E*TRADE Roth Conversion: How It Works, Pros & Key Considerations

A Roth conversion refers to moving assets from a Traditional IRA, SEP IRA, SIMPLE IRA, or rollover IRA into a Roth IRA. In doing so, you convert pre-tax or tax-deferred funds into an account that grows tax-free (subject to rules). E*TRADE supports Roth conversions as part of its retirement planning services. According to their retirement planning materials, a Roth conversion transfers assets from eligible pre-tax retirement accounts into a Roth IRA, and can be done for all or part of those assets.

The major appeal is that once the funds are in the Roth IRA, qualified withdrawals (after meeting age and holding requirements) are generally tax-free. Because of that, many investors use Roth conversions as a long-term tax strategy, especially when they expect higher tax rates later or want to reduce required minimum distributions (RMDs). E*TRADE also notes that recharacterization (undoing a conversion) is no longer permitted under current tax law, so once converted, it’s final.

In this article, we will dissect how E*TRADE handles Roth conversion, what rules apply, what to watch out for, how technology aids the process, real examples and use cases, and pros and cons.

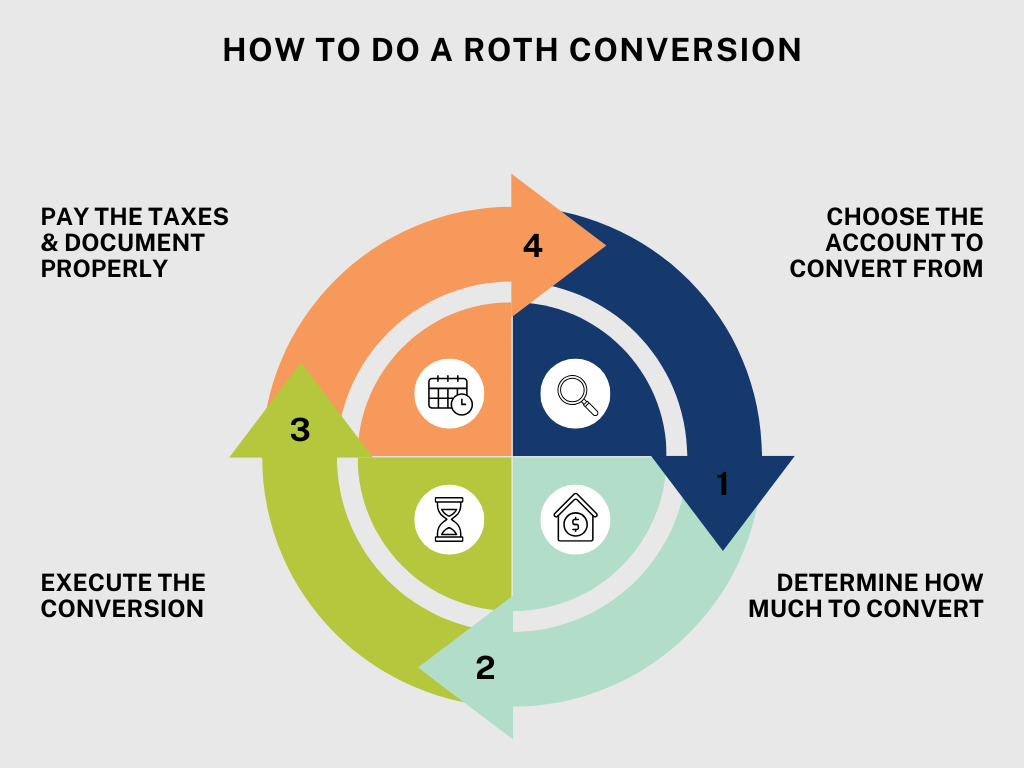

How E*TRADE Handles the Roth Conversion Process

Initiating the Conversion

To start a Roth conversion at ETRADE, you generally request a Roth IRA Conversion Request, indicating which Traditional, Rollover, SEP, or SIMPLE IRA account you want to convert (all or partial). ETRADE provides tools and client support to guide you through this process.

You can select to convert the assets in kind (i.e., keep the same securities) or liquidate positions to cash, then convert. E*TRADE’s system typically displays your account investment holdings and conversion options, letting you pick which assets or amounts to convert.

One community discussion noted that E*TRADE uses “current value” when executing in-kind conversions (the market value at the conversion moment), rather than waiting for end-of-day pricing. This matters for timing and tax calculations.

Tax Treatment and Reporting

When you convert, the amount converted (if pre-tax) is treated as ordinary income in that tax year. You will need to report it on your tax return, and E*TRADE (as custodian) will issue the appropriate IRS form (such as Form 1099-R) showing the conversion distribution. The income tax is due in the year of conversion.

Because recharacterization is no longer allowed, once the assets are converted to Roth, you cannot “undo” the conversion if markets decline or tax circumstances worsen. That adds permanence and risk to timing decisions.

Also, each conversion has its own five-year rule for penalty-free withdrawals of the converted funds if the owner is under age 59½. Even though contributions to Roth IRAs generally can be withdrawn tax and penalty-free, converted amounts must satisfy a separate five-year holding rule to avoid a 10% penalty if withdrawn early.

Eligibility and Restrictions

E*TRADE’s documentation states that Roth conversion can be done regardless of income level (the MAGI limits for contributions do not apply to conversion). So even high-income individuals who cannot directly contribute to a Roth can convert from a Traditional IRA to a Roth.

However, special rules exist for SIMPLE IRAs: a SIMPLE IRA cannot be converted to a Roth during the first two years after the account was opened (depending on plan rules).

Also, if you are required to take RMDs (once of age), you must satisfy those first before conversion.

Strategic Considerations Before Converting

Tax Rate and Future Expectations

One of the primary considerations is your current tax bracket vs the expected future bracket. If you believe your tax rate will be higher later (due to income increases, higher rates, or larger IRA balances), paying taxes now at a lower rate may make sense. Conversely, if your tax rate is high now and expected to drop, conversion might hurt.

Time Horizon and Growth Opportunity

Roth conversions tend to be more beneficial if you allow the converted funds to grow over a long period. The longer the horizon, the more tax-free compounding works in your favor, offsetting the upfront tax cost.

Ability to Pay Taxes Outside the IRA

Ideally, you pay the conversion taxes using funds external to the IRA (not by taking funds out of the IRA itself), since withdrawing from the IRA to pay taxes reduces the converted base and loses tax-advantaged growth potential.

Partial Conversions

You’re not forced to convert the full balance. Many investors choose partial conversions over multiple years to spread out the tax burden. E*TRADE supports converting portions of the account.

Market Timing Risk

Because conversion involves triggering taxable income, converting during market highs may lead to a bigger tax bill. Conversely, in a market downturn (lower asset values), converting when values are depressed can reduce the tax cost. But waiting for a rebound might mean you lose some growth periods.

Technology & Platform Benefits for Roth Conversion

Modern brokerages like E*TRADE offer tools to simplify conversions, mitigate errors, and enhance decision-making.

Conversion Wizards & Interface Tools

E*TRADE’s retirement planning software includes IRA selectors and conversion tools that walk you through selecting the source IRA, the target Roth account, choosing assets to convert, and estimating tax consequences. These interfaces reduce manual errors.

Real-Time Valuation & Execution

Because conversions can be executed in kind, E*TRADE’s systems track the real-time market value of holdings. This allows you to convert at the moment’s value rather than waiting for price confirmation at the end of the day. This precision helps with tax planning and matching target conversion amounts.

Tax Projection Simulations

Some platforms simulate how a given conversion amount will impact taxable income, marginal tax rates, and Medicare or other phase-in impacts. That helps investors choose amounts that minimize tax drag or bracket creep.

Reporting and Recordkeeping

The platform automatically generates necessary tax forms and tracks the five-year conversion clocks, making it easier to monitor which conversion years satisfy the holding periods.

These technological benefits help reduce friction, improve decision quality, and reduce compliance risk.

Real-World Examples & Use Cases

Example 1: Mid-Career Professional Converting Over Years

Jessica is 45 and has a Traditional IRA worth $500,000. She anticipates being in a higher tax bracket by retirement. Rather than converting all at once (which could push her into a much higher bracket), she plans to convert $50,000 yearly for ten years.

Each year, she uses E*TRADE’s tool to simulate the tax impact and selects a mix of equities and bonds to convert. Over time, she shifts a portion of her IRA to Roth status, reducing future RMD burdens and locking in tax-free growth while managing her marginal tax rates each year.

Example 2: Converting in a Market Dip

Mark holds $200,000 in his Traditional IRA, mostly equities. During a market correction, his balance drops to $170,000. He sees this as an opportunity to convert a large portion now, because his tax liability will be lower due to the lower value. In E*TRADE’s conversion interface, he selects a portion to convert in-kind, transferring the same securities into his Roth IRA.

As the market recovers, growth occurs inside the Roth tax-free. His strategy uses market volatility as a conversion opportunity, reducing the tax cost during a depression.

Example 3: High-Income Earner with No Roth Contribution Eligibility

Samantha earns well above the Roth IRA contribution limits. She cannot make direct Roth contributions, but she holds a Traditional IRA. She uses E*TRADE’s conversion capability to convert $100,000 from her Traditional IRA, triggering taxable income this year. Over the decades, she hopes the tax-free distributions outweigh the upfront cost.

During the process, she uses E*TRADE’s simulations to ensure the conversion does not push her into an undesirable bracket or affect other income-driven deductions.

Example 4: Near-Retirement with RMD Considerations

Robert is 72. He has already begun RMDs from his Traditional IRA. He wishes to convert some remaining funds to a Roth to reduce future taxable withdrawals and estate burdens.

Because he must first satisfy his RMD for the year, he withdraws the RMD amount, pays tax, and then converts portions of the remaining balance. This mixed strategy helps him shift more of his balance into Roth while obeying rules about required distributions.

Benefits of Roth Conversions

Tax-Free Withdrawals in Retirement

One of the biggest advantages is that once you satisfy age and holding requirements, qualified withdrawals are tax-free. This gives future flexibility and reduces future tax drag.

No Required Minimum Distributions

Unlike Traditional IRAs, which require RMDs beginning at a certain age, Roth IRAs do not impose RMDs on the original owner. That allows assets to grow longer and provides flexibility in estate planning.

Tax Diversification

Holding both pre-tax (Traditional) and post-tax (Roth) accounts gives you flexibility to manage taxable income in retirement by choosing which account to draw from based on tax planning needs.

Estate and Legacy Benefits

Because Roth IRAs do not force distributions for the owner, you can pass more to heirs. Although beneficiaries may have distribution rules, the assets can grow tax-free further.

Locking in Current Tax Rates

If you believe tax rates will rise, converting now locks in today’s rate for the converted amount. It shifts the tax burden to the present instead of the uncertain future.

Use Cases & Problem Solving

Use Case 1: Managing Taxable Income in Retirement

Problem: In retirement, combining IRA withdrawals and Social Security pushes you into high brackets.

Solution: Use Roth assets first or partially, reducing taxable income. Over time, a Roth conversion helps shift more burden into tax-free buckets.

Use Case 2: Preventing Future Estate Tax Drift

Problem: Large tax-deferred IRA balances can lead to high income tax liabilities.

Solution: Converting some or all to Roth reduces taxable principal, making wealth transfer more tax-efficient for beneficiaries.

Use Case 3: Mitigating Required Minimum Distribution Pressure

Problem: Traditional IRA balances force high mandatory withdrawals, especially in years when you don’t need the income.

Solution: Roth conversion reduces the balance subject to future RMDs, giving more flexibility with distributions.

Use Case 4: Capturing Low-Income Years

Problem: Some years you may have a lower taxable income (career transitions, break years).

Solution: Convert in those “lower-income” years when tax brackets are favorable, optimizing the tax cost of conversion.

Risks & Downsides to Watch

- Higher Tax Burden Now: Conversions trigger taxable income now, potentially forcing you into higher tax brackets.

- Loss if Market Drops: If the value of the converted assets falls after conversion, you cannot undo the conversion to recoup taxes paid.

- Five-Year Penalty Rule: If you withdraw converted funds too soon, you may incur a 10% early withdrawal penalty if under age 59½ unless exceptions apply.

- Impact on Other Tax Benefits: Adding conversion income could reduce eligibility for deductions, credits, or affect phase-outs.

- Complexity of Partial Conversions & Recordkeeping: Tracking multiple conversion years and five-year clocks becomes administratively burdensome.

Key Best Practices

- Convert in phases rather than all at once, especially if your balance is large.

- Pay conversion taxes from outside funds, preserving the full conversion base to grow in Roth.

- Use simulations and tax projections to avoid bracket creep into undesirable ranges.

- Monitor five-year clocks for conversion years to know when you can withdraw without penalties.

- Time conversions around dips in market value to reduce tax cost, but don’t delay too long.

- Satisfy required minimum distributions before conversion if applicable.

- Keep good records of annual conversions, amounts, and dates.

Frequently Asked Questions

Q1: Can I convert my Traditional IRA to Roth with E*TRADE even if my income is high?

Yes. The income limits for Roth contributions do not apply to conversions. You can convert regardless of modified adjusted gross income.

Q2: Once I convert, can I reverse it?

No. The law no longer allows “recharacterization” of Roth conversions. Once you convert, it cannot be undone.

Q3: What is the five-year rule for Roth conversions?

Each conversion has its own five-year holding period. If you withdraw converted funds within five years (and you are under age 59½), you may incur a 10% penalty unless exceptions apply.