MetaTrader Real Account: Complete Guide to Understanding, Benefits, and Real-World Use

A MetaTrader real account is your entry point into real financial trading. Unlike a demo account that uses virtual funds, a real account involves your actual money and connects directly to live financial markets through a broker. Whether you trade currencies, commodities, or indices, a MetaTrader real account allows you to place trades that truly impact your balance’s profit or loss.

This article explains in detail how a MetaTrader real account works, what makes it different from a demo account, the main benefits, the technology behind it, real-world use cases, and practical advice to help you trade more effectively.

What Is a MetaTrader Real Account?

When you open MetaTrader on your computer or phone, you can log in with two types of accounts: demo and real. A demo account is a training tool. It simulates market conditions using virtual money so that you can practice trading without financial risk.

A real account, however, uses actual funds. You deposit money with a broker, connect that broker to your MetaTrader platform, and every trade you place will affect your real balance. Your profits and losses are genuine, and your decisions matter. A real account represents a serious commitment. It is where strategy, risk management, and discipline become essential.

How a MetaTrader Real Account Works

Step 1: Opening the Account

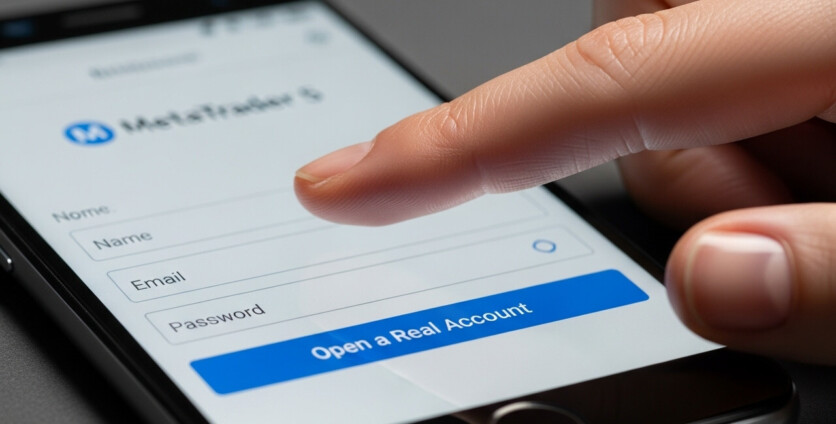

A real account begins with a broker, not directly within MetaTrader. The broker provides access to financial markets and supports MetaTrader as the trading platform.

When you sign up, you usually need to complete identity verification by uploading your ID and proof of address. Once approved, the broker gives you login details: an account number, password, and server name. You then enter this information into MetaTrader to connect your account.

Step 2: Funding the Account

After verification, you deposit money into your trading account using methods the broker provides (such as bank transfer or card deposit). This money becomes your available trading balance.

Only after funding does your account become active for real trading.

Step 3: Trading Live

Once connected, MetaTrader displays live price charts, order windows, and market depth. You can now open trades on real financial instruments like EUR/USD, gold, or S&P 500.

When you click “Buy” or “Sell,” the order goes to your broker, who executes it in the live market. From that moment, every movement in price affects your account balance. You may see profits grow or losses accumulate in real time.

Real Account vs Demo Account

Although both use the same MetaTrader interface, there are major differences between demo and real accounts.

Emotional Difference

Trading with real money creates pressure. Fear and excitement can affect your decisions. In a demo account, you might trade fearlessly because there is no real risk. But when your own money is involved, emotions become part of the experience.

This emotional factor is what makes live trading more challenging and more rewarding.

Execution Difference

In demo trading, orders usually execute instantly at displayed prices because no real market is involved. In real trading, prices fluctuate constantly, and your orders may experience slight delays, slippage, or different fill prices.

This variation is normal and part of real market behavior. Learning to adapt to it is crucial for professional traders.

Financial Difference

Demo accounts use virtual funds and have no transaction costs. Real accounts involve deposits, withdrawals, spreads, commissions, and possible overnight fees. Managing these costs is part of real-world trading discipline.

Benefits of Using a MetaTrader Real Account

1. Real-World Experience

Trading live helps you understand how the market truly behaves. You learn how fast prices move, how news affects volatility, and how emotions influence your reactions. No simulation can fully replicate that experience.

2. Opportunity for Real Profit

A real account allows you to earn actual income if your trades are successful. Even small gains can add up over time as you improve your strategy.

3. Deeper Risk Awareness

Because your capital is at stake, you learn to manage risk properly. You begin to appreciate stop-loss orders, position sizing, and the importance of discipline.

4. Full Access to Trading Features

Real accounts often include features not available in demos, such as advanced order types, leverage adjustments, and access to certain markets or instruments.

5. Connection to Market Liquidity

Your trades in a real account interact with actual market liquidity providers. This means you are participating directly in the global financial system, with real bid and ask prices.

Technology Behind MetaTrader Real Accounts

MetaTrader is known for its powerful and stable technology that supports millions of traders worldwide.

Reliable Platform Architecture

The platform runs on a client-server model. Your MetaTrader software communicates with your broker’s trading server, which handles orders, updates your balance, and manages your positions. This structure ensures fast execution and reliable performance.

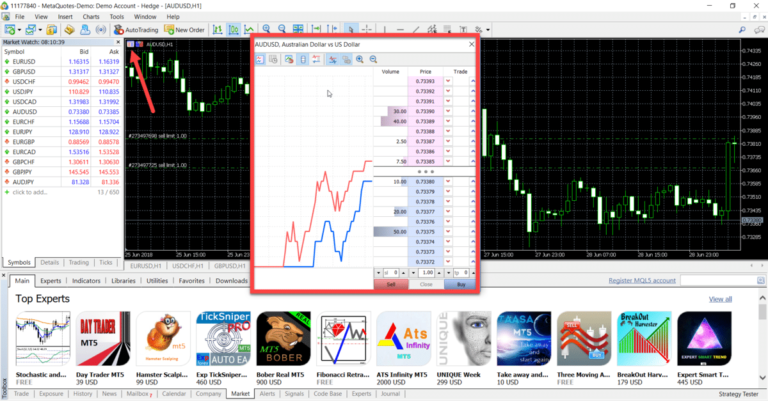

Automation Through Expert Advisors

MetaTrader allows traders to automate their strategies using Expert Advisors (EAs). These are scripts written in MQL 4 or MQL 5 programming languages.

When linked to a real account, these EAs can automatically open, close, or modify positions based on programmed logic. It enables algorithmic trading, which is used widely by professional traders and institutions.

Real-Time Market Data

A real account provides access to live price feeds, economic calendar integration, and technical indicators that update in real time. This helps traders analyze the market with current data instead of delayed or simulated information.

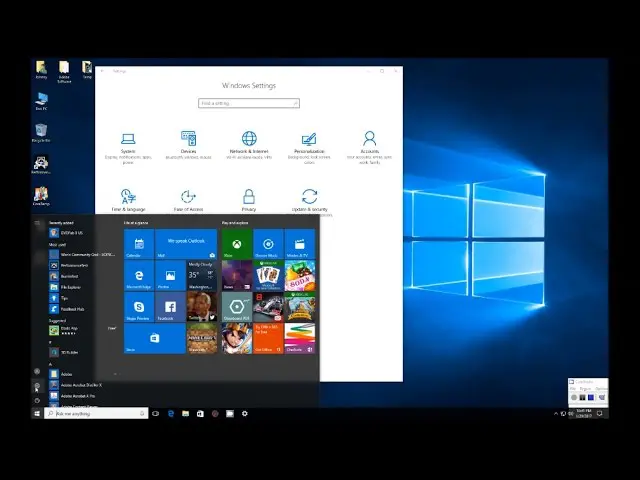

Multi-Device Compatibility

MetaTrader real accounts can be accessed from desktops, web browsers, and mobile devices. All your positions and data are synchronized, allowing you to monitor your trades anywhere.

Real-World Examples and Use Cases

Here are a few realistic situations showing how traders use MetaTrader real accounts in everyday trading.

Example 1: Day Trader Managing Short-Term Positions

A day trader opens a MetaTrader real account to trade major currency pairs such as EUR/USD. They focus on short-term price movements, entering and exiting positions within the same day.

Because this is a real account, every fraction of a pip matters. The trader must manage spreads, execution time, and slippage carefully. Over time, live experience helps refine their timing and strategy accuracy.

Example 2: Swing Trader Managing Medium-Term Strategies

Another trader uses MetaTrader to trade commodities like gold or crude oil over several days or weeks. Their real account allows them to analyze charts, place stop-losses, and hold positions through market fluctuations.

The live environment teaches patience and helps them adapt to real overnight swaps, margin requirements, and volatility caused by global news.

Example 3: Automated Trading System

A professional developer creates a trading robot (Expert Advisor) that automatically trades based on trend indicators. In a demo account, it performs well. When moved to a real account, the results vary because of live spreads, latency, and execution differences.

By monitoring its performance in a real environment, the trader can fine-tune parameters for more consistent returns.

Example 4: Diversified Portfolio Management

Some investors use MetaTrader real accounts to manage multiple asset classes in one place — forex, indices, metals, and cryptocurrencies. With one login, they can monitor all their trades, account equity, and exposure.

This centralized setup provides full transparency and real-time performance tracking.

Practical Benefits of Trading in a Real Account

Building Financial Discipline

Real trading forces you to plan every trade carefully. You begin to track results, analyze mistakes, and maintain a journal. This discipline improves your overall approach to investing.

Learning Through Real Feedback

Because real accounts expose you to actual profit and loss, you receive immediate feedback from the market. You learn which strategies truly work and which fail under pressure.

Developing Long-Term Confidence

Trading live helps you gain confidence through experience. Even small achievements — like following your plan or controlling losses build trust in your own abilities.

Challenges and Risks of Real Trading

Trading real money also involves risks. Understanding these challenges helps you manage them effectively.

Emotional Stress

Losses hurt. When trades go wrong, it can be tempting to act impulsively. Successful traders learn to separate emotions from decisions and focus on their strategy.

Over-Leverage

Many brokers allow high leverage, which can magnify both profits and losses. Using too much leverage can quickly wipe out your capital. Always trade with a risk plan in place.

Technical Problems

Internet connection failures, software crashes, or server delays can affect execution. It’s wise to ensure your equipment and internet connection are reliable before trading live.

Broker Reliability

Your experience also depends on your broker’s quality. Always choose a regulated and trustworthy company that offers good execution and transparent pricing.

Best Practices for Success with a MetaTrader Real Account

- Start small. Begin with a modest deposit until you’re comfortable managing live trades.

- Use a written plan. Define your strategy, risk limits, and profit targets before you start trading.

- Test first. Practice your method on a demo account before switching to real money.

- Track results. Keep a trading journal to review decisions and improve performance.

- Stay disciplined. Avoid over-trading and emotional reactions.

- Keep learning. Markets change constantly. Stay updated on global events and technical tools.

Real-World Lessons from Traders

Many experienced traders report that their biggest progress came after switching from demo to real trading. The emotional difference, exposure to risk, and direct feedback made them more professional.

They also learned the importance of risk management, protecting capital is often more important than chasing profit. Real accounts reveal that success comes from consistency, not luck.

Frequently Asked Questions

Q1: What is required to open a MetaTrader real account?

You need to choose a broker that supports MetaTrader, register, verify your identity, and deposit funds. The broker will then provide login details for MetaTrader.

Q2: Can I switch between demo and real accounts easily?

Yes. Within the MetaTrader platform, you can log in to either account type using different credentials. This allows you to practice in demo mode while also managing a live account.

Q3: Is trading with a MetaTrader real account safe?

Safety depends on your broker and your own practices. Use a regulated broker, enable secure login methods, and avoid trading more than you can afford to lose.