Yieldstreet Investment Platform: In-Depth Guide to Alternative Investing for 2025

The world of investing has expanded beyond traditional markets. While most investors are familiar with stocks, bonds, and mutual funds, a growing segment of people is turning to alternative investment assets that offer unique returns, diversification, and opportunities once limited to institutions.

At the forefront of this transformation is Yieldstreet, a digital platform that makes it possible for individual investors to access a range of private market opportunities. From real estate and private credit to art finance and legal settlements, Yieldstreet allows everyday investors to participate in asset classes that used to be exclusive to the ultra-wealthy.

This article offers a complete exploration of the Yieldstreet investment platform, covering its structure, key advantages, investment examples, benefits of its technology, practical use cases, and a detailed FAQ section to help you understand whether this platform fits your investment strategy.

Understanding the Yieldstreet Investment Platform

Yieldstreet is an alternative investment marketplace that connects individual investors with private market opportunities. The platform was founded in 2015 with a mission to democratize access to alternative investments that were traditionally out of reach for non-institutional investors.

How the Platform Works

Yieldstreet operates as a digital marketplace. Investment opportunities known as offerings are sourced, underwritten, and reviewed by Yieldstreet’s internal investment team. Each opportunity comes with specific terms, including the investment minimum, target return, maturity date, and risk factors.

Investors can browse available offerings through the Yieldstreet dashboard, choose the ones that align with their goals, and allocate funds directly through the platform. Once invested, they can track performance, distributions, and maturity timelines from their account interface.

The Core Concept

At its core, Yieldstreet aims to help investors build diversified portfolios that are not solely dependent on public market performance. Instead of being limited to stock market volatility, investors gain access to private credit, real estate debt, art-backed loans, and other uncorrelated assets.

This diversification is crucial for long-term stability and potentially improved returns, especially in uncertain economic conditions.

Types of Investments Available on Yieldstreet

Yieldstreet offers a variety of asset classes, each with different levels of risk, return, and duration. Let’s examine some of the most notable categories available on the platform.

Real Estate Investments

Yieldstreet provides access to real estate-backed opportunities in the debt and equity structures. These can include commercial developments, residential housing, or property refinancing projects.

Investors typically earn returns through interest payments, rental income, or appreciation at the project’s completion. Real estate investments on Yieldstreet often appeal to those who want tangible asset exposure without the hassle of direct property management.

Private Credit

Private credit refers to loans made to businesses or individuals that are not issued by banks or traded on public markets. These loans may fund expansion, construction, or other ventures.

Investors benefit by earning interest from these loans, often at higher rates than public fixed-income securities. Private credit offerings usually have defined maturities and clear repayment terms, making them attractive to yield-seeking investors.

Legal Finance

This is one of Yieldstreet’s most distinctive offerings. Legal finance investments involve funding legal cases in exchange for a share of the settlement or judgment proceeds.

These opportunities can provide returns that are uncorrelated to broader market movements because they depend on case outcomes rather than economic cycles. However, they also carry unique risks related to litigation outcomes and legal proceedings.

Art Finance and Collectibles

Yieldstreet also allows investors to participate in art-backed loans or fractional ownership of valuable artworks. This asset class connects the worlds of finance and fine art.

By investing in art finance, investors can diversify into an asset that often holds intrinsic value and cultural significance. Art investments can be influenced by market trends, collector demand, and appraisal changes.

Short-Term Notes

For those seeking liquidity, Yieldstreet offers short-term notes and fixed-income instruments with maturities ranging from a few months to a year. These are designed for investors who prefer quicker access to returns without committing to long holding periods.

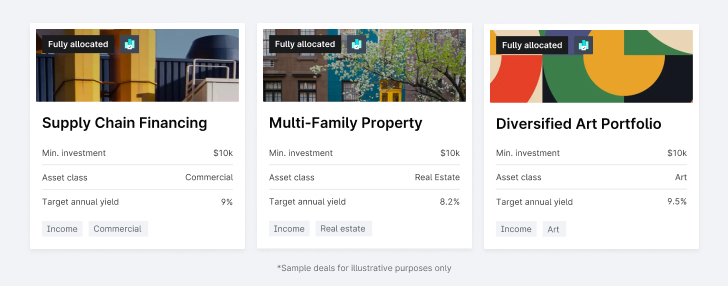

Real-World Examples of Yieldstreet Offerings

To understand how the platform functions, let’s review several real-world product examples and use cases from Yieldstreet’s portfolio.

1. Yieldstreet Alternative Income Fund

This fund is a diversified, multi-asset vehicle that invests across different alternative asset classes, including private credit, real estate, and asset-backed loans.

It aims to deliver consistent income through quarterly distributions while also allowing for capital appreciation. Because it’s structured as a managed fund, investors gain instant diversification without having to select individual deals.

This product is ideal for investors who want simplified exposure to private markets and prefer a “set-it-and-forget-it” approach.

2. Short-Term Note Program

The Yieldstreet short-term note series consists of fixed-term investment notes, usually lasting between three and twelve months. These notes pay a fixed interest rate and return principal at maturity.

They appeal to investors looking for shorter commitments, predictable returns, and less exposure to long-term market risks. Despite the shorter horizon, these notes can offer competitive yields relative to traditional bonds.

3. Real Estate Debt Opportunities

Yieldstreet’s real estate offerings have included loans for apartment complexes, industrial buildings, and commercial redevelopments.

In these deals, investors act as lenders, earning interest payments while the property serves as collateral. If the developer completes the project and repays the loan, investors receive their interest plus principal back at the end of the term.

4. Legal Settlement Finance

In one case, Yieldstreet funded a portfolio of ongoing commercial litigation cases. Investors received returns based on the outcome and timing of settlements.

This type of investment is highly specialized but attractive to investors seeking exposure to non-traditional and uncorrelated returns.

5. Art Finance Investment

An example from Yieldstreet’s portfolio involved providing a loan secured by high-value artworks from established artists. The borrower used the loan proceeds for other investments, and the art served as collateral.

If the borrower repaid as agreed, investors received fixed interest payments. If not, the artwork could be sold to recover principal, offering a unique security mechanism tied to the global art market.

Benefits of Investing Through Yieldstreet

Yieldstreet’s rise in popularity stems from the distinct advantages it offers. Here’s a closer look at the key benefits that make this platform stand out.

Access to Private Markets

Yieldstreet opens doors to asset classes that were once only accessible to institutions or accredited investors. Individuals can now participate in opportunities such as private debt or real estate projects that offer higher yields than traditional investments.

Diversification Beyond Stocks and Bonds

Because Yieldstreet’s offerings often have low correlation with public markets, they can help reduce overall portfolio volatility. For example, a downturn in the stock market might not affect a real estate loan or litigation investment in the same way.

Higher Potential Returns

Alternative investments often offer higher yields due to their illiquidity and risk profile. Yieldstreet’s curated offerings are designed to target returns that exceed traditional fixed-income products.

Professional Due Diligence

Every offering undergoes a rigorous vetting process by Yieldstreet’s internal team. This includes assessing borrower credibility, collateral valuation, and repayment structure. This institutional-grade due diligence provides a layer of confidence for investors who may not have access to these resources on their own.

Automated Portfolio Management

With Yieldstreet 360, investors can opt for a managed portfolio that automatically diversifies across multiple alternative assets. This helps investors avoid the complexity of individual deal selection while still gaining exposure to high-quality opportunities.

Transparency and Reporting

Yieldstreet provides clear offering documents, performance updates, and cash flow statements. Investors can monitor all activity through a digital dashboard, ensuring complete visibility into their portfolio’s status.

Risks and Considerations

While Yieldstreet presents unique opportunities, it’s important to understand that these investments come with higher risks compared to traditional assets.

Illiquidity Risk

Most Yieldstreet investments cannot be easily sold or redeemed before maturity. Investors must be comfortable locking up capital for extended periods.

Credit and Project Risk

Private loans and real estate projects carry the possibility of default or underperformance. A developer’s failure to meet project milestones or repay debt can lead to losses.

Market and Regulatory Risk

External factors such as rising interest rates or changing regulations can impact performance. Investors should also be aware of Yieldstreet’s past scrutiny by regulators regarding certain disclosures.

Limited Diversification Within Deals

While Yieldstreet offers various asset types, each deal can be concentrated in a single borrower or project. Therefore, spreading investments across multiple deals is essential.

Technology Advantages of Yieldstreet

A key component of Yieldstreet’s value lies in its technological foundation. The platform leverages advanced systems to improve accessibility, transparency, and operational efficiency.

Streamlined Onboarding and Verification

Yieldstreet automates investor onboarding, accreditation checks, and compliance verification. This ensures that only eligible investors participate, while reducing administrative delays.

Data-Driven Deal Selection

The platform’s underwriting process uses technology to evaluate potential deals. Factors like asset valuation, historical performance, and cash flow modeling are analyzed to assess risk and return potential.

Real-Time Portfolio Tracking

Investors have access to a comprehensive dashboard displaying real-time updates, distribution schedules, and risk summaries. This transparency builds trust and simplifies portfolio monitoring.

Secure Transaction Infrastructure

Yieldstreet employs encryption and digital safeguards to protect sensitive investor data. It also ensures secure fund transfers between accounts, minimizing operational risk.

Automation in Managed Portfolios

Yieldstreet 360 uses automation to rebalance portfolios and adjust exposure based on market dynamics. This helps maintain target risk levels and diversification without manual intervention.

Practical Use Cases for Yieldstreet

To understand how the platform fits different investment goals, here are some real-world scenarios:

1. Income Generation for Retirees

A retiree seeking stable income might invest in Yieldstreet’s short-term notes or income fund, which offer predictable distributions without exposure to stock market volatility.

2. Diversification for Experienced Investors

An investor with heavy exposure to equities might allocate a portion of their portfolio to Yieldstreet’s private credit deals to reduce correlation and improve stability.

3. Long-Term Growth for High-Net-Worth Individuals

A high-net-worth investor looking for long-term appreciation could invest in real estate or art-backed opportunities that may yield significant returns over several years.

4. Passive Investing via Yieldstreet 360

An investor who prefers a hands-off approach can use Yieldstreet 360 for automated diversification across multiple private market assets.

5. Hedge Against Market Volatility

During times of market uncertainty, investors may use alternative assets like legal finance to offset the effects of public market downturns.

Who Should Consider Yieldstreet

Yieldstreet is best suited for investors who:

- Are accredited and meet minimum income or net worth requirements.

- Have medium to long-term investment horizons.

- Understand and can tolerate illiquidity risk.

- Seek diversification outside traditional markets.

- Want exposure to private credit, real estate, or niche asset classes.

Yieldstreet may not be appropriate for individuals who require quick liquidity or have limited risk tolerance.

Conclusion

The Yieldstreet investment platform has reshaped access to alternative assets, bridging the gap between institutional opportunities and individual investors. Through its diversified offerings, strong technological infrastructure, and managed portfolio options, it allows investors to explore new dimensions of wealth creation.

Frequently Asked Questions (FAQ)

1. Is Yieldstreet a safe investment platform?

Yieldstreet is a legitimate platform with a growing user base and a history of offering vetted investments. However, like all private investments, it carries inherent risks such as default or illiquidity. It should be approached as part of a diversified strategy.

2. How are returns generated on Yieldstreet?

Returns come from the underlying performance of investments—interest payments, project income, or proceeds from legal settlements. Each offering clearly specifies its expected yield and payment schedule.

3. What is the minimum investment on Yieldstreet?

Most offerings require a minimum investment, often around $10,000, though this can vary depending on the asset class and deal structure.