Multi-Manager Platform: The Complete Guide to Modern Investment Architecture and Technology in 2025

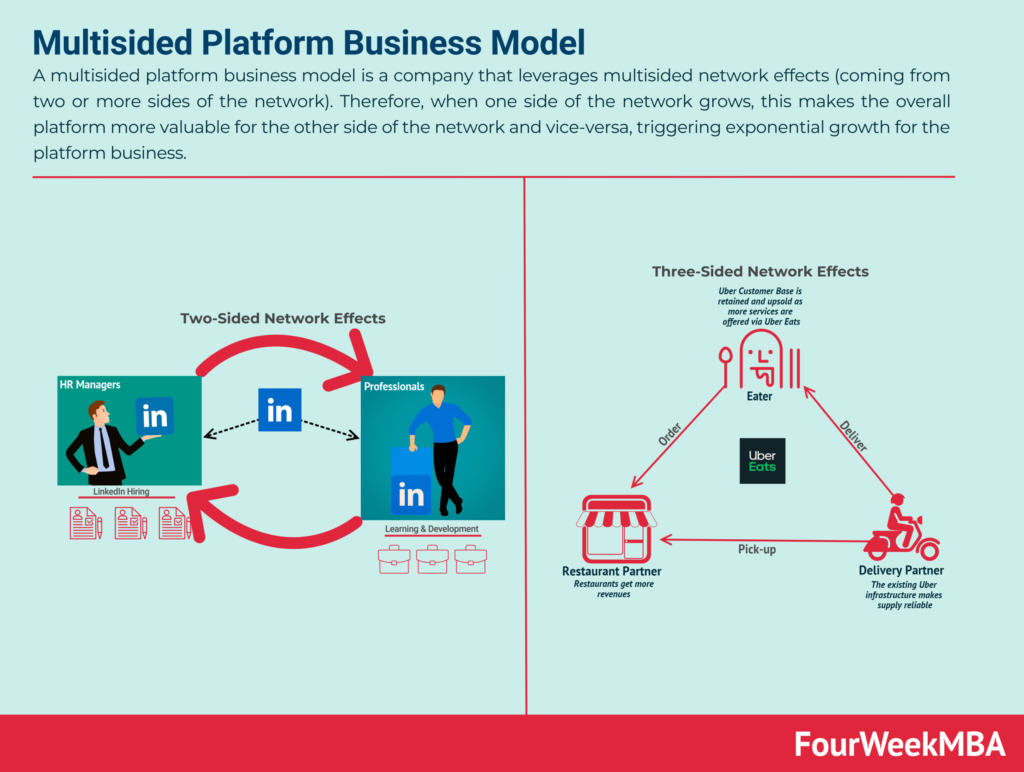

The world of investment management has evolved dramatically over the past two decades. As markets become more complex and investors demand greater diversification, single-manager strategies often struggle to deliver consistent performance across all asset classes. To solve this, the multi-manager platform model was developed.

A multi-manager platform refers to an investment framework or technological system that brings together multiple professional investment managers, each specializing in a distinct asset class or strategy under a unified structure. Instead of relying on a single manager to handle all investment decisions, this platform allocates capital across a variety of managers who each manage a specific portion of the portfolio.

In recent years, technology-driven multi-manager platforms have become essential tools for institutional investors, wealth managers, and financial advisors. These platforms simplify portfolio construction, enhance risk diversification, and streamline administrative processes, allowing users to access multiple fund managers through one integrated interface.

This article explores in depth how multi-manager platforms function, the technology behind them, their advantages, and real-world examples that demonstrate their practical applications in modern finance.

How a Multi-Manager Platform Works

Structural Overview

A multi-manager platform serves as a centralized investment infrastructure. It enables investors to build diversified portfolios by combining several independent investment managers, each chosen for their expertise in a specific market niche or strategy.

Here’s how it generally operates:

- Platform Provider: The platform serves as the operational and technological backbone, offering access, administration, and oversight.

- Investment Managers: Each participating manager runs their own mandate—such as equities, private credit, real estate, or hedge funds—within the overall portfolio.

- Portfolio Allocation Engine: Technology manages capital allocation dynamically, distributing funds across managers based on pre-defined strategies or performance metrics.

- Risk and Reporting System: The platform continuously aggregates data from all managers, providing unified reporting and risk analytics to investors and advisors.

This structure allows investors to benefit from multiple sources of alpha while minimizing concentration risk. It also gives advisors a streamlined way to access, monitor, and manage complex portfolios without manually coordinating multiple fund relationships.

Core Technology Components

Modern multi-manager platforms are powered by fintech infrastructure that integrates advanced analytics, cloud-based administration, and automated reporting. Key technological elements include:

- Data Aggregation and Normalization: The platform collects performance data, risk metrics, and transactions from each underlying manager and standardizes them for unified reporting.

- API Integrations: Seamless connections between custodians, portfolio systems, and fund administrators ensure real-time updates and transparency.

- AI-Driven Allocation Engines: Machine learning algorithms help optimize capital allocation across managers, adjusting exposures in response to market trends.

- Cloud Architecture: Enables scalability, data security, and global accessibility for investors and advisors.

Together, these elements transform what used to be a manual, fragmented investment process into a digital, transparent, and efficient ecosystem.

Benefits of Using a Multi-Manager Platform

Diversification and Risk Reduction

One of the primary reasons investors use multi-manager platforms is diversification. Instead of being dependent on a single manager’s strategy or market outlook, portfolios gain exposure to multiple managers with distinct investment styles and asset classes.

This structure reduces concentration risk and allows performance stability across varying market cycles. For example, one manager may focus on growth equities while another targets private credit or macro hedge fund strategies. If one area underperforms, others can offset the loss—creating a more resilient portfolio overall.

Operational Efficiency

Without a platform, managing multiple investment managers involves significant paperwork, compliance requirements, and reporting challenges. A multi-manager platform automates these administrative processes.

Investors and advisors gain access to all their holdings through one digital interface. Subscription documents, due diligence reports, capital calls, and performance statements are centralized and updated in real time. This reduces errors, saves time, and increases transparency.

Institutional-Level Oversight

These platforms provide institutional-grade governance and monitoring tools, including automated compliance checks, real-time performance tracking, and risk dashboards. Investors can quickly evaluate manager performance, liquidity status, and risk exposure without waiting for quarterly updates.

Access to Specialized Expertise

Each manager on a multi-manager platform brings deep expertise in their area—whether it’s emerging markets, venture capital, structured credit, or ESG-focused equities. By accessing multiple specialists, investors gain a broader perspective and higher-quality investment decisions than they could achieve through one generalist manager.

Scalability and Flexibility

For financial advisors or family offices, scalability is crucial. Multi-manager platforms enable easy onboarding of new managers, rebalancing between strategies, and adapting to changing client needs. This flexibility allows advisors to manage both small and large portfolios efficiently.

Real-World Examples of Multi-Manager Platforms

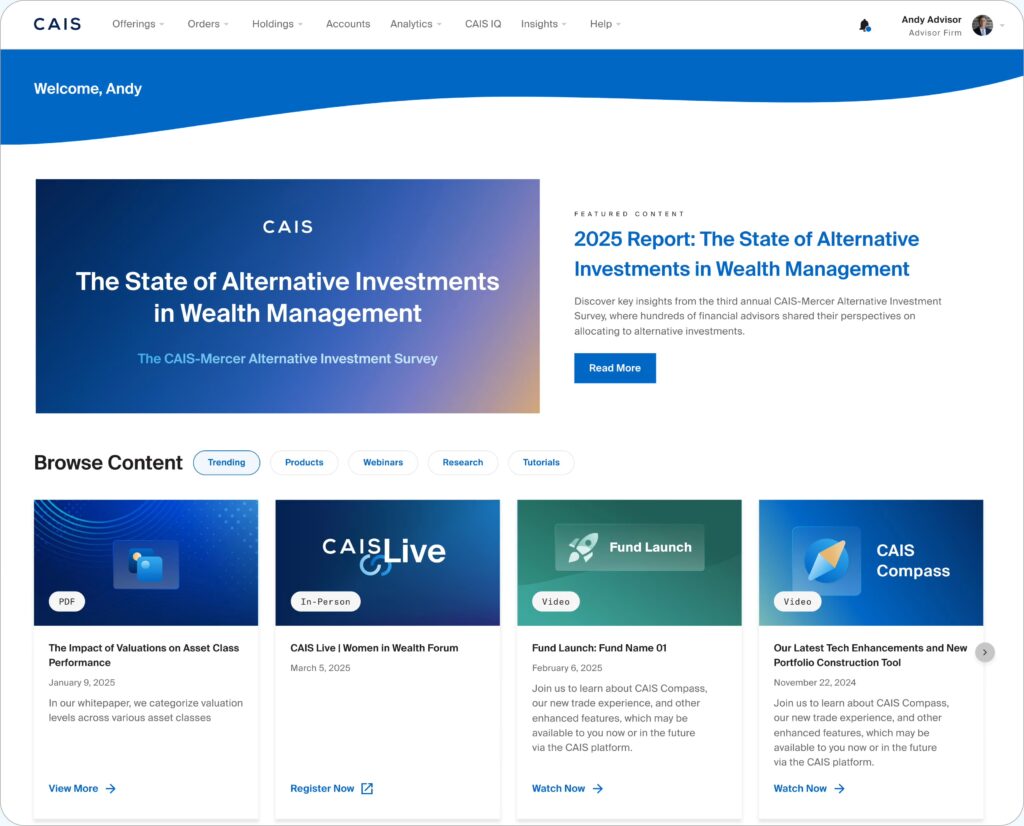

Example 1: CAIS Multi-Manager Platform

CAIS, a leading alternative investment platform, operates a technology-driven multi-manager model that connects financial advisors to a curated selection of alternative asset managers. It allows users to access private equity, private credit, hedge funds, and structured notes within a single ecosystem.

CAIS also provides a Models Marketplace, featuring pre-constructed multi-manager model portfolios built around asset classes like private credit or real assets. These models combine multiple top-tier managers into a single allocation, simplifying diversification and execution for advisors.

Each fund listed on CAIS undergoes third-party due diligence by Mercer, ensuring quality and transparency. This structure empowers advisors to deliver institutional-grade investment opportunities with reduced operational friction.

Example 2: BlackRock Multi-Manager Solutions

BlackRock, the world’s largest asset manager, operates several multi-manager platforms across different investment verticals. Its Multi-Manager Alternative Strategies Fund combines the expertise of multiple external managers within a single portfolio, aiming to deliver absolute returns with controlled volatility.

These platforms leverage BlackRock’s Aladdin risk management system, a powerful technology suite that consolidates risk analytics, performance tracking, and portfolio modeling across managers.

Through this approach, BlackRock ensures each manager’s contribution complements others, reducing overlap and enhancing overall portfolio efficiency.

Example 3: Mercer Multi-Manager Platform

Mercer, a global investment consulting and solutions provider, operates one of the most advanced multi-manager platforms in the institutional world. Its platform aggregates strategies from hundreds of fund managers, providing institutional clients with diversified portfolios tailored to specific goals such as growth, income, or capital preservation.

Mercer’s multi-manager framework benefits from rigorous research, continuous monitoring, and independent oversight. Each fund manager is selected and reviewed by Mercer’s global research team, ensuring consistent performance and alignment with client objectives.

For corporate pension funds and insurance companies, this platform provides a turnkey solution for managing complex portfolios across multiple asset classes.

Example 4: Man Group’s Multi-Manager Hedge Fund Platform

Man Group, one of the world’s largest hedge fund managers, offers a multi-manager hedge fund platform that pools a diverse set of hedge fund strategies under one structure. Its platform includes long/short equity, macro, quant, and credit-focused managers, all coordinated through a centralized system.

The technology underlying Man Group’s platform includes AI-driven analytics and data science capabilities that assess correlations, factor exposures, and risk-adjusted returns across managers.

This sophisticated system allows institutional investors to access hedge fund-style diversification without having to manage multiple separate relationships or operational burdens.

Example 5: UBS Multi-Manager Investment Platform

UBS operates a multi-manager platform through its wealth management division, designed for high-net-worth clients and institutional investors. The platform offers both traditional and alternative strategies managed by external managers carefully vetted by UBS’s research and due diligence teams.

Using advanced technology, UBS consolidates performance and risk data across managers, providing clients with unified performance dashboards and analytical insights. The firm’s focus on ESG integration and sustainability reporting makes this platform particularly appealing for investors seeking responsible investment diversification.

Benefits of Technology in Multi-Manager Platforms

Technology plays a central role in the evolution of multi-manager platforms. It not only simplifies access but also enhances accuracy, scalability, and decision-making.

Automation and Workflow Optimization

Advanced automation streamlines portfolio onboarding, due diligence, compliance, and reporting. Tasks that once required extensive manual work—like reconciling manager reports or calculating risk exposure—are now handled automatically through cloud-based systems.

Real-Time Analytics and Risk Management

Modern platforms use data analytics and AI to provide real-time visibility into performance and risk. This enables faster decision-making and proactive adjustments to portfolio allocations when market conditions change.

Integration with Custodians and Data Providers

Through APIs and secure integrations, multi-manager platforms connect with custodians, administrators, and fund managers. This creates a seamless data flow that eliminates redundancies and ensures accuracy across all levels of investment management.

Enhanced Transparency and Security

Blockchain and encrypted data layers are increasingly being incorporated to improve transaction security, audit trails, and investor trust. Investors and regulators can verify positions, transactions, and valuations more easily, creating a higher level of transparency across the investment chain.

Practical Use Cases and Real-Life Applications

Use Case 1: Wealth Management Firm Managing Diversified Portfolios

A financial advisory firm serving high-net-worth clients wants to offer exposure to private equity, real estate, and hedge funds. Instead of sourcing managers individually, the firm uses a multi-manager platform to construct balanced portfolios.

The platform’s technology handles subscription logistics, performance aggregation, and compliance, enabling advisors to scale operations while maintaining a boutique client experience.

Use Case 2: Pension Fund Seeking Diversified Return Sources

A pension fund requires steady, risk-adjusted returns to meet long-term obligations. Through a multi-manager platform, it allocates capital to multiple managers across fixed income, infrastructure, and private credit.

The platform provides unified risk analysis, ensuring that no single exposure dominates the portfolio. Real-time reporting helps trustees make informed decisions and comply with regulatory requirements.

Use Case 3: Family Office Centralizing Investments

A family office with investments across different asset managers struggles with fragmented data and inconsistent reporting. By adopting a multi-manager platform, the office gains a single view of its global investments.

This centralization simplifies oversight, improves transparency, and allows the family office to analyze performance across all managers simultaneously.

Frequently Asked Questions (FAQ)

Q1: What is the main purpose of a multi-manager platform?

The main purpose is to provide investors with diversified exposure across multiple investment managers and strategies while simplifying administration, reporting, and oversight through a unified technological platform.

Q2: Who uses multi-manager platforms?

They are used by institutional investors, wealth management firms, family offices, and financial advisors who want to combine multiple managers and strategies efficiently within a single investment framework.

Q3: Are multi-manager platforms only for large investors?

Not necessarily. While they were originally designed for institutions, modern technology-driven platforms now allow smaller advisors and private investors to access similar structures with lower minimum investments and simplified workflows.