The Complete Guide to Wealth Financial Advisors: How They Help You Build and Protect Your Wealth

In today’s world, managing money isn’t as simple as saving and investing. Taxes, inflation, market volatility, and new financial tools make it more complex than ever. That’s why many people turn to wealth financial advisors who guide clients in creating long-term financial stability and achieving their goals.

This article will explain in simple, detailed terms who wealth financial advisors are, what they do, how technology helps them, examples of real-world use cases, and the benefits of working with them.

What Is a Wealth Financial Advisor?

A wealth financial advisor is a trained financial professional who helps individuals or families manage and grow their money. Their job is not just about choosing investments. Instead, they provide a complete service that includes financial planning, tax strategy, estate planning, retirement planning, and risk management.

In short, a wealth financial advisor acts as your financial partner for life. They create a roadmap that helps you reach your goals, whether it’s buying property, saving for retirement, starting a business, or leaving a legacy for your family.

Most importantly, these advisors look at your entire financial picture, not just one part. They make sure all elements s investments, taxes, insurance, and estate planning work together smoothly to help you build and preserve wealth efficiently.

The Core Responsibilities of Wealth Financial Advisors

Financial Planning and Goal Setting

Before creating any plan, an advisor will help you define your goals clearly. This could include:

- Retiring comfortably by a specific age

- Funding your children’s education

- Buying or expanding a business

- Leaving an inheritance to your heirs

Once goals are defined, the advisor creates a step-by-step financial plan. This plan serves as your personal “money roadmap,” helping you understand what actions to take today to achieve your long-term objectives.

Investment Management

Wealth financial advisors design customized investment strategies based on your goals, time horizon, and risk tolerance. For example, a young investor may hold more growth-oriented assets like stocks, while someone nearing retirement might focus more on income-generating investments such as bonds or real estate.

They constantly monitor and adjust your investments to match market conditions and life changes. This active management ensures your portfolio stays aligned with your financial objectives and risk comfort.

Risk Management and Insurance

Every financial plan includes some level of risk from market downturns to unexpected events like illness or job loss. Wealth financial advisors assess your exposure to these risks and suggest suitable protections such as life insurance, disability coverage, or emergency savings strategies.

Their goal is to make sure that one unexpected event doesn’t derail your financial stability or goals.

Tax Optimization

Advisors also help clients minimize taxes legally and efficiently. They use tax-efficient investment strategies, such as placing certain assets in tax-deferred accounts, managing capital gains, or structuring income to reduce overall tax liability.

This doesn’t mean avoiding taxes; it means managing your money smarter so you keep more of what you earn.

Estate and Legacy Planning

For those who want to pass wealth to future generations, estate planning is essential. Wealth financial advisors collaborate with legal professionals to design trust structures, wills, and charitable foundations.

Their purpose is to ensure your assets go to the right people or causes smoothly, with minimal legal complications or taxes.

Real-World Examples of Wealth Financial Advisor Use Cases

Example 1: High-Income Professional with Company Stock

Imagine a senior executive who has accumulated a large portion of their wealth in company shares. This can create a concentration risk, meaning their financial future depends too heavily on one company’s success.

A wealth financial advisor would help the executive:

- Diversify their portfolio to reduce risk

- Create a plan for selling or exercising stock options efficiently

- Manage tax implications from these transactions

- Reinvest the profits in line with long-term goals

This strategy ensures the executive’s wealth grows steadily without relying on a single asset.

Example 2: Entrepreneur Preparing to Sell a Business

An entrepreneur planning to sell a successful business faces many financial decisions: how to handle the sale proceeds, reduce taxes, reinvest the money, and plan for retirement.

A wealth financial advisor helps by:

- Structuring the sale for optimal tax efficiency

- Developing a reinvestment plan

- Ensuring sufficient liquidity for living expenses

- Planning long-term legacy and philanthropic goals

By doing this, the advisor turns a one-time event into a lifelong source of financial security.

Example 3: Family Planning Multi-Generational Wealth

A family with significant assets wants to ensure a smooth wealth transfer to future generations. A wealth financial advisor helps them by:

- Setting up trusts and family funds

- Educating heirs on financial responsibility

- Coordinating estate, tax, and investment plans

- Creating family governance structures to maintain harmony

This comprehensive planning ensures the family’s wealth supports not only their financial needs but also their shared values and legacy.

Example 4: Pre-Retirement Transitioning to Retirement

A 60-year-old client is nearing retirement and is unsure how to shift from saving to spending. A wealth financial advisor helps them:

- Estimate post-retirement income needs

- Build an income strategy from savings and investments

- Plan withdrawals to minimize taxes

- Adjust portfolio risk for long-term security

The advisor ensures the transition from working life to retirement is smooth and sustainable, without running out of money too early.

How Technology Improves Wealth Financial Advisory Services

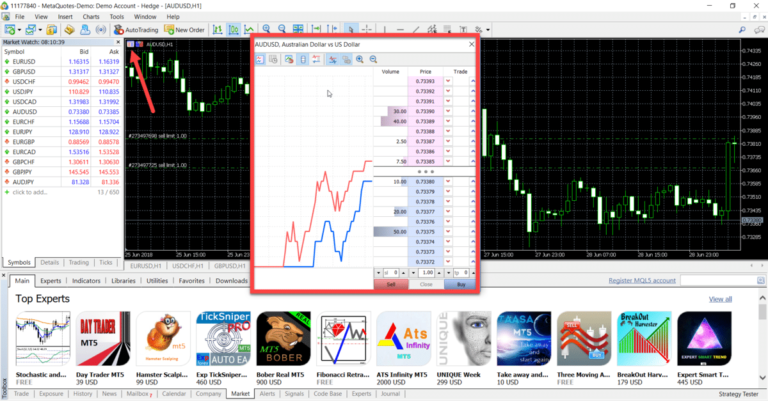

Technology has revolutionized the financial advisory industry. Today’s wealth financial advisors use advanced tools and data analytics to provide faster, smarter, and more transparent service.

Here’s how technology adds value:

Data and Portfolio Tracking

Modern software allows both advisors and clients to track investments, asset performance, and progress toward goals in real time. You can log into a secure dashboard anytime to see your financial picture clearly.

Automated Rebalancing and Alerts

Advisors use automation tools to monitor portfolio allocations. When markets fluctuate, these systems automatically rebalance your investments to maintain the right mix of assets, ensuring your portfolio stays on target.

Scenario Planning and Forecasting

Sophisticated modeling tools allow advisors to test “what-if” scenarios. They can simulate market crashes, inflation spikes, or changes in income to see how each scenario affects your financial plan. This helps them prepare adjustments in advance, not just react when things go wrong.

Secure Communication and Collaboration

Cloud-based systems enable secure sharing of reports and documents. Clients can message their advisors, review plans, and approve updates without face-to-face meetings, saving time while keeping information safe.

Benefits of Working with a Wealth Financial Advisor

1. Expert Guidance and Holistic Strategy

Wealth financial advisors don’t look at one part of your finances; they see the whole picture. Their goal is to align your investments, taxes, estate plans, and insurance policies into one unified strategy. This approach eliminates conflicts between different financial decisions and ensures your money works together toward your goals.

2. Behavioral Coaching and Emotional Support

Many investors make emotional decisions, such as selling during market downturns or chasing short-term gains. Advisors act as coaches who help you stay disciplined and stick to your long-term plan, especially when emotions run high.

3. Time Savings and Stress Reduction

Managing your finances can be overwhelming and time-consuming. Having an advisor frees you from daily decision-making and gives you peace of mind knowing a professional is handling complex details on your behalf.

4. Improved Financial Outcomes

Studies show that investors who work with advisors tend to achieve higher long-term returns and greater financial security, mainly because of disciplined strategies, tax planning, and ongoing adjustments to market changes.

5. Better Use of Technology

Advisors with modern tools provide transparent, data-driven advice. You can easily view your performance, track your goals, and understand every move, making your financial journey more interactive and educational.

Common Problems Wealth Financial Advisors Help Solve

Problem 1: Unorganized Finances

Many people have multiple investment accounts, debts, and insurance plans, but no unified strategy. Advisors organize everything, creating a single, easy-to-follow financial roadmap.

Problem 2: High Tax Burden

Taxes can eat away at your wealth if not managed properly. Advisors implement strategies to reduce tax exposure through timing, investment types, and smart structuring.

Problem 3: Poor Investment Discipline

Without a plan, investors often make emotional or uninformed decisions. Advisors provide structure, helping clients stay calm during market volatility and stick to their strategy.

Problem 4: Lack of Retirement Planning

People often underestimate how much they’ll need for retirement. Advisors calculate realistic goals, build income strategies, and make sure savings last for decades.

Problem 5: Complicated Estate Issues

Without proper planning, wealth transfer can become messy. Advisors coordinate legal, tax, and family aspects so assets are passed efficiently and peacefully.

Why a Wealth Financial Advisor Is Useful in Real Life

In everyday life, financial decisions are emotional, confusing, and sometimes conflicting. Having a wealth financial advisor transforms this complexity into a clear plan. They not only manage numbers but also guide behavior, communication, and long-term thinking.

They ensure your financial decisions are proactive, not reactive. Instead of guessing what to do next, you’ll have a structured roadmap helping you move confidently toward your financial goals, even in uncertain markets.

Frequently Asked Questions

Q1: Do I need a wealth financial advisor if I’m not rich?

Yes. While these advisors often work with higher-net-worth clients, anyone with multiple goals, assets, or investments can benefit. They help bring structure and long-term vision to your finances.

Q2: How do wealth financial advisors get paid?

Most charge either a percentage of the assets they manage, a flat annual fee, or hourly rates for specific services. The key is transparency; always understand how your advisor earns money and whether they act as a fiduciary (required to act in your best interest).

Q3: Can a financial advisor guarantee results?

No advisor can guarantee specific investment results. However, they can improve your chances of success by creating structured, diversified plans and providing ongoing guidance to help you avoid costly mistakes.