AGL Share Price: Comprehensive Guide to Trends, Analysis, and Real Market Insights

The term “AGL share price” captures the attention of both professional investors and everyday traders. Whether you are a seasoned market participant or someone just beginning to track shares, knowing how and why the price of AGL stock moves is essential to understanding the company’s health and investor sentiment.

This article provides a detailed exploration of AGL’s share price what it represents, how it changes, the factors that drive it, and what investors can learn from those movements. We’ll also include practical examples, case studies, and real-world insights on how this information can be used for financial analysis and decision-making.

Understanding the AGL Share Price

The AGL share price refers to the market value of one share of AGL stock at a specific moment in time. It is determined by the balance between buyers and sellers in the open market. The more investors are willing to buy, the higher the price tends to go. Conversely, when more investors sell, the price can drop.

The Role of Market Supply and Demand

Every share price is shaped by the forces of supply and demand. If investors expect the company’s earnings to grow, demand rises, pushing the share price upward. But if investors lose confidence perhaps because of losses, regulatory pressure, or economic uncertainty supply increases as more investors sell, and the price declines.

For AGL, which operates in sectors like energy and healthcare depending on the specific entity being referred to, investor confidence often fluctuates with changes in government policy, global market trends, and financial performance.

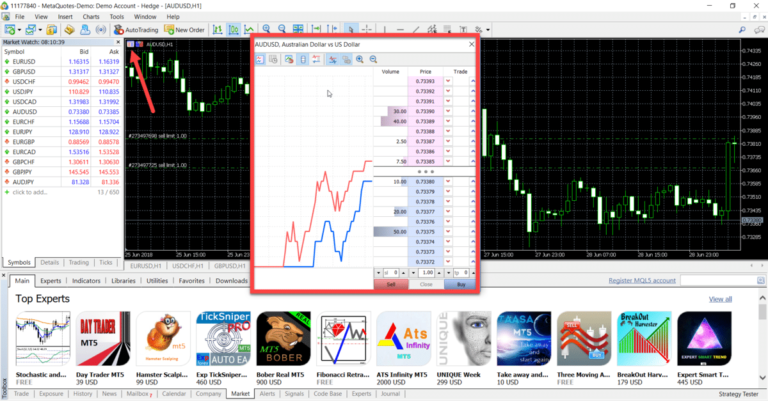

Daily Price Movements

The “AGL share price” is not static; it fluctuates throughout the trading day. During market hours, every transaction between a buyer and a seller establishes a new price. The last traded price is the most common reference point used by financial media and investors. Other relevant terms include:

- Bid price: The highest price buyers are currently offering.

- Ask price: The lowest price sellers are willing to accept.

- Spread: The difference between bid and ask prices, which reflects market liquidity.

Understanding these elements helps investors interpret not only the current price but also how the market values the company at any given moment.

Historical Context and Market Background

AGL is a well-known ticker symbol that can refer to more than one company, depending on the market. In the United States, Agilon Health, Inc. trades under the ticker AGL on the New York Stock Exchange. In Australia, AGL Energy Limited trades under the same ticker on the Australian Securities Exchange.

Both companies share the same symbol but operate in completely different industries. Agilon Health is a healthcare service provider focusing on value-based care models for seniors, while AGL Energy is one of Australia’s largest energy producers and retailers.

Each company’s share price is driven by unique industry forces, yet both represent interesting case studies in how corporate fundamentals, economic conditions, and investor psychology influence stock valuation.

Recent Price Trends

In recent months, AGL (agilon health) has seen significant fluctuations in its share price. It traded within a broad range over the past year, showing volatility common among growth-oriented companies facing operational challenges. Investors have been closely watching its progress toward profitability and its ability to sustain membership growth while managing costs.

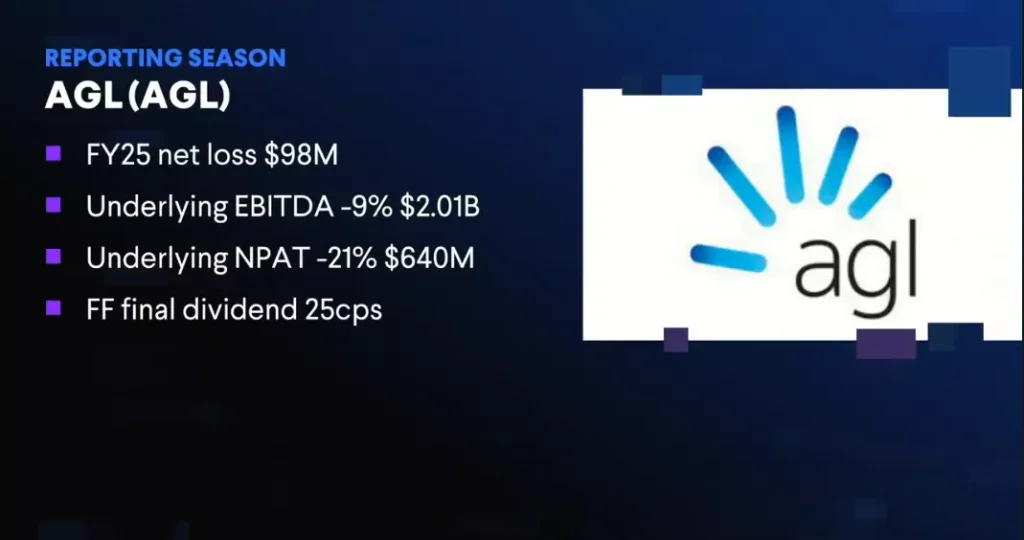

Similarly, AGL Energy in Australia experienced major price swings following announcements about future profit forecasts and renewable energy investments. Shareholders reacted sharply to lower-than-expected earnings guidance, reminding investors how sensitive share prices can be to even small changes in company outlooks.

Factors That Drive the AGL Share Price

The AGL share price moves in response to a variety of fundamental and external influences. Understanding these factors is key to interpreting whether price movements are temporary reactions or long-term trends.

Company Fundamentals

At the core of any stock price lies the company’s financial performance. Revenue, profit margins, and growth potential are the most direct influences. For Agilon Health, investors focus on its ability to reduce medical costs, expand partnerships with healthcare providers, and improve operational efficiency.

AGL Energy’s share price, on the other hand, is driven by energy prices, regulatory shifts, and the global transition toward renewable power sources. The company’s capital expenditure, cost management, and carbon reduction strategies also play major roles.

Investor Sentiment and Market Confidence

Even if the company’s fundamentals are solid, investor perception can push the share price higher or lower. Market confidence often swings based on expectations rather than actual performance. Positive news such as new partnerships, leadership changes, or policy reforms can lift sentiment, while negative headlines or profit warnings can send prices down sharply.

Macroeconomic and Regulatory Environment

Interest rates, inflation, and regulatory policy have enormous effects on share prices. In healthcare, new government rules or Medicare reimbursement changes can alter profitability expectations overnight. In energy, policy shifts toward sustainability can impact both short-term costs and long-term growth potential.

AGL’s share price often mirrors broader macro trends when interest rates are high, investors may demand faster profitability; when policy uncertainty grows, volatility increases.

Market Liquidity and Trading Volume

A company’s stock that trades with high volume generally has more stable pricing because there are enough buyers and sellers to balance supply and demand. Thinly traded stocks can be more volatile. AGL’s share price tends to react strongly during earnings announcements or sector news when trading volume surges.

Real-World Examples of AGL Share Price in Action

Below are several real-world examples showing how the AGL share price has influenced decision-making and strategic outcomes in both personal and institutional contexts.

Example 1: Retail Investor Portfolio Strategy

A small investor owns several healthcare stocks, including AGL (agilon health). She notices that AGL’s share price has dropped 10% in a week due to negative earnings sentiment. Instead of panicking, she uses this data to assess whether the drop is temporary or a sign of deeper trouble.

She compares AGL’s price movement with healthcare sector indices and finds that the entire industry is under pressure due to reimbursement policy changes. The insight helps her make a balanced decision she holds her position, knowing the weakness is sector-wide, not company-specific.

Example 2: Institutional Analyst Comparison

An institutional analyst tracks the share prices of several healthcare companies. By charting AGL’s share price alongside competitors like Humana and UnitedHealth, the analyst identifies patterns of underperformance and investigates potential reasons.

He concludes that AGL’s lower share price partly reflects its earlier-stage business model, not necessarily poor performance. This kind of comparative analysis helps institutions allocate capital intelligently, balancing risk and reward across multiple holdings.

Example 3: Corporate Financing Decisions

A company’s management often pays close attention to its share price when deciding whether to issue new stock or raise debt. For Agilon Health, a rising share price signals market confidence, which can lead to more favorable financing terms. Conversely, if the price is falling, issuing new shares becomes more expensive and dilutive for existing shareholders.

Monitoring the share price allows management to time such moves strategically, preserving shareholder value.

Benefits of Tracking the AGL Share Price

Improved Financial Awareness

Tracking AGL’s share price regularly gives investors a clearer sense of market dynamics and sentiment. It enables individuals to recognize how news, earnings reports, and global events influence valuation. Over time, this habit builds a deeper understanding of market psychology.

Informed Investment Decisions

The share price reflects the market’s collective expectations about the future. Analyzing how and why it moves helps investors identify entry and exit points more effectively. For example, if AGL’s price consistently reacts positively to earnings surprises, traders can use that knowledge to anticipate future behavior.

Risk Management and Portfolio Control

By keeping an eye on share price trends, investors can manage risk proactively. Setting price alerts, stop-loss limits, or hedging strategies based on AGL’s volatility can protect portfolios from unexpected losses.

Benchmarking Performance

AGL’s share price can serve as a performance benchmark. Comparing it to peers or broader indices shows whether the stock is outperforming or lagging. This insight helps both retail and institutional investors refine their strategies and adjust holdings accordingly.

Strategic Planning for Companies

For corporations, the share price functions as a public signal of market confidence. A strong price trend boosts reputation, attracts investors, and makes mergers or acquisitions more feasible. A falling share price, however, may pressure management to improve communication or restructure operations.

Practical Use Cases

Timing Market Entry and Exit

Investors often struggle with when to buy or sell. Observing trends in the AGL share price, especially alongside trading volume, can reveal potential turning points. Sharp movements after earnings calls or guidance updates can be used as signals to enter or exit positions strategically.

Evaluating Long-Term Growth Potential

The share price tells a story about what the market expects in the future. For AGL, consistent improvement in fundamentals like member growth or energy transition can gradually translate into upward price momentum. Long-term investors use these patterns to evaluate whether short-term volatility masks deeper value opportunities.

Assessing Risk and Volatility

Every stock carries some degree of risk. By analyzing the historical volatility of AGL’s share price, investors can estimate how much fluctuation to expect. This helps in position sizing deciding how much of one’s portfolio should be allocated to AGL relative to more stable holdings.

Understanding Investor Psychology

The AGL share price also reflects the emotional side of markets. Fear, optimism, and herd behavior can create short-term distortions. Learning to interpret these signals helps investors avoid common mistakes such as panic selling or buying into unsustainable rallies.

Future Outlook for AGL Share Price

The outlook for AGL depends on which company is being considered.

For Agilon Health, the key will be how effectively it transitions toward profitability while maintaining growth. Cost control, member retention, and regulatory stability will determine future performance. If the company continues expanding its healthcare network and reducing losses, market sentiment could improve.

For AGL Energy, the focus remains on balancing traditional energy production with investments in renewable power. Government climate policy and global energy prices will shape investor confidence. The company’s recent profit guidance revisions show that earnings expectations are still sensitive to external factors such as fuel costs and environmental policy changes.

In both cases, long-term investors should expect periodic volatility but recognize that a well-executed strategy and consistent communication can stabilize share performance over time.

Frequently Asked Questions

Q1: What does the AGL share price represent?

The AGL share price represents the current market value of one share of AGL stock. It reflects investor sentiment, company performance, and expectations about future profitability.

Q2: Why does the AGL share price fluctuate so much?

Fluctuations occur due to changing demand and supply, new information such as earnings results, policy updates, and macroeconomic conditions. In industries like healthcare and energy, regulatory changes and commodity prices add further volatility.

Q3: How can investors use AGL share price information effectively?

Investors can use AGL’s share price data to monitor trends, identify opportunities, manage risk, and compare performance with industry peers. Regular analysis of price movements, combined with knowledge of company fundamentals, leads to more informed and confident investment decisions.