A Complete Guide to the Firstrade International Account for Global Investors

For many investors around the world, accessing U.S. financial markets can be challenging. Restrictions, high fees, and limited brokerage options often prevent people from trading American stocks or ETFs easily. The Firstrade International Account was created to solve this problem. It allows investors who are not U.S. citizens or residents to open an account and trade directly on U.S. exchanges.

This guide will help you understand how the Firstrade international account works, who it is for, what benefits it offers, and how technology makes it easier to manage investments across borders. You’ll also see real-world examples of how global investors use this account effectively.

What Is the Firstrade International Account?

The Firstrade International Account is a brokerage account designed for non-U.S. residents who want to trade U.S.-listed securities. Through this account, investors from around the world can buy and sell American stocks, ETFs, options, and mutual funds, just like U.S. investors.

Unlike many other brokers that limit access for foreign clients, Firstrade offers a simple online application process for international investors. Applicants only need to provide identification, proof of address, and complete standard forms related to taxation. The account functions similarly to a regular U.S. brokerage account, but with added support for overseas clients.

Firstrade is known for its commission-free trading, user-friendly platform, and multilingual support. These features make it attractive to investors who want global market access without paying high brokerage fees.

Why Investors Choose the Firstrade International Account

Global investors have several reasons for choosing the Firstrade international account:

- Access to U.S. Markets

Investors from Asia, Europe, and other regions can directly trade stocks listed on the New York Stock Exchange (NYSE) and NASDAQ. This gives them exposure to world-leading companies like Apple, Amazon, and Microsoft. - Zero-Commission Trading

Firstrade offers commission-free trades for many investment products. This is a major advantage for international investors who often pay higher fees in their local markets. - Global Diversification

The U.S. market provides opportunities across different industries and sectors. International investors can use the Firstrade account to diversify their portfolios beyond their home country. - Multilingual Support

Firstrade provides customer support in multiple languages, including English, Mandarin, and Cantonese, making it easier for non-English-speaking investors to get assistance. - Secure and Regulated Platform

As a U.S.-based brokerage firm, Firstrade is regulated under U.S. financial laws. Investors can feel more secure knowing their assets are held under strict compliance standards.

Key Features of the Firstrade International Account

Here are the main features that make this account appealing:

- No Minimum Deposit for Stock Trading – Investors can start small and grow their portfolios over time.

- Multiple Investment Options – Access to stocks, ETFs, options, mutual funds, and bonds.

- Free Research Tools – Firstrade provides data, news, and market insights to help investors make informed decisions.

- Easy Online Management – The web and mobile platforms allow users to trade, track performance, and review market movements anytime.

- No Inactivity or Maintenance Fees – Unlike some brokers, Firstrade does not charge account maintenance fees, making it cost-effective for long-term investors.

These features make the Firstrade International Account one of the most convenient choices for investors who live outside the U.S. but want to trade American securities.

Real-World Examples of How Investors Use the Account

Example 1: An Asian Investor Diversifying Globally

A professional investor living in Singapore wants to reduce risk in their portfolio by adding U.S. assets. Through the Firstrade international account, they can purchase shares of global companies such as Google and Tesla, as well as index ETFs that track the S&P 500. By doing this, they spread risk across different economies and gain exposure to a stable market environment.

Because the account has zero-commission trades, the investor can make smaller purchases regularly, which helps them build a diversified portfolio over time without high costs.

Example 2: A Global Expat with Assets in Multiple Countries

A high-net-worth individual who divides time between Europe and Asia wants a central place to manage U.S. investments. The Firstrade international account provides access to U.S. markets from anywhere in the world. They can view their portfolio, trade from mobile devices, and receive support in their preferred language. This helps them maintain a consistent investment strategy no matter where they live.

Example 3: A Young Investor Starting Small

A 25-year-old investor in Latin America wants to start investing but has limited funds. The Firstrade international account allows them to begin with small trades, since there is no minimum deposit required. They use Firstrade’s educational tools and market research to learn how U.S. markets work. Over time, they build experience and confidence while growing their savings in international stocks.

Benefits of the Firstrade International Account

1. Low-Cost Trading

The zero-commission structure is one of the biggest benefits. For international investors who are used to paying high local broker fees, this feature can make a huge difference in long-term returns.

2. Wide Access to U.S. Markets

Through Firstrade, investors can access thousands of U.S.-listed companies and funds. This gives them opportunities to invest in the world’s most innovative and stable companies.

3. Advanced Technology and Research Tools

Firstrade’s platform integrates stock screeners, analysis reports, and market data that help users make informed decisions. Investors can set alerts, monitor watchlists, and use real-time market updates to react quickly to changes.

4. Global Accessibility

Because everything is managed online, investors can trade from anywhere in the world. The mobile app allows them to buy and sell shares in real time, track prices, and view charts 24/7.

5. Secure Environment

Firstrade operates under U.S. financial regulations, which means investor funds are protected by industry-standard safeguards. This creates trust and stability for international clients.

Use Cases: Problems the Account Helps Solve

Limited Access to U.S. Investments

Many countries have restrictions that prevent local brokers from offering direct access to U.S. markets. Firstrade solves this by allowing investors to open an account directly with a U.S. broker from abroad.

High Transaction Costs

In some markets, brokerage fees and taxes on international trading can be expensive. With commission-free trading and no account maintenance fees, Firstrade helps reduce these costs significantly.

Currency Diversification

Investors who earn or save in a single currency face risks from currency fluctuations. By investing in U.S. dollars through Firstrade, they can hedge against local currency depreciation.

Lack of Research Tools

Local brokers in smaller markets may not provide advanced analytics or global stock screeners. Firstrade gives international investors access to U.S.-based research and professional market insights.

Difficulty Managing Multiple Accounts

Frequent travelers or expats may have accounts in several countries. With Firstrade, they can consolidate part of their investments into one U.S. brokerage, simplifying management and record-keeping.

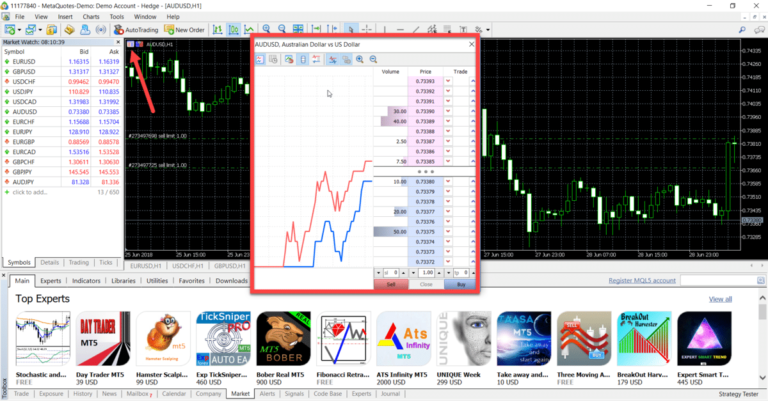

Technology Advantages

Modern technology plays a key role in how the Firstrade international account operates. The platform’s technology provides:

- Fast execution speed is important when trading in volatile markets.

- Cross-device synchronization allows users to trade on desktop or mobile seamlessly.

- Real-time price updates and portfolio tracking.

- Automated alerts for price changes, dividend announcements, and important market events.

- Integrated learning tools that help beginners understand trading concepts.

By using these technologies, Firstrade creates an environment where global investors can trade efficiently, safely, and with full control over their portfolios.

Important Considerations Before Opening an Account

While the Firstrade international account offers many advantages, there are a few things to keep in mind:

- Funding and Withdrawal Costs

International wire transfers may include fees or exchange rate differences. It’s important to plan for these costs when transferring money to and from the U.S. - Local Tax Rules

Even though Firstrade handles U.S. taxation for dividends and capital gains, investors must still report earnings to their local tax authorities according to home-country laws. - Currency Exchange Risk

Since investments are in U.S. dollars, investors whose home currency is different may see value fluctuations due to exchange rates. - Regional Restrictions

Some countries may have specific regulations that affect who can open U.S. brokerage accounts. Investors should verify eligibility before applying. - Learning Curve for New Investors

U.S. markets can be complex, especially for beginners. While Firstrade provides tools and education, investors should take time to understand market rules, taxes, and risks before trading actively.

How the Account Supports Financial Independence

The Firstrade international account can play a powerful role in helping individuals achieve financial independence. By providing direct access to global markets, it enables investors to grow wealth beyond local opportunities. It also helps balance portfolios, manage risks, and build exposure to stable U.S. assets that might not be available domestically.

For entrepreneurs, professionals, and early investors in developing economies, having a Firstrade account can be a gateway to global investing, offering a chance to participate in world-leading markets without moving abroad.

Summary

The Firstrade International Account bridges the gap between local investors and U.S. markets. It allows people from many countries to open a U.S. brokerage account online, trade stocks and ETFs with zero commission, and enjoy advanced research tools all within a secure, regulated environment.

Key benefits include:

- Low trading costs

- Global diversification

- Access to leading U.S. companies

- Advanced technology and tools

- Easy-to-use online and mobile platforms

Whether you’re a new investor looking to expand globally or a seasoned trader managing a worldwide portfolio, the Firstrade international account offers an accessible, cost-efficient, and reliable solution.

Frequently Asked Questions

Q1: Who can open a Firstrade international account?

Anyone who is not a U.S. citizen or resident but wants to invest in U.S. markets may apply, provided their country of residence is supported. Applicants must submit identification and tax-related forms.

Q2: Does the account require a minimum deposit?

No. There is no minimum deposit for trading stocks and ETFs, making it ideal for beginners and small investors who want to start gradually.

Q3: Are there any hidden fees for international investors?

While trading commissions are free, investors may face small costs related to wire transfers, currency exchange, or international banking fees. These charges depend on the investor’s bank and country.