CAIS Alternative Investments: The Complete 2025 Guide for Financial Advisors and Investors

The investment world is evolving rapidly. Traditional assets such as stocks and bonds are no longer the only options for building diversified, high-performing portfolios. Many investors, particularly institutions and high-net-worth individuals, are turning to alternative investments assets that fall outside conventional public markets. These include private equity, hedge funds, private credit, real estate, structured notes, and other private market opportunities.

However, one of the biggest challenges in the alternative investment space has been accessibility and operational complexity. For years, such investments were available only to large institutions with specialized teams.

This is where CAIS short for Capital Integration Systems enters the picture. CAIS is a financial technology (fintech) platform founded in 2009 with a clear mission: to democratize access to alternative investments. It provides financial advisors, family offices, and wealth managers with a centralized system to discover, evaluate, and manage alternative investment opportunities.

In essence, CAIS connects independent financial advisors to a global network of institutional-quality alternative investments, offering the technology, infrastructure, and education they need to integrate these assets seamlessly into their clients’ portfolios.

What Are Alternative Investments?

Before diving deeper into CAIS, it’s important to understand what alternative investments are and why they matter.

Alternative investments refer to asset classes outside the traditional categories of publicly traded stocks, bonds, and cash. These may include:

- Private Equity: Investments in private companies not listed on public stock exchanges.

- Hedge Funds: Pooled investment funds that use a wide range of strategies to generate returns, including long/short positions, derivatives, and leverage.

- Private Credit: Debt financing provided to private companies, often with higher yields than traditional bonds.

- Real Estate and Infrastructure: Tangible assets that can provide income and inflation protection.

- Structured Notes: Customized financial instruments that combine fixed-income and derivative components to offer specific risk-return profiles.

- Venture Capital, Commodities, and Collectibles: Other forms of alternative investments that diversify portfolios.

Traditionally, these investments have been limited to institutional investors due to high minimums, complex due diligence, and lengthy paperwork. CAIS changes this by offering a technology-driven solution that simplifies access, education, and execution for financial advisors and their clients.

Understanding How CAIS Works

CAIS serves as a comprehensive digital platform for financial advisors who want to include alternative investments in their clients’ portfolios. Its ecosystem is built around several integrated components that together create a seamless end-to-end experience.

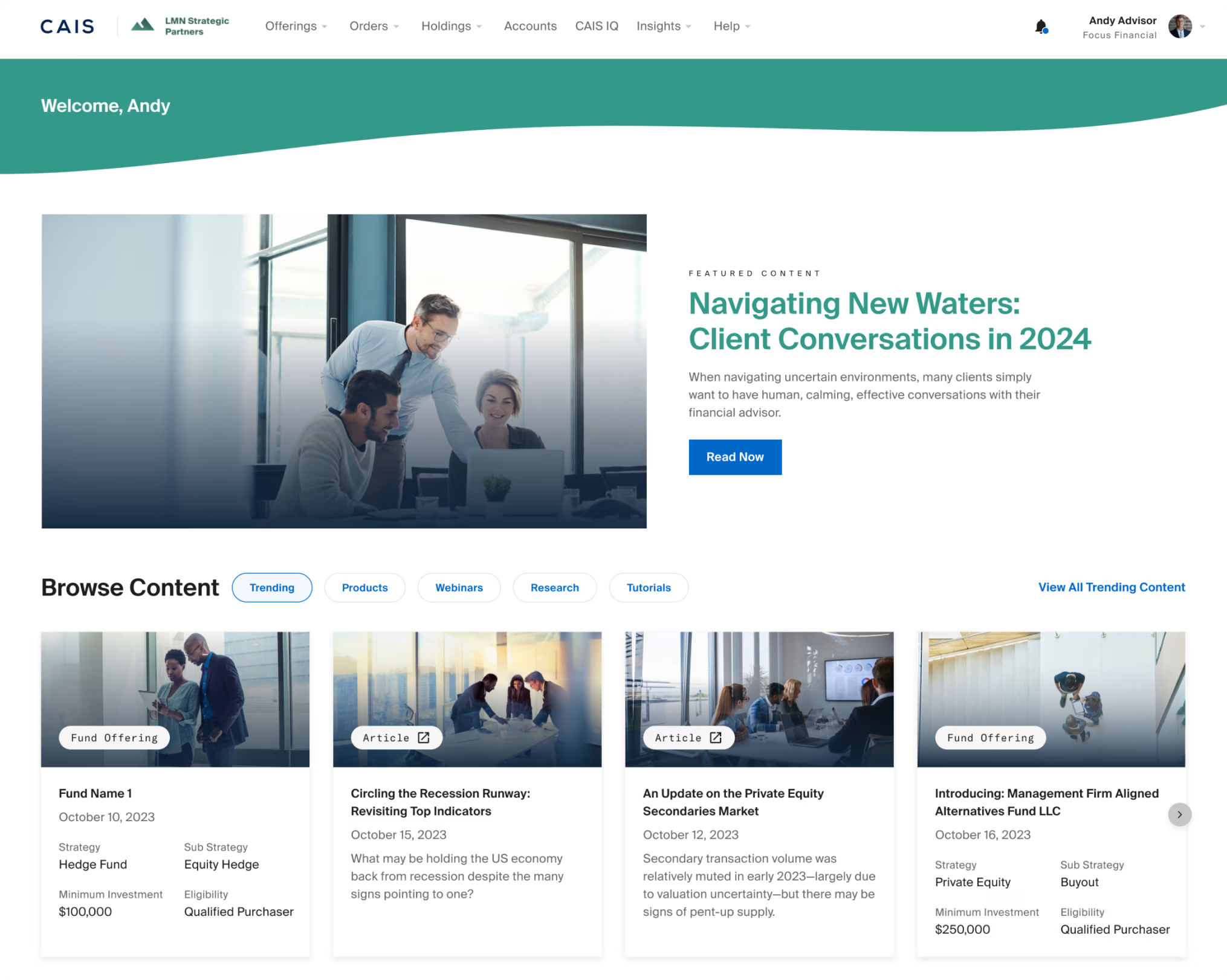

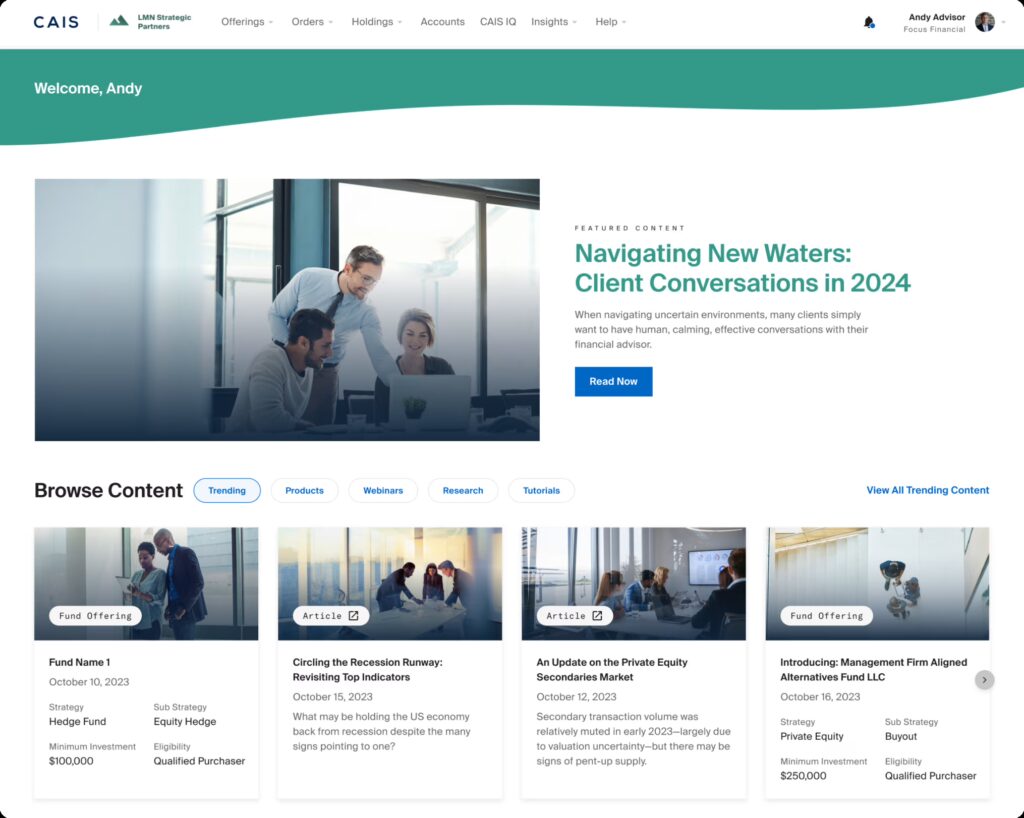

1. CAIS Marketplace

The CAIS Marketplace is the platform’s core hub. It features a curated selection of alternative investment opportunities sourced from leading global asset managers. Advisors can browse, evaluate, and subscribe to investments such as private equity funds, hedge funds, private credit vehicles, and structured products—all in one place.

What makes the CAIS Marketplace unique is that every investment opportunity undergoes third-party due diligence, typically conducted by Mercer, one of the world’s leading consulting firms. This ensures that the funds and strategies available on the platform meet institutional-level quality and transparency standards.

The marketplace allows advisors to:

- Filter and compare investments by asset class, strategy, risk level, or liquidity profile

- Review detailed fund documents and performance metrics

- Complete subscription processes digitally, without manual paperwork

- Access educational resources related to each offering

This eliminates much of the friction and complexity historically associated with alternative investing.

2. CAIS Solutions (SaaS Platform)

CAIS Solutions is a software-as-a-service (SaaS) platform designed to manage all alternative investment operations whether sourced through CAIS or from external managers. It helps advisors centralize data, workflows, and reporting into a single, unified interface.

Through CAIS Solutions, financial advisors can:

- Onboard and monitor alternative investments acquired outside of CAIS

- Manage subscriptions, capital calls, and distributions

- Track performance and cash flows

- Maintain compliance and documentation integrity

This feature allows advisory firms to consolidate all their alternative holdings into one secure system, saving time and reducing operational errors.

3. CAIS Custom Funds

CAIS also offers a Custom Funds service that enables firms to design their own multi-manager or single-manager investment vehicles. This allows boutique wealth management firms to create branded private funds tailored to their client base, while CAIS handles the underlying operational infrastructure subscription processing, compliance, and fund administration.

This capability helps advisors expand their product offerings without having to build in-house fund management systems.

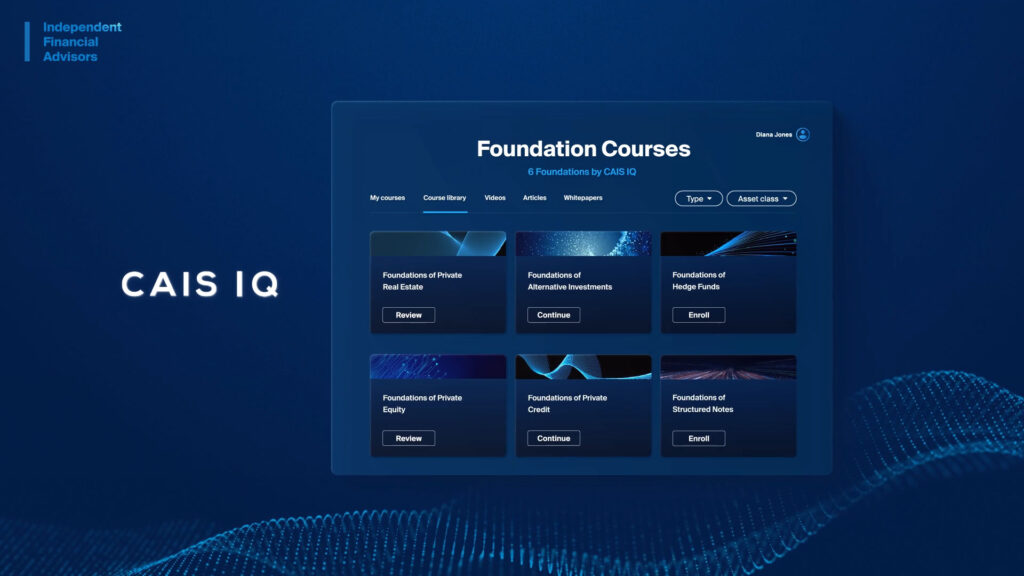

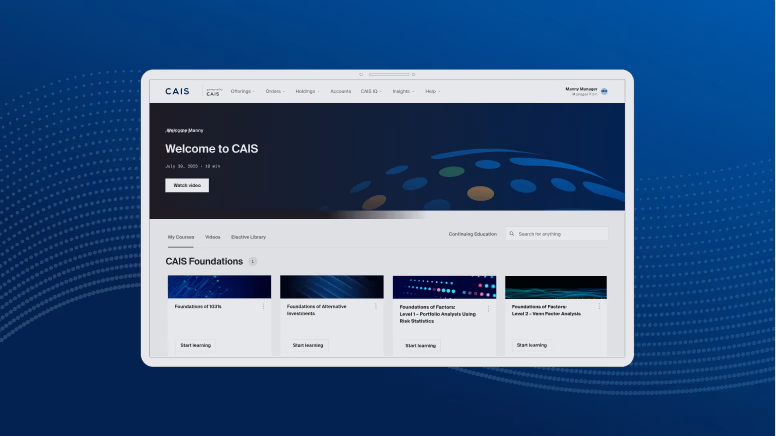

4. CAIS IQ: Learning and Education

Education is a major barrier to the adoption of alternative investments. Many advisors are less familiar with private markets, risk factors, and liquidity constraints.

To solve this, CAIS created CAIS IQ, an educational platform that provides interactive courses, insights, and certification programs. It empowers financial professionals to deepen their understanding of alternative investments, structured notes, and portfolio integration techniques.

CAIS IQ uses micro-learning modules, interactive quizzes, and real-world examples to ensure that advisors can make informed decisions for their clients.

5. Post-Trade Operations and Reporting

After investments are executed, CAIS offers comprehensive post-trade tools that manage the entire lifecycle of alternative investments. These include document management, compliance tracking, valuation reporting, and integration with custodial systems.

This end-to-end automation reduces administrative workload and helps ensure compliance, accuracy, and transparency.

Benefits of Using CAIS Alternative Investments

CAIS brings a wide range of benefits for advisors, investors, and wealth management firms. These advantages stem from its combination of technology, access, education, and operational infrastructure.

1. Democratizing Access to Alternatives

For decades, alternative investments were available only to institutional investors or ultra-wealthy individuals due to high entry minimums and operational barriers.

CAIS changes this landscape by enabling financial advisors of all sizes to offer institutional-quality investments to their clients. Through feeder funds, pooled vehicles, and structured notes with lower minimums, CAIS expands the reach of private market investing to a broader audience.

This democratization allows smaller advisory firms to compete with larger institutions and offer the same level of sophistication in portfolio management.

2. Simplified Operations and Reduced Complexity

One of the biggest pain points in the alternative investment world is the administrative complexity. Traditional processes involve manual paperwork, inconsistent reporting formats, and lengthy subscription timelines.

CAIS automates these processes reducing errors, accelerating workflows, and improving overall efficiency. Advisors can now execute trades, complete compliance steps, and monitor investments through a single digital platform.

This not only saves time but also enhances client experience by making alternative investments more transparent and manageable.

3. Enhanced Diversification and Risk Management

Alternative investments can improve portfolio performance by providing diversification benefits and exposure to non-correlated assets. In volatile markets, these assets often move independently of public equities and bonds, which helps reduce overall portfolio risk.

Through CAIS, advisors can easily incorporate alternatives such as private credit, hedge funds, and real estate into diversified model portfolios creating balanced exposure across liquid and illiquid asset classes.

4. Institutional-Level Due Diligence and Transparency

Due diligence is critical in the alternative investment world. CAIS partners with Mercer to perform third-party due diligence on the majority of its offerings.

This ensures that each investment listed on the platform has undergone rigorous evaluation of its strategy, performance history, risk management, and operational integrity.

The result is increased transparency and confidence for both advisors and clients—allowing them to invest with greater clarity and control.

5. Integration of Liquid and Illiquid Alternatives

CAIS bridges the gap between illiquid alternatives (like private equity or venture capital) and semi-liquid assets (such as interval funds and structured notes).

Advisors can manage both types within the same platform, using unified reporting and risk analysis tools. This integration allows more flexible portfolio construction, enabling investors to balance long-term private commitments with shorter-term liquidity options.

Real-World Examples of CAIS Alternative Investments in Action

Example 1: Building a Multi-Manager Private Credit Portfolio

A mid-sized advisory firm wants to help clients diversify beyond bonds by investing in private credit. Traditionally, sourcing multiple private credit funds would require negotiating with several managers, managing multiple documents, and coordinating different reporting systems.

Through CAIS, the firm can access a multi-manager private credit model portfolio that combines several private credit strategies direct lending, mezzanine debt, and special situations into a single structure.

The advisor can allocate client capital in one transaction and monitor all positions through CAIS’s dashboard. Capital calls, distributions, and performance updates are automatically tracked and reconciled.

This streamlines the entire process and allows advisors to deliver institutional-quality credit exposure without the operational complexity.

Example 2: Structured Notes and Semi-Liquid Alternatives

Some investors want downside protection or enhanced income but do not want to commit to fully illiquid investments. CAIS offers structured notes and ticker-traded interval funds, which provide periodic liquidity while maintaining alternative exposure.

For example, an advisor can use CAIS to select a structured note with a specific risk-return profile—such as capital protection with upside participation. The platform handles documentation, execution, and reporting automatically.

Advisors can monitor structured notes, private funds, and interval funds within the same dashboard, offering a comprehensive view of all client holdings.

Example 3: Integrating Legacy Alternative Investments

Many advisory firms manage clients who already hold alternative investments acquired outside of CAIS. These legacy positions are often tracked manually, leading to errors and inefficiencies.

Using CAIS Solutions, advisors can onboard and manage these external assets directly within the CAIS platform. This creates a unified view of all alternative holdings, regardless of where they originated.

The system consolidates performance data, cash flows, and reporting helping firms achieve full transparency and operational control over all their clients’ alternative investments.

Example 4: Creating Custom Branded Funds

A boutique wealth management firm wants to offer clients a proprietary alternative fund that blends real estate, private equity, and venture capital. Building such a vehicle in-house would typically require heavy infrastructure and regulatory oversight.

CAIS enables the firm to create acustom fund using its operational backbone. CAIS manages the compliance, subscription, and administration processes, while the firm focuses on portfolio design and branding.

This allows smaller firms to launch their own institutional-grade alternative funds efficiently and cost-effectively.

Use Cases: How CAIS Solves Real-World Problems

Use Case 1: Reducing Administrative Burden

Problem: Advisors spend countless hours managing capital calls, subscription paperwork, and compliance documents.

Solution: CAIS automates onboarding, document handling, and reporting, reducing manual tasks and allowing advisors to focus on strategy and client relationships.

Use Case 2: Expanding Client Access

Problem: Many clients cannot meet high investment minimums for private funds.

Solution: CAIS provides access to pooled vehicles and feeder structures with lower minimums, enabling broader participation in private markets.

Use Case 3: Portfolio Diversification

Problem: Traditional portfolios often have high exposure to public market volatility.

Solution: CAIS allows advisors to integrate private market assets that provide uncorrelated returns and long-term growth potential.

Use Case 4: Liquidity Management

Problem: Managing cash flows and liquidity around private fund commitments is difficult.

Solution: CAIS tracks capital calls, distributions, and expected liquidity events, helping advisors plan for cash flow needs with precision.

Use Case 5: Education and Knowledge Building

Problem: Advisors need more confidence when recommending alternatives to clients.

Solution: CAIS IQ provides structured learning modules and certifications, helping advisors build expertise and credibility in the alternative investment space.

The Technological Edge of CAIS

CAIS is more than just a marketplace it’s an advanced technology infrastructure that modernizes how alternative investments are accessed and managed.

Some of its key technological advantages include:

- Cloud-Based Platform: Accessible anywhere, scalable across thousands of clients.

- Automation: Reduces paperwork, speeds up compliance and reporting.

- Data Integration: Connects with custodians, performance reporting systems, and CRM tools.

- Security and Compliance: Built-in features that meet institutional security and regulatory standards.

- Analytics: Provides advisors with real-time insights into performance, risk, and cash flows.

These technological foundations enable advisors to bring institutional-grade investment capabilities to retail and mass-affluent clients something that was virtually impossible a decade ago.

Frequently Asked Questions (FAQ)

Q1: Who can use CAIS?

CAIS is designed for registered investment advisors (RIAs), broker-dealers, family offices, and wealth management firms that want to integrate alternative investments into client portfolios. It is not a retail investment platform; access is limited to financial professionals.

Q2: Are all CAIS investments illiquid?

No. While many private market funds have long lock-up periods, CAIS also offers semi-liquid alternatives like interval funds and structured notes. Advisors can create balanced portfolios with a mix of illiquid and liquid alternatives to meet client needs.

Q3: Does CAIS replace human advisors?

Absolutely not. CAIS enhances an advisor’s capabilities by automating operations and providing access to institutional products. Advisors still play a vital role in portfolio construction, client education, and suitability assessment.