Reddit Financial Advisor: Real Insights, Advice Trends, and Lessons from Online Communities

Reddit has become one of the most influential platforms for financial discussions. Millions of users gather across subreddits like personalfinance, investing, and financialindependence to share their experiences with financial advisors, investment strategies, and money management. The keyword “Reddit financial advisor” encompasses an entire ecosystem of honest stories, candid reviews, and lessons learned, often from individuals who have navigated both successes and mistakes.

In this article, we’ll explore what people on Reddit truly think about financial advisors. You’ll learn how users evaluate their advisors, common challenges they face, and how technology is reshaping the financial advisory landscape. We’ll also review several real-world examples and use cases that show how financial advisors bring value beyond investment performance.

What “Reddit Financial Advisor” Really Means

When you search for “Reddit financial advisor”, you’re entering a community-driven knowledge hub. Reddit users talk about financial advisors with refreshing honesty, praising the good, warning against the bad, and analyzing the complex relationships between advisors and clients.

Community Conversations and Themes

Reddit discussions around financial advisors often center on transparency, cost, trust, and long-term planning. Users want to know whether financial advisors are worth the investment and how to distinguish between fee-only fiduciaries and commission-driven agents.

A recurring comment across subreddits is that “you don’t hire an advisor to beat the market; you hire one to manage your life’s complexity.” This perspective underscores how financial advisors serve broader roles beyond choosing investments to include tax efficiency, estate planning, and behavioral coaching.

Trust and Transparency

Reddit users are often skeptical of advisors who prioritize product sales over unbiased advice. Many posts stress the importance of fiduciary duty, meaning advisors who are legally required to act in the client’s best interest. Transparency about fees, methods, and incentives is the cornerstone of what Reddit communities consider “a good advisor.”

Why People Turn to Reddit for Financial Advisor Discussions

Reddit’s community-driven model offers something traditional financial media cannot: authenticity. Users share personal stories that range from glowing recommendations to cautionary tales about hidden fees or disappointing experiences.

Real-Life Learning Environment

People use Reddit as a collective learning space. New investors can read how others chose advisors, negotiated fees, or even fired them after poor results. Experienced users often guide newcomers by explaining what questions to ask and how to spot red flags in an advisor’s behavior.

Unfiltered Experiences

Unlike promotional websites, Reddit hosts honest, raw experiences. Users don’t hesitate to call out poor service or share genuine appreciation for advisors who truly improved their financial well-being. This environment allows for more balanced and realistic expectations of what advisors can and cannot do.

The Value of a Financial Advisor According to Reddit

Beyond Investment Returns

Many Reddit users point out that a financial advisor’s true value isn’t always about outperforming the stock market. Instead, it’s about helping clients achieve clarity in their financial goals. Advisors offer structure: budgeting, tax planning, insurance coordination, and estate management.

A Redditor once summarized it well: “I don’t pay my advisor to pick stocks; I pay them so I don’t make panic decisions when the market crashes.” This sentiment reveals that emotional discipline is often one of the most underrated benefits advisors provide.

When Financial Advisors Add the Most Value

Based on Reddit discussions, the need for an advisor grows when a person’s financial life becomes complicated, such as owning multiple properties, running a business, or planning for early retirement. In those situations, Reddit users agree that a qualified advisor can save time, prevent tax mistakes, and provide peace of mind.

Real-World Examples and Use Cases

Here are several detailed real-world examples inspired by Reddit discussions that demonstrate how financial advisors work in different scenarios.

Example 1: The Mid-Career Professional Facing Complexity

A Reddit user in their 40s shared how they struggled managing stock options, real estate, and multiple retirement accounts after changing jobs. Their finances had become tangled, and they worried about tax exposure.

Their financial advisor helped consolidate assets, restructured stock option exercises to minimize taxes, and created a long-term retirement withdrawal plan. The advisor also introduced estate strategies, ensuring that assets would transition smoothly to beneficiaries.

The user later commented that the advisor’s fee was “worth it” not because of higher returns, but because it simplified their financial life and reduced stress.

Example 2: The Retiree Needing Sustainable Withdrawals

A Reddit discussion on r/personalfinance highlighted retirees concerned about running out of money too soon. One retiree described hiring a financial advisor to design a personalized withdrawal strategy from their 401(k), IRA, and taxable accounts.

The advisor modeled market downturn scenarios and adjusted withdrawals to ensure stability even during recessions. The user wrote that they felt “financially calmer” knowing their plan was sustainable and flexible.

This example shows how advisors deliver tangible value not through beating the market, but by managing cash flow, risk, and peace of mind.

Example 3: The Young DIY Investor Seeking Validation

Some Redditors are do-it-yourself investors but occasionally consult advisors for specialized advice. One user who managed their own ETF portfolio hired a fee-only advisor for a one-time review to confirm that their strategy was tax-efficient and well-balanced.

This hybrid model, DIY investing with occasional professional input, appears frequently in Reddit discussions. It’s ideal for investors who want to remain in control but still seek expert guidance for complex questions.

Example 4: The Entrepreneur with Diversified Assets

A small business owner posted about needing help coordinating personal and business finances. Their advisor created a structure that optimized income distribution, managed liquidity between business and personal assets, and planned for succession.

Reddit users responding to this post highlighted how such advisory relationships prevent costly errors, especially for entrepreneurs juggling multiple revenue streams.

Benefits of Using Technology in Financial Advisory

Technology is transforming how financial advisors operate, and Reddit discussions frequently mention these innovations. Modern tools increase efficiency, transparency, and personalization, key factors that improve client satisfaction.

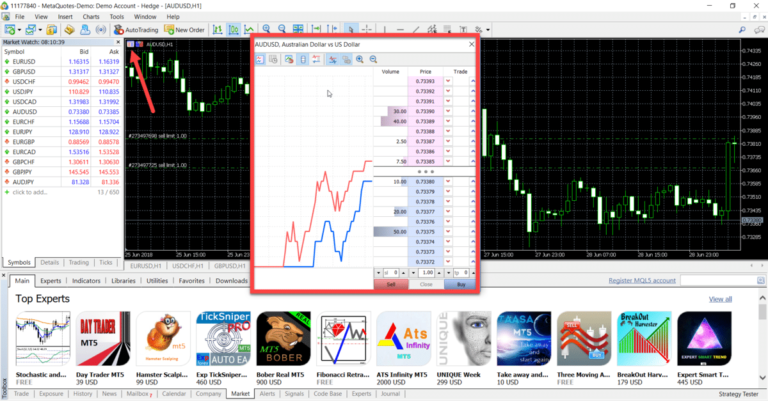

Automation and Digital Efficiency

Financial technology (fintech) allows advisors to automate portfolio rebalancing, risk analysis, and tax-loss harvesting. This reduces manual errors and frees up time for deeper client conversations. Many Redditors appreciate advisors who use technology to streamline operations and minimize human bias.

Data Visualization and Transparency

Modern financial platforms provide clients with dashboards that clearly show investments, fees, and performance metrics. Transparency has become a defining expectation for Reddit users, who often distrust opaque systems. By using real-time dashboards, advisors build credibility and help clients understand how decisions affect outcomes.

Behavioral Insights and Predictive Analytics

Some advisors employ predictive analytics to model different market scenarios or life changes. These simulations help clients see how decisions like buying property or retiring early impact long-term stability. Reddit users value this proactive approach as it converts uncertainty into informed planning.

Practical Benefits of a Financial Advisor

Peace of Mind

Many Redditors admit they could manage their finances independently, but prefer having an advisor for emotional reassurance. Knowing that a professional monitors their portfolio and plans future adjustments helps reduce anxiety, especially during volatile markets.

Time Efficiency

Managing complex finances is time-consuming. Advisors take on research, tax strategy, and monitoring duties, freeing clients to focus on their careers or families.

Professional Perspective

Financial advisors bring an objective lens, helping clients avoid emotional or impulsive decisions. Reddit users often credit their advisors for preventing costly market timing or panic selling.

Holistic Coordination

Advisors coordinate between multiple domains—investments, insurance, real estate, and estate planning—to ensure all financial components align with life goals. This integrated perspective is something most DIY investors struggle to maintain alone.

Detailed Use Cases: What Problems a Financial Advisor Helps Solve

Use Case 1: Complex Tax Situations

When clients have multiple income streams—salary, business, rental, or investment—taxes become intricate. Advisors help optimize deductions, manage the timing of income recognition, and prevent overpayment. Reddit users often highlight this as one of the most valuable advisory services.

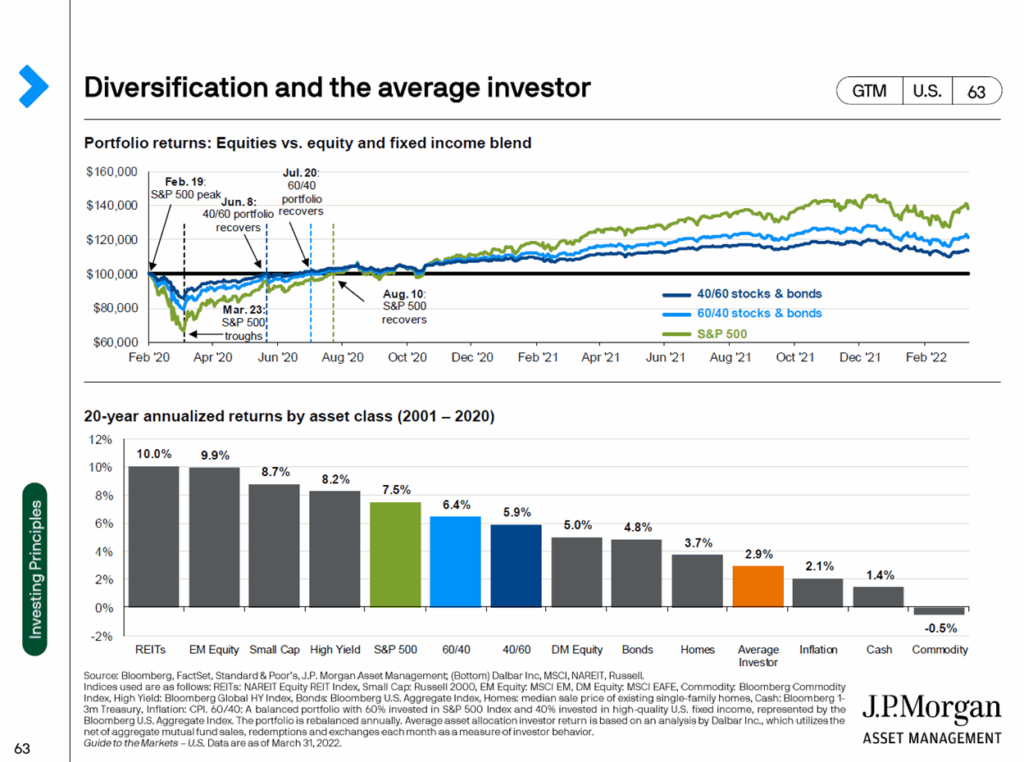

Use Case 2: Market Volatility and Behavioral Coaching

During market downturns, emotional reactions can derail long-term plans. Advisors serve as behavioral coaches, reminding clients to stay the course and avoid rash decisions. Redditors often discuss how their advisors prevented panic-selling during events like the 2020 market crash.

Use Case 3: Transition Planning

Whether it’s retirement, selling a business, or receiving an inheritance, major transitions require careful planning. Advisors ensure cash flow stability, optimize tax outcomes, and provide a strategic roadmap. Reddit discussions emphasize that having a professional during these times can save years of regret.

Key Lessons from Reddit Discussions

- Transparency matters more than returns. Redditors value honesty about fees and strategies over promises of high performance.

- Fee-only fiduciary models inspire trust. Advisors who avoid commissions are often the most respected in discussions.

- Technology improves communication. Clients appreciate digital platforms that make progress visible and understandable.

- Emotional discipline is invaluable. Many users say their advisors saved them from impulsive mistakes, not just financial losses.

Frequently Asked Questions

Q1: Are financial advisors worth hiring for small portfolios?

According to Reddit discussions, financial advisors add the most value when finances are complex or time-consuming. For small, simple portfolios, DIY investing using index funds may suffice. As your wealth and financial responsibilities grow, professional guidance becomes more beneficial.

Q2: What red flags should I look for when choosing an advisor?

Reddit users warn against advisors who charge hidden fees, push specific products, or avoid explaining their compensation. Always seek transparency, fiduciary commitment, and clear communication.

Q3: Can I combine DIY investing with occasional advisor consultations?

Yes. Many Redditors follow a hybrid model, managing day-to-day investments themselves while consulting advisors for tax, estate, or retirement planning. This approach balances independence with professional oversight.