Top Alternatives to CAIS for Alternative Investment Platforms in 2025

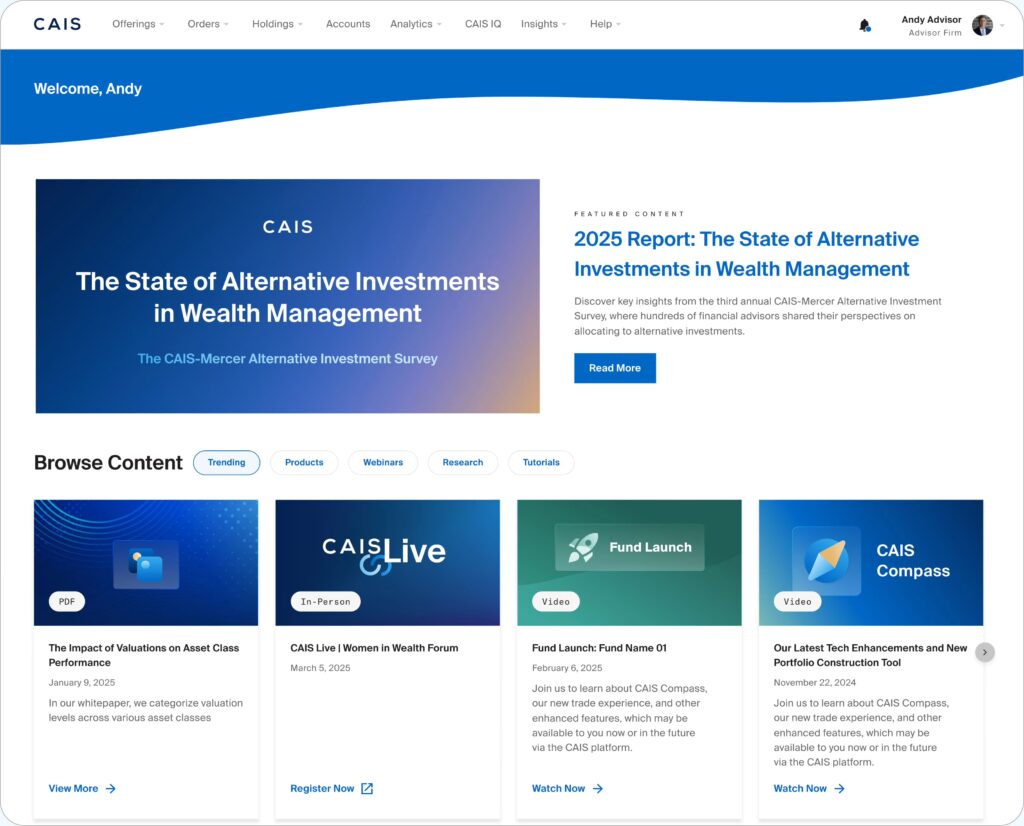

When someone refers to CAIS alternatives, they typically mean alternative investment platforms or technologies that offer functionalities similar to or complementary to those of CAIS. CAIS (Capital Integration Systems) is a fintech platform that connects independent financial advisors with alternative asset managers, streamlining discovery, due diligence, subscriptions, post-trade operations, and reporting across private markets, hedge funds, structured products, and custom funds.

Because CAIS has matured and expanded, introducing SaaS tools, model portfolios, integrations with TAMP (turnkey asset management platforms), and more, many advisors or firms may seek alternative platforms or complementary providers that offer distinct features, access to niche strategies, lower fees, or geographic reach. This article explores in depth what to look for in CAIS alternatives, the strengths and tradeoffs, real-world competitor platforms, use cases, benefits, and FAQs.

Key Features to Evaluate in a CAIS Alternative

Platform Access & Product Breadth

A good alternative to CAIS should offer a broad, curated menu of alternative investments private equity, private credit, hedge funds, real assets, structured notes, interval funds, etc. The platform should allow filtering, research, and subscription workflows.

Because many alternative managers restrict access, the platform’s manager network and relationships are critical. CAIS, for example, works with over 70+ alternative asset managers.

Operational and Post-Trade Infrastructure

One of CAIS’s core advantages is its end-to-end operations: managing subscriptions, capital calls, document workflows, custodian integrations, reporting, and legacy fund onboarding under CAIS Solutions.

Alternatives must demonstrate robust post-trade tools: centralized reporting, data aggregation, KYC/AML logic, document management, and the ability to import external (legacy) funds.

Model Portfolios and Portfolio Construction Tools

Many advisors prefer to invest via model portfolios or multi-asset allocations rather than selecting individual funds. CAIS recently launched a Models Marketplace to host multi-asset and multi-manager alternative models and integrate with its portfolio construction tool, Compass. A strong CAIS alternative should offer a similar model or managed-allocation frameworks, possibly with AI assistance, dynamic rebalancing, or allocation optimization.

Integration and Ecosystem Compatibility

Because advisors often use multiple systems (custodians, reporting, TAMPs, managed account platforms), a good CAIS alternative should integrate via APIs, connectors, or embed into existing advisor systems. For example, CAIS announced the ability to integrate with other TAMPs and managed account platforms.

Compatibility and flexibility in user experience are key.

Due Diligence, Transparency, and Risk Controls

Alternatives should provide third-party due diligence, manager evaluation, risk analytics, and performance transparency. CAIS partners with Mercer for independent diligence. (CAIS)

The alternative must match or exceed those standards to compete credibly.

Examples of CAIS Alternative Platforms

Below are real-world platforms that can be considered CAIS alternatives or complementary systems, each with distinctive capabilities and trade-offs.

iCapital

iCapital is a leading alternative investment platform acting as a fintech aggregator and distributor for private funds, infrastructure, hedge funds, and credit. It works with many banks and institutions to deliver access to alternative funds. (Wikipedia)

iCapital offers:

- A marketplace where advisors can evaluate and subscribe to private funds

- Fund access across multiple geographies and strategies

- Strong institutional relationships and custodian integration

Relative to CAIS, iCapital often excels in scale, international reach, and deep relationships with large banks and wealth channels. But some advisors may find its interfaces less flexible for boutique advisa ors or lack of certain model tools that CAIS has begun providing.

Yieldstreet

Yieldstreet focuses more on individual alternative investing, including asset classes like real estate, art finance, legal finance, and private credit. In 2025, it introduced Yieldstreet360, an automated managed portfolio product offering diversified exposure to private markets with quarterly liquidity and annual rebalancing.

While Yieldstreet is not always tailored for large advisor networks, it provides a useful alternative for investors and advisors wanting exposure to niche alternative strategies, especially in private credit and real assets. Its strength lies in educational content, unique asset classes, and accessible exposure, though it may lack CAIS-level institutional integration, due diligence frameworks, or full post-trade automation.

Allocations

Insert image of Allocations platform interface or fund admin workflow here

Allocations is a fintech platform for fund administration, SPV (special purpose vehicle) formation, and operational automation for private deals. It helps in forming funds, managing capital calls, investor communications, and compliance tasks. (Wikipedia)

While Allocations is narrower in scope (focusing on infrastructure rather than full marketplace access), it is a compelling alternative when combined with distribution platforms. Advisors or fund sponsors looking to build custom vehicles—without reinventing operations—can leverage Allocations. It complements platforms like iCapital or Yieldstreet, offering a backend layer for private vehicles.

How CAIS Alternatives Compare: Trade-Offs & Strategic Fit

When comparing CAIS and its alternatives, advisors must weigh trade-offs. Here’s a summary of typical differences:

- Breadth vs specialization: Some platforms cover broad asset classes (like CAIS and iCapital), while others ffocus on iche strategies (like Yieldstreet).

- Scale vs flexibility: Larger platforms may have deeper resources, but smaller ones may give more control or customizable user experience.

- Technology integration: Platforms that integrate well with advisor tech stacks reduce friction.

- Operation support: The stronger the post-trade infrastructure (document automation, legacy onboarding), the more friction is removed.

- Fee structures: Pricing models (platform fees, fund fees, subscription fees) vary and impact net returns.

- Due diligence & trust: Established third-party validation (like CAIS’s Mercer partnership) is a differentiator; newer platforms must build similar credibility.

Advisors should select a CAIS alternative based on their client size, asset mix, operational sophistication, and integration requirements.

Benefits of Using Technology-Driven Alternative Platforms (Beyond CAIS)

Even for competitors, the broader benefits of technology in alternative investing are similar—and critical.

Automation of Manual Processes

Platforms reduce manual burdens: onboarding, KYC/AML checks, document execution, subscription workflows, capital calls, and performance aggregation. Instead of coordinating dozens of relationships across manual spreadsheets and PDF documents, advisors manage all the workflow seamlessly.

Unified Data, Reporting & Visibility

Instead of fragmented reports from multiple managers, tech-enabled platforms unify all alternative holdings in one dashboard. Advisors can view cash flows, performance, risk metrics, and liquidity in real time, improving oversight and client communication.

Dynamic Portfolio Construction & Scenario Analysis

Modern platforms often embed analytics or third-party engines to evaluate the impact of adding or removing alternative allocations. Advisors can simulate how a new private credit or hedge fund addition affects overall risk, correlation, or liquidity constraints.

Scalability & Client Growth

With operations decoupled from manual work, advisors can scale their alternative offerings across more clients without proportionate increases in back-office burden. That efficiency helps them grow without linear overhead.

Lower Barriers to Entry for Clients

Technology-enabled platforms often enable feeder structures, pooled funds, or lower minimum vehicles that allow smaller clients to access alternative strategies—once the domain of institutions. This democratization is one of CAIS’s founding goals. (CAIS)

Thus, technology unlocks both operational efficiency and broader access.

Use Cases: How CAIS Alternatives Solve Real Problems

Use Case 1: Advisor Consolidating Multiple Legacy Alternative Holdings

Problem: An advisor has clients with private funds acquired years ago from various sources. Reconciliation, cash call tracking, and documentation are fragmented across systems.

Solution with a CAIS alternative or complementary platform: The advisor imports legacy fund data into a unified platform (like CAIS Solutions or similar). That platform handles aggregation, performance normalization, and reporting. The advisor gains a consolidated view of all alternative assets—both new and existing.

Use Case 2: Boutique Firm Launching Its Own Alternative Fund

Problem: A small advisory firm wants to offer a proprietary alternative product blending real estate and private credit, but lacks infrastructure.

Solution: Using a platform like Allocations or a CAIS-style custom fund feature, the firm can build a branded fund with operational support, subscription tools, reporting, and compliance mechanisms. They can then distribute via marketplaces (CAIS, iCapital, or similar).

Use Case 3: Accessing Specialized Strategies Not in CAIS

Problem: An advisor wants exposure to a region-specific private debt fund or an art-finance vehicle not yet available in CAIS’s curated menu.

Solution: They use complementary platforms—like Yieldstreet—for access to alternative strategies or niche asset classes. Then they manage those exposures alongside CAIS investments using integrated reporting (if possible) or through manual reconciliation.

Use Case 4: Embedding Alternative Investing Within a Broader TAMP or Managed Account

Problem: A firm uses a TAMP or managed account system for equities and fixed income and wants to integrate alternatives seamlessly.

Solution: Choose a platform that integrates with that TAMP (API or plug-in). CAIS has begun enabling integration with TAMPs. Similarly, alternatives must support embedding. This allows advisors to manage both traditional and alternative assets in one workflow without context switching.

Use Case 5: Offering Model Portfolios with Alternatives

Problem: An advisory firm wants to efficiently deploy alternative allocations across client accounts rather than selecting individual funds.

Solution: A platform offering models or multi-manager allocations enables advisors to assign a model (for example, 20% private credit, 10% hedge funds) and let the system handle the underlying fund execution and rebalancing. CAIS’s Models Marketplace is an example of that trend. (CAIS) Alternatives offering model portfolios help reduce decision complexity.

Best Practices When Selecting a CAIS Alternative

- Align with your operational maturity.

If your firm is early-stage, you may prefer a simpler interface with strong automation. More mature firms might demand API-level integration, custom modeling, and white-labeling. - Evaluate manager coverage and strateg.y breadth

Examine which alternative strategies and geographies the platform supports, and whether those align client’sour client needs (emerging markets, real assets, private credit, hedge funds, etc.). - Test integration capabilities

Ensure the platform can integrate with your custodians, reporting tools, CRM, or TAMP systems. Data connectivity reduces friction. - Confirm due diligence and governance ..standards

The platform should provide transparent criteria, third-party reviews, and periodic monitoring of managers. - Review the fee structure and alignment of interests

Understand platform fees, fund-level fees, and how they impact net returns. Prefer platforms with aligned incentives and transparent pricing. - Ensure scalability an..d flexibility

The platform should support growth—new clients, new strategies, modular tools, and ideally, the ability to switch or expand without major disruption. - Support and education

A good platform offers advisor education, training tools, and support during implementation and ongoing use.

Frequently Asked Questions (FAQ)

Q1: Are CAIS alternatives necessarily better or worse than CAIS?

Not inherently. Alternatives to CAIS may offer areas where CAIS is less optimized—such as access to niche strategies, lower fees, or stronger infrastructure in specific geographies. However, CAIS remains a benchmark in integrated alternative investing for advisors with a mature, broad platform ecosystem. The right choice depends on your firm’s priorities, operational needs, and client mix.

Q2: Can I use multiple platforms at once?

Yes. Many advisors use CAIS in combination with other platforms. The key is managing fragmentation, choosing platforms that offer integration or good reporting exports to consolidate holdings.

Q3: How difficult is migration from CAIS to another platform (or vice versa)?

Migration complexity depends on how many funds you hold, how clean your data is, and whether the new platform supports legacy import tools. A major consideration is political: fund managers may restrict transfers. Always perform due diligence and plad.