ETRADE Funds Availability: Understanding How and When Your Money Becomes Usable

ETRADE funds availability is one of the most important topics for both new and experienced investors. When you deposit money into your ETRADE account, you might notice that it takes time before you can actually use that money to trade, withdraw, or transfer. Understanding when and why your funds become available is crucial to managing your investments effectively and avoiding unnecessary delays or violations.

In this article, we’ll explain in detail what funds availability means on E*TRADE, how it works depending on the deposit method, what factors influence clearance time, and how investors can plan smarter around it. We’ll also look at real-world use cases and benefits to help you navigate your trading activities confidently.

What Does “Funds Availability” Mean on E*TRADE?

Funds availability refers to the amount of time it takes for deposited money to become usable in your ETRADE account. When you transfer money from your bank or deposit a check, the funds do not always appear instantly. Instead, ETRADE holds the money for a few business days to verify and process the transaction.

This period allows the platform to confirm that the funds are legitimate and securely transferred from your bank to your E*TRADE account. During this time, the deposit may appear in your account balance but cannot be used for trading or withdrawal until it is fully cleared.

E*TRADE typically follows a structured funds availability policy:

- Deposits made before 4:00 p.m. Eastern Time are counted for that business day.

- Most deposits become fully available by the fourth business day after the deposit date.

- Larger or new deposits may require additional verification, leading to slightly longer hold times.

This policy ensures that your money and E*TRADE’s systems remain safe, reducing the risk of fraud or failed transfers.

How E*TRADE Funds Availability Works

The availability timeline depends on the deposit method you use. Different funding methods have different clearing processes and security checks. Let’s explore the main options:

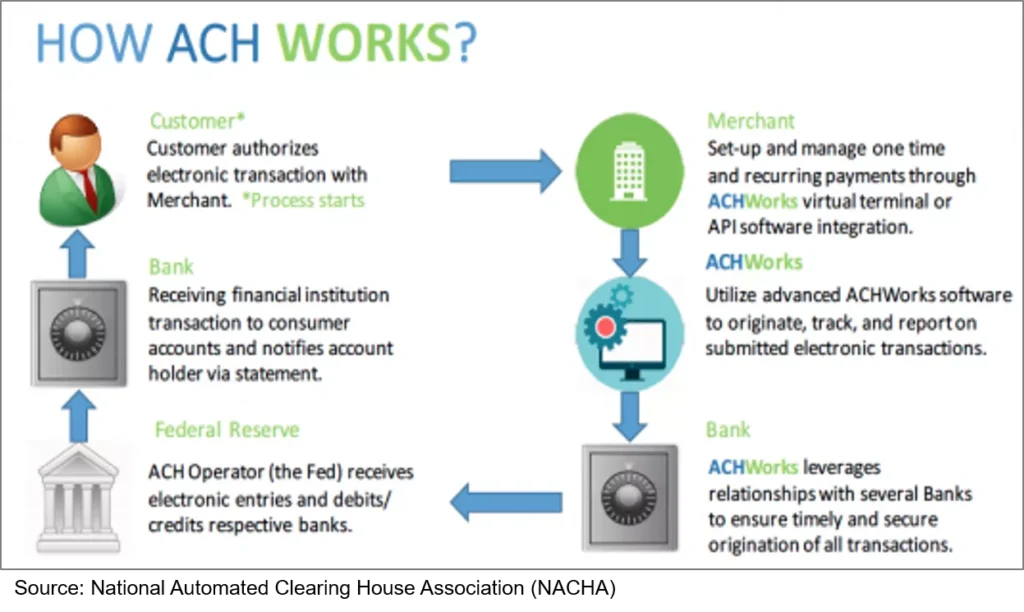

1. Bank Transfer (ACH)

Bank transfers often referred to as ACH transfers are one of the most common funding methods. When you move money from your external bank account to E*TRADE, the transfer typically takes two to three business days to complete.

E*TRADE may show the funds as “pending” or “unsettled” during this time. Once the transfer fully clears, you’ll see the funds marked as “available to trade” or “available to withdraw.”

Some experienced users report partial availability where a small portion of the deposit becomes usable sooner based on account history or the amount deposited.

2. Check Deposit

Check deposits usually take longer to process than electronic transfers. When you deposit a check through the E*TRADE mobile app or by mail, funds typically become available within four business days.

This timeline can vary depending on factors such as:

- The size of the check.

- The origin of the check (personal, business, or government).

- Your account’s activity history.

In certain cases, E*TRADE may release a small portion of the check funds earlier, allowing you limited trading access while the remainder clears.

3. Wire Transfer

Wire transfers are the fastest way to fund your E*TRADE account. When your bank sends a wire before the cutoff time (usually around 6:00 p.m. ET), the funds are often available on the same business day.

Wire transfers cost more than ACH transfers but are ideal for traders who need to act quickly or take advantage of sudden market movements.

4. Mobile and Instant Deposits

E*TRADE also offers mobile check deposits through its app. You simply take a photo of your check and submit it electronically. The system automatically verifies your submission, though hold times remain similar to standard check deposits.

Some accounts may also have partial instant deposit privileges, where a portion of the funds becomes available immediately. This is based on your transaction history, account status, and past funding reliability.

The Role of Settlement in E*TRADE Funds Availability

To fully understand E*TRADE’s fund availability, you must also understand settlement rules. When you sell an investment (like a stock or ETF), the proceeds are not instantly available for reuse or withdrawal. The funds must first “settle.”

What Is Settlement?

Settlement is the process of completing a trade ensuring that the buyer pays and the seller delivers the security. In most U.S. markets, the settlement period is T+1, meaning one business day after the trade date.

For example:

If you sell a stock on Monday, the proceeds will typically settle and become available by Tuesday. Until then, those funds are considered “unsettled.”

Why Settlement Matters

E*TRADE enforces these rules to comply with financial regulations and to prevent what is known as a freeride violation. A freeride occurs when you buy a security using funds from a sale that hasn’t yet settled, then sell that new security before the funds clear.

If this happens, E*TRADE may restrict your account, requiring that you only trade using fully settled funds for up to 90 days. Understanding settlement helps you avoid these issues and manage trades smoothly.

Key Factors Affecting Funds Availability

Several factors can influence how quickly your funds become available in your E*TRADE account:

- Deposit Method: Wire transfers are fastest, while checks take the longest.

- Account Type: Margin accounts sometimes provide quicker access than cash accounts.

- Deposit History: Established accounts with regular deposits may receive partial early access.

- Verification Status: New accounts typically have longer hold times for initial deposits.

- Deposit Size: Larger deposits may trigger additional verification for security reasons.

E*TRADE uses automated systems and risk algorithms to determine when and how much of your deposit can be made available early. These measures balance user convenience with safety.

Real-World Examples of Funds Availability

Example 1: New Investor with ACH Deposit

Emma opens an ETRADE account and transfers $3,000 from her bank using ACH. Because it’s her first deposit, ETRADE applies the standard hold time of about four business days. Although the deposit shows in her balance almost immediately, it remains unavailable for trading until the clearing process finishes.

For new investors, it’s always wise to fund the account several days before you plan to trade so that funds are ready when needed.

Example 2: Active Trader Reacting to Market Changes

Liam, an active trader, notices a sudden price drop in one of his watchlist stocks. He transfers $10,000 via bank transfer to seize the opportunity. Because of ETRADE’s hold policy, the full funds are not available instantly. However, based on his account history, ETRADE credits $2,000 as partially available funds.

He uses the available portion to enter a smaller position while waiting for the rest of his money to clear. This example shows how partial availability can still help traders act strategically.

Example 3: Check Deposit Using Mobile App

Sophie deposits a $5,000 check through the E*TRADE app. The system confirms the submission, but the funds are marked “pending.” Three business days later, $1,000 becomes available for trading, and the remainder clears by the fifth day.

This partial access system allows E*TRADE to balance convenience with security, preventing fraudulent or invalid check transactions.

Example 4: Wire Transfer for Fast Trading

Noah needs to invest quickly after a market announcement. He sends a wire transfer from his bank before 6:00 p.m. ET. Within a few hours, E*TRADE credits his account and the funds are fully available for trading the same day.

Although wire transfers may involve a fee, traders like Noah use them when time-sensitive opportunities arise.

Benefits of E*TRADE’s Funds Availability System

E*TRADE’s fund availability policies may seem restrictive at first, but they offer significant benefits for users and the platform.

1. Increased Financial Security

Hold times prevent fraud and unauthorized transfers. By verifying each deposit, E*TRADE ensures that the funds truly exist and belong to the account holder. This safeguards both the investor and the platform.

2. Better Account Management

Predictable timelines help investors plan their trading schedules. You can anticipate when deposits will clear, making it easier to execute trades or withdrawals at the right time.

3. Regulatory Compliance

The U.S. financial system requires brokers to follow specific settlement and fund-holding procedures. E*TRADE’s policies comply with these regulations, reducing the risk of violations and account restrictions.

4. Efficient Risk Control

Instant access to large, unverified deposits could create major financial risks. By imposing clearance periods, E*TRADE maintains healthy liquidity and protects against system misuse.

5. Enhanced Transparency

Clear timelines and communication about funds availability help build trust between E*TRADE and its customers. Users know exactly why and how their funds are being held.

Common Problems and How to Avoid Them

Even though E*TRADE’s system is efficient, investors sometimes run into issues related to funds availability. Here’s how to avoid them:

- Plan deposits in advance: Always transfer funds several days before expected trading.

- Monitor your balances: Check your “available to trade” and “available to withdraw” sections regularly.

- Avoid trading with unsettled funds: Doing so may lead to violations and temporary account restrictions.

- Use wire transfers for urgency: If you need immediate access, wires are usually same-day.

- Keep a settled cash buffer: Maintain a small reserve of settled funds to avoid waiting periods during active trading days.

Practical Use Cases: When Funds Availability Matters Most

Use Case 1: Capturing a Market Opportunity

Imagine spotting a sudden stock dip that you believe will recover soon. If your funds are still pending, you can’t act. Understanding fund availability helps you plan deposits in advance to seize time-sensitive trades.

Use Case 2: Rebalancing a Portfolio

Investors who regularly rebalance their portfolios rely on precise timing. If funds from sales or deposits aren’t yet available, it could delay the rebalance. Knowing your settlement schedule ensures efficient portfolio management.

Use Case 3: Avoiding Account Violations

Many new investors unknowingly trade using unsettled funds, leading to “good faith” or “freeride” violations. Understanding E*TRADE’s hold times ensures you stay compliant and avoid temporary trading restrictions.

Use Case 4: Managing Withdrawals Efficiently

If you need to withdraw cash for personal expenses, deposit hold periods can delay the process. Tracking when funds become fully available helps you plan withdrawals without interruptions.

Tips for Managing E*TRADE Fund Availability

- Check Fund Status Regularly: Always verify whether your money is “pending,” “settled,” or “available.”

- Understand Cutoff Times: Deposits made before 4:00 p.m. ET count for that day; later deposits are processed the next business day.

- Maintain a Cash Cushion: Keep some settled cash in your account for quick trades or withdrawals.

- Use Faster Methods for Urgent Needs: Choose wire transfers or instant deposits when speed matters.

- Avoid Overtrading with Unsettled Funds: Wait until your funds clear to prevent account restrictions.

Frequently Asked Questions

1. How long does E*TRADE take to make funds available?

Most deposits are available within four business days, depending on the method. Wire transfers can be available the same day, while ACH and checks typically take longer.

2. Why does my balance show money I can’t use yet?

Those funds are pending verification. They appear in your account but are not yet settled, meaning E*TRADE hasn’t completed processing the transaction.

3. What happens if I trade with unsettled funds?

Trading with unsettled funds can cause a good faith or freeride violation. If this happens, E*TRADE may restrict your account for up to 90 days, allowing only trades with fully settled cash.