry execution risk construction delays, cost overruns, or leasing challenges can affect returns.

- Market cycles and economic downturns can impact valuations.

- Fees, although often lower than traditional real estate funds, can still reduce net returns.

- Investors must conduct due diligence, especially on CrowdStreet where deals vary widely in quality and risk.

Summary

The Cadre vs CrowdStreet comparison shows two leading but distinct approaches to online real estate investing.

- Cadre stands out for its curated deal selection, institutional partnerships, co-investment structure, and potential liquidity through a secondary market.

- CrowdStreet excels in offering variety, sponsor diversity, and investor control over deal selection.

If you value high selectivity, data-driven decisions, and liquidity options, Cadre may be your platform. If you prefer choice, flexibility, and hands-on control, CrowdStreet could be the better fit.

Ultimately, many investors diversify across both using Cadre for quality exposure and CrowdStreet for variety achieving a balanced, well-rounded real estate portfolio.

Frequently Asked Questions

1. Do both Cadre and CrowdStreet require accreditation?

Yes. Most investments on both platforms are available only to accredited investors, meaning those who meet specific income or net-worth thresholds defined by financial regulations.

2. Can I sell my investment before the project ends?

Cadre offers a secondary market that sometimes allows investors to sell holdings quarterly, depending on demand and eligibility. CrowdStreet investments are generally illiquid until the underlying property is sold or refinanced.

3. Which platform tends to offer higher returns?

Returns depend on the quality of the deals, market conditions, and execution. Historically, Cadre’s curated approach has targeted double-digit annualized returns, while CrowdStreet’s results vary based on each sponsor’s strategy. Investors should focus on risk-adjusted returns rather than headline numbers.