Top Addepar Alternatives in 2025: Best WealthTech Platforms for Family Offices & Advisors

Wealth management and portfolio analytics have become more complex with growth in alternative investments, private equity, structured products, and multi-entity ownership. Addepar, a high-end wealth management software platform, is widely adopted in the industry for its data aggregation and reporting capabilities.

Yet, Addepar isn’t always the ideal fit for every firm. Some users find its pricing model restrictive or its complexity heavy. Others look for newer platforms with more automation, better alternative asset support, or more flexible integration. In this article, we explore the top Addepar alternatives in 2025, comparing their strengths, technological benefits, real-world examples, use cases, and how to decide which one suits your needs best.

What Is Addepar, and Why Seek Alternatives?

Addepar is a cloud-based wealth management software aimed at RIAs (Registered Investment Advisors), family offices, and firms managing high-net-worth and ultra-high-net-worth clients. It offers portfolio data aggregation, analytics, performance reporting, and a strong emphasis on multi-asset visibility.

Its core strengths lie in bringing together disparate data sources, alternative investments, private equity, real estate, and structured products into a consolidated reporting framework. It provides deep analytics and custom report generation.

Still, some firms search for alternatives for various reasons:

- AUM-based pricing models can penalize growth, making the cost scale steep for fast-growing assets.

- Steep learning curves for configuration, integration, and operation.

- Gaps in alternative asset automation, such as capital call/cash flow document parsing.

- Less flexibility in ownership structures or sovereignty over data.

- Desire for more modern UI/UX, faster onboarding, or modular architecture.

Thus, evaluating alternatives is sensible for firms that want more flexibility, a lower cost structure, or better support for emerging asset types.

Criteria for Evaluating Addepar Alternatives

When comparing alternatives, consider the following critical dimensions:

- Data Aggregation & Connectivity

How many custodians, banks, private funds, and alternative data sources are supported? Can the platform automatically ingest capital calls, distributions, and NAV statements? - Alternative Asset Support & Cash Flow Modeling

For firms with private equity, real estate, venture capital, structured products, the ability to model cash flows, hurdle rates, distributions, and waterfall structures is vital. - Reporting & Customization

How flexible are the reporting tools? Can you build investor reports, performance attribution, multi-entity consolidated views, and ownership look-through? - Pricing Structure & Scalability

Fixed or tiered pricing often appeals more than AUM-based fees. A pricing model that doesn’t penalize growth is preferred. - User Interface, Onboarding & Usability

Setup time, ease of use, user interface design, and client dashboards matter for adoption. - APIs & Integration

A robust API layer and modular integration allow linking with CRM, accounting systems, risk engines, document automation, and other systems. - Security, Governance & Compliance

Ensure encryption, permissioned access, audit trails, and compliance with relevant regulations. - Support & Ecosystem

The vendor’s support, professional services, community, and third-party integrations are crucial.

Using these criteria, the next sections present leading alternatives along with detailed features and comparative strengths.

Top Addepar Alternatives in 2025

Here are five standout platforms that often surface as viable alternatives to Addepar. Each brings specific strengths and trade-offs worth understanding.

Masttro

Masttro is a platform explicitly built for family offices, multi-family offices, and wealth managers with complex private asset portfolios. It offers AI-powered document automation, capital call management, consolidated reporting, and multi-currency support.

One of its standout features is fixed pricing rather than AUM-based billing, helping firms scale without punitive costs.

Masttro emphasizes usability and speed of onboarding, claiming a relatively short implementation period, and supports deep alternative investments, ownership structures, and real-time dashboards.

Because of its modern architecture and family office focus, Masttro differs from generic heavy platforms; it’s built by professionals who understand the workflow of private wealth.

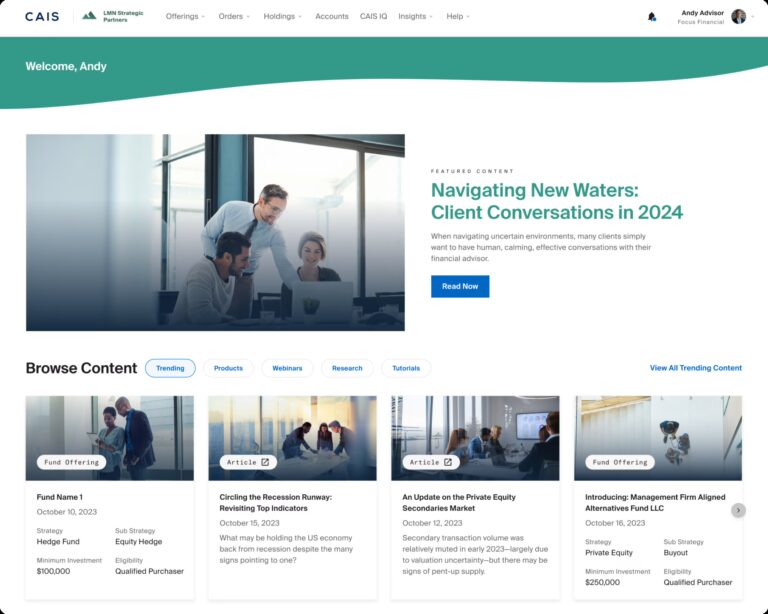

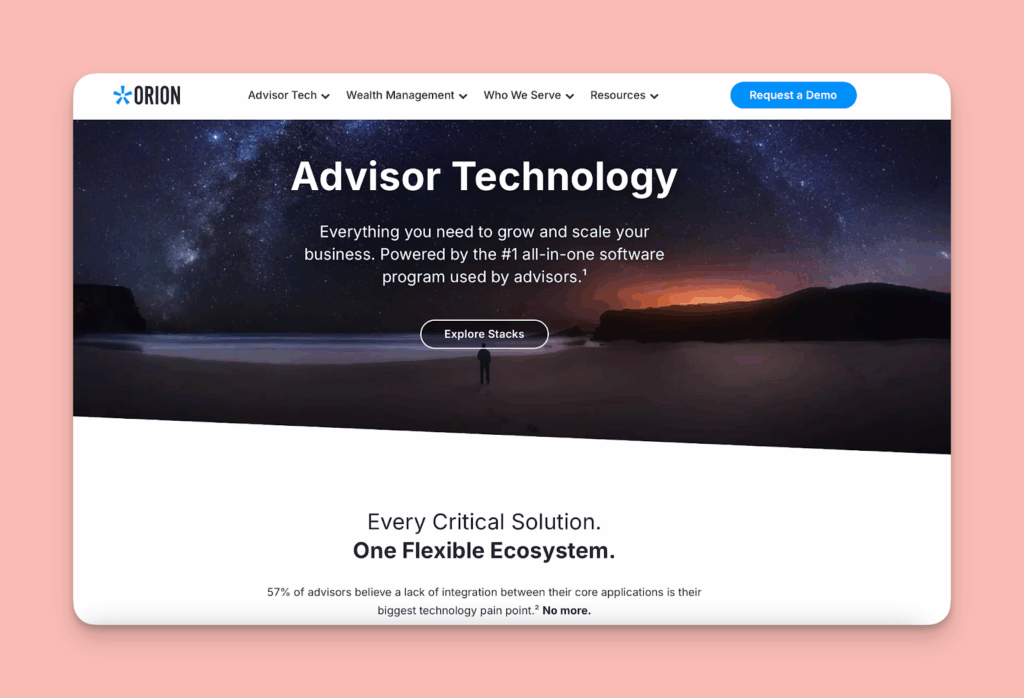

Orion Advisor Tech

Orion is a mature platform widely used by RIAs that offers modules for reporting, portfolio accounting, billing, operations, and client experience. It’s frequently cited as a competitor to Addepar.

While Orion may not have the same depth in alternative asset models as Addepar, it is strong in modular flexibility, integrations, and support. Many users choose Orion because they can pick and choose modules relevant to their business.

Orion also supports APIs and integration with tax, CRM, and financial planning tools, making it more extensible in a tech stack.

For advisors who prefer incremental adoption, Orion can serve as a robust alternative to Addepar, especially when alternative asset exposure is modest.

Backstop Solutions

Backstop Solutions targets investment operations, institutional teams, research, and portfolio management. It is not purely a wealth reporting system but an operations and productivity suite that includes portfolio tools, CRM, investor relations modules, and sophisticated data workflows.

This makes Backstop a good alternative for firms that see portfolio management as only one piece of their business, especially those with investor relations, capital raising, or research functions.

Although not as deep in alternative asset analytics as Addepar in some cases, Backstop distinguishes itself by integrating multiple operational roles into one tool.

Riskalyze

Riskalyze is known for its “Risk Number” methodology, a quantitative measure of investor risk tolerance. While it is not a full substitute for Addepar in all respects, many firms use it as a complementary platform for risk alignment, portfolio construction, and reporting.

It supports asset aggregation, scenario modeling, tax optimization, and advisor tools. Because of its strong focus on risk, Riskalyze can pair well with other reporting systems.

Some firms might choose Riskalyze over Addepar if their main priority is aligning portfolios to risk tolerance, rather than full-blown alternative asset modeling.

Kubera

Kubera is more lightweight compared to large institutional tools, but it is often considered a modern option for wealth tracking, especially for tech-savvy advisory firms. It aggregates numerous account types, including traditional assets, cryptos, domains, and alternative holdings.

While it doesn’t offer as extensive modeling as Addepar’s richest features, its strength lies in ease-of-use, wide asset coverage, modern UI, and appeal to younger or tech-forward clients.

Some firms use Kubera as a front-end client portal or net-worth aggregation complement to deeper backend systems.

Benefits of Using Technology-Driven Wealth Platforms

Modern wealth platforms leverage advanced technologies to deliver clear, practical advantages. Here are some core benefits:

Automation and Efficiency

By automating data ingestion, document parsing, and transaction reconciliation, these platforms free up teams from manual tasks. For example, knowing when capital calls or distributions happen in alternative investments without manual tracking is a major time-saver.

Real-Time Visibility & Dashboarding

Instant dashboards and consolidated views allow advisors and clients to see portfolio breakdowns, performance attribution, cash flows, and exposures in real time. This transparency improves decision-making.

Scalable Pricing Models

With fixed or tiered pricing (vs. AUM-based), firms can scale assets without facing runaway software costs. That flexibility encourages growth.

Better Risk Analytics & Scenario Modeling

Platforms integrate scenario stress tests, attribution, scenario overlays, and risk calculations (e.g., value-at-risk, skew, drawdown modeling). These insights help advisers anticipate market changes and adjust exposures.

Modular & API-Driven Architecture

Modern platforms often support modular plug-ins and robust APIs, which means advisors can integrate CRM, accounting systems, tax engines, analytics tools, or custom client portals. This flexibility supports innovation and customization.

Enhanced Client Experience

Beautiful, accessible client portals and report generation capabilities allow clients to log in and get updated statements, historical views, and documentation on demand, boosting engagement and satisfaction.

Data Governance & Security

High-end platforms include encryption, permissioned access, audit logs, and compliance features. Centralizing all data mitigates the risk of errors and ensures robust governance.

Use Cases & Problems Solved

Use Case 1: Family Office with Complex Ownership Structures

A multi-family office managing multiple entities and trusts has holdings across real estate, private funds, public equities, and art. They need look-through ownership, consolidated reporting, and capital call tracking.

Addepar alternatives like Masttro can ingest fund-level statements, automate cash flow models, and provide unified dashboards. This reduces reliance on spreadsheets and ensures governance across entities without manual reconciliation.

Use Case 2: Growing RIA That Needs Modular Expansion

An RIA firm starts with simple public equity portfolios but plans to add alternative strategies, credit, or custom strategies. They don’t want to commit to a full-stack system.

They choose Orion to handle core tasks now (accounting, reporting), and later layer in modules or integrations for alternatives as their needs evolve. The modular nature accommodates growth without disruption.

Use Case 3: Integration-Heavy Ecosystem

A wealth firm already uses a CRM system, tax planning software, document management, billing systems, and wants a central portfolio hub.

An alternative with strong API support (like Orion or Masttro) becomes the central data engine, connecting all subsystems. Data flows automatically, reducing fragmentation across tools.

Use Case 4: Risk-Focused Advising

An advisory firm emphasizes aligning portfolio risk with client tolerance. They use Riskalyze for risk number alignment and pairing to the portfolio.

They may use a reporting system alongside it, but their core decision logic rests on risk analytics, which Riskalyze handles elegantly, solving the gap in traditional tools.

Use Case 5: Boutique Tech-First Wealth Firm

A boutique firm focused on digital native clients wants slick UI, mobile access, and diverse asset coverage (including crypto, domain names, and alternative assets).

Projects like Kubera fit this segment by giving a modern, intuitive interface with multi-asset aggregation. The firm might use Kubera for client-facing dashboards and another backend platform for heavy-duty modeling.

How to Choose the Right Alternative

Deciding on the best alternative depends on your priorities and growth trajectory. Use this checklist:

- Map your asset types and see which platform supports them natively (e.g. alterna,tives, private funds).

- Estimate your growth path and check whether pricing scales well.

- Assess your existing stack (CRM, accounting, billing) and prefer platforms with strong API/integration capabilities.

- Evaluate ease of implementation and the vendor’s professional services support.

- Test reporting flexibility and client portal usability.

- Review security, governance, and compliance features to ensure institutional-grade trust.

- Ask whether the platform is modular or monolithic. Modularr allows incremental adoption.

Frequently Asked Questions

1. Can an Addepar alternative fully replace Addepar’s features?

Some alternatives match many of Addepar’s core capabilities, especially in aggregation, reporting, and basic modeling. However, for ultra-custom alternative asset modeling, waterfall structures, and deep legacy support, firms often combine platforms or extend functionality via APIs.

2. How serious is the cost issue with AUM-based pricing?

Very. As a firm’s assets grow, AUM-based fees for software can become prohibitive, effectively charging you for success. Alternatives with fixed, tiered, or usage-based pricing give more predictable scaling.

3. How long does it take to onboard and migrate from Addepar to another platform?

It depends on complexity and data quality. Simple portfolios may take weeks; complex setups with many custodian sources, alternative assets, and custom reporting may take months. Good vendors provide migration support, data mapping, and testing.