Understanding E*TRADE Joint Accounts: Complete Guide, Benefits, and Real Use Cases

An E*TRADE joint account is a brokerage account shared between two or more individuals, typically spouses, partners, or family members, that allows them to invest and manage assets together. Through this structure, each account holder has equal rights to deposit, trade, and withdraw funds. E*TRADE, one of the most established online brokerage platforms, offers joint accounts designed for flexibility, transparency, and ease of access.

The main appeal of an ETRADE joint account lies in its ability to help partners collaborate on financial goals such as retirement planning, wealth accumulation, or educational savings. It provides all the features of a traditional ETRADE individual brokerage account but with shared ownership and responsibility. This means both parties can make investment decisions, view account activities, and track performance in real time.

How an E*TRADE Joint Account Works

A joint account at ETRADE operates similarly to other brokerage accounts but with co-ownership. Both account holders are equally responsible for the account’s assets and liabilities. They can deposit cash, purchase stocks, bonds, ETFs, or mutual funds, and access ETRADE’s research and analytical tools.

The account structure typically falls into two main types:

- Joint Tenants with Rights of Survivorship (JTWROS): If one account holder passes away, ownership automatically transfers to the surviving account holder.

- Tenants in Common (TIC): Each owner holds a specific percentage of the account, which can be transferred to their estate upon death rather than automatically to the co-owner.

ETRADE’s digital platform simplifies account management through a single interface where both users can monitor performance, set alerts, and customize watchlists. The joint account seamlessly integrates with ETRADE’s financial tools for portfolio analysis and tax planning.

Setting Up an E*TRADE Joint Account: The Process Explained

Opening an E*TRADE joint brokerage account is a straightforward process that can be completed online in minutes. Both applicants must provide their personal information, including Social Security numbers, employment details, and financial background. Verification is essential since both owners share equal legal authority over the account.

Once approved, the joint account functions like any E*TRADE individual account, allowing trading in:

- Stocks and ETFs

- Options and mutual funds

- Bonds and fixed-income products

- Managed portfolios and retirement planning tools

E*TRADE also provides strong security protocols such as two-factor authentication and encryption to ensure safe joint access.

Benefits of Using an E*TRADE Joint Account

1. Shared Financial Management

A joint account enables partners to work together toward shared financial objectives. Whether saving for a home, managing investments, or building retirement wealth, both owners can monitor progress and make joint decisions efficiently. This collaborative structure eliminates the need for multiple separate accounts.

2. Efficient Portfolio Consolidation

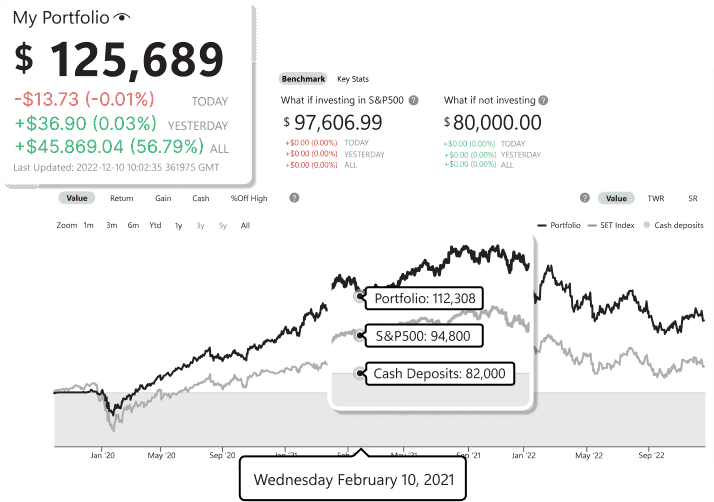

Instead of maintaining several individual accounts, a joint account centralizes investment management. This simplifies tax filing, performance analysis, and asset diversification. E*TRADE’s dashboard offers a complete overview of your joint investments, helping both partners align their strategies.

3. Tax and Estate Advantages

For Joint Tenants with Rights of Survivorship (JTWROS), assets automatically transfer to the surviving account holder. This feature minimizes estate complications and can streamline wealth transition planning. Additionally, E*TRADE provides detailed tax reporting tools, making it easier to manage capital gains and losses.

4. Powerful Technological Tools

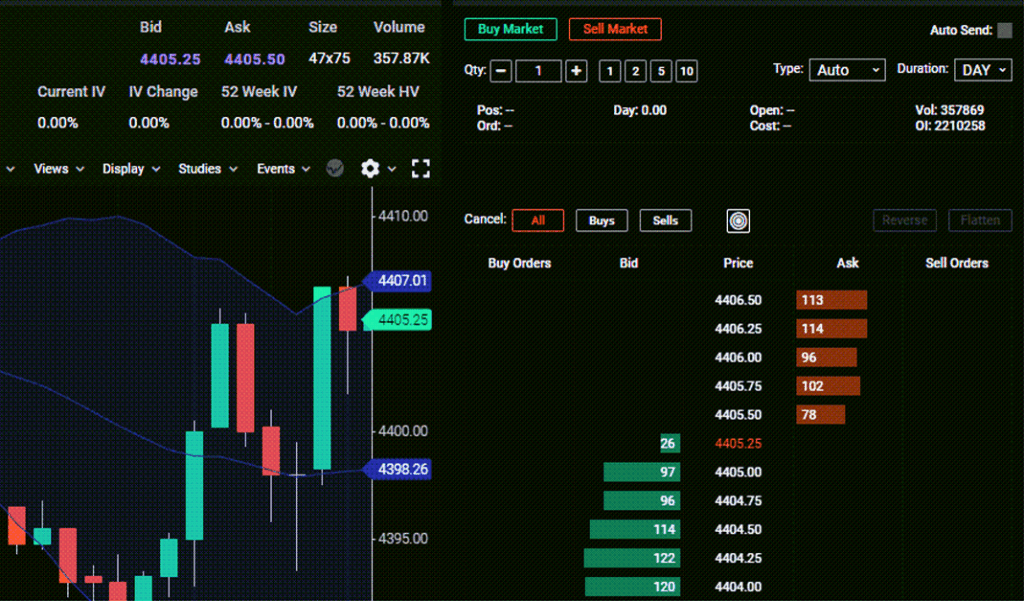

ETRADE’s technology provides extensive analytical tools, mobile access, and customizable alerts. The **Power ETRADE platform** is designed for joint investors who want detailed charts, real-time data, and automated portfolio insights, ensuring both account holders stay informed.

Real-World Example 1: E*TRADE Core Portfolios

E*TRADE Core Portfolios is an automated investment service (robo-advisor) that fits perfectly with joint accounts. Couples or partners can invest together in diversified portfolios managed by algorithms and human oversight.

For example, a married couple saving for retirement can choose a moderate-risk Core Portfolio. The system automatically adjusts investments according to their shared goals and risk tolerance. The joint account setup allows both partners to review progress, rebalance, and make changes collaboratively.

This product highlights how E*TRADE’s automation technology simplifies complex investment decisions for two or more owners, promoting transparency and alignment in financial planning.

Real-World Example 2: E*TRADE Managed Portfolios

For partners who prefer professional guidance, E*TRADE Managed Portfolios offers actively managed investment strategies. This service pairs joint account owners with a team of E*TRADE financial advisors who tailor asset allocation and diversification based on the couple’s objectives.

Consider two business partners who want to grow a shared investment fund. Through a joint managed portfolio, ETRADE’s advisors can design a balanced mix of equity and fixed-income investments to suit their timeline. Both partners can track performance through ETRADE’s intuitive dashboard, ensuring accountability and transparency.

This approach combines technology-driven insights with expert advice ideal for those seeking a more hands-off experience without sacrificing control.

Real-World Example 3: ETRADE’s Power ETRADE Platform

The Power E*TRADE platform is particularly beneficial for joint account holders who want deep control over trading activities. It includes advanced charting tools, real-time market data, and strategic trade simulations.

Imagine two siblings managing their family’s inheritance through an ETRADE joint account. Using Power ETRADE, they can collaborate to analyze stock trends, monitor ETF performance, and execute trades efficiently. The built-in education center allows both users to learn and adapt investment strategies together, regardless of skill level.

This use case demonstrates how technology enhances joint financial management by making sophisticated tools accessible to both owners.

Real-World Example 4: E*TRADE Retirement Joint Account Setup

While retirement accounts are usually individual, some couples coordinate their investments through a shared joint brokerage account alongside their IRAs. E*TRADE’s flexible platform allows them to manage taxable investments together while maintaining personal retirement accounts separately.

For instance, a couple in their 40s might use an E*TRADE joint account to invest in dividend-paying stocks and ETFs for long-term growth while keeping their IRAs focused on tax-deferred assets. This dual-structure approach allows them to balance risk, manage cash flow, and build a stronger financial foundation collaboratively.

Benefits of Technology in E*TRADE Joint Accounts

E*TRADE leverages cutting-edge technology to simplify the joint investing experience. Key technological advantages include:

Real-Time Collaboration

Both account holders can log in simultaneously to track performance, set trading alerts, and review activity. This ensures transparency and shared decision-making at all times.

Advanced Analytics

E*TRADE’s built-in research tools and data visualization dashboards help both partners analyze asset performance. They can use technical indicators, historical data, and forecast tools to align strategies effectively.

Mobile Accessibility

The E*TRADE mobile app enables seamless account management from anywhere. Whether depositing funds or reviewing stock performance, both users stay connected to their joint financial goals in real time.

Enhanced Security

With advanced encryption and biometric login options, E*TRADE ensures both users’ access remains secure. Each account holder can customize permissions and alerts, reducing the risk of unauthorized activity.

Use Cases: When to Choose an E*TRADE Joint Account

Managing Shared Investments Between Partners

Couples or business partners who aim to invest collectively benefit from the transparency and efficiency of joint accounts. E*TRADE’s structure supports equal participation in every financial decision.

Building a Family Wealth Portfolio

Families managing inheritance or long-term educational funds can use an E*TRADE joint account to diversify investments while keeping oversight centralized. The shared structure simplifies asset monitoring and ensures responsible collaboration.

Retirement and Long-Term Planning

Joint accounts complement individual retirement accounts by offering flexibility in taxable investment strategies. This allows couples to synchronize long-term growth while maintaining independent retirement portfolios.

Common Challenges and How E*TRADE Solves Them

While joint accounts introduce shared responsibility, they can also lead to communication gaps or misaligned financial goals. E*TRADE addresses these issues through:

- Shared access tools that promote transparency.

- Custom alerts to keep both parties informed.

- Educational resources that help joint investors make informed decisions together.

By integrating technology and human insight, E*TRADE ensures both partners remain engaged and informed throughout their investment journey.

Frequently Asked Questions (FAQ)

1. Can both account holders trade independently in an E*TRADE joint account?

Yes. Both holders have full trading authority and can deposit, withdraw, or invest funds unless otherwise specified in the account setup.

2. Does E*TRADE charge additional fees for joint accounts?

No. E*TRADE joint accounts carry the same commission structure and maintenance policies as individual accounts, with no extra costs for shared ownership.

3. Can I convert my individual E*TRADE account into a joint account?

You cannot directly convert it, but you can open a new joint account and transfer assets from your individual account into the shared one with E*TRADE’s guidance.