Understanding the ETRADE Securities Account: A Complete Guide for Smart Investors

An E*TRADE Securities Account is a powerful and versatile brokerage account that allows investors to buy and sell various financial instruments such as stocks, ETFs, mutual funds, bonds, and options. It serves as a digital gateway to the global financial markets, giving both beginners and experienced traders access to diverse investment opportunities through an easy-to-use and technology-driven platform.

ETRADE, one of the most recognized names in online investing, has built its reputation on innovation, transparency, and accessibility. Whether your goal is to grow long-term wealth, trade actively, or build a balanced investment portfolio, the ETRADE Securities Account provides a flexible foundation.

This article offers a detailed exploration of how E*TRADE Securities Accounts work, their features, real-world examples, benefits, and use cases. By the end, you’ll understand how this type of account can help shape your investment strategy.

What Is an E*TRADE Securities Account

Definition and Core Functionality

A securities account is a financial account used to hold and trade investments such as stocks, bonds, and funds. The E*TRADE Securities Account is a specific type of brokerage account that gives investors direct access to trade in U.S. and global markets.

With this account, users can deposit funds, purchase investments, and monitor portfolio performance through E*TRADE’s secure online or mobile platforms. Every transaction whether buying Apple shares or investing in government bonds is processed through this securities account.

It also serves as a record-keeping hub, storing your holdings, cost basis, performance data, and transaction history. For investors, it acts as both a storage vault for assets and an active trading mechanism.

Different Types of E*TRADE Accounts

E*TRADE offers several account types, many of which are built around the securities account structure:

- Standard Brokerage Account – Ideal for everyday investors who want to buy and sell stocks, ETFs, or options.

- Retirement Accounts (IRAs) – Include Traditional, Roth, and Rollover IRAs with tax advantages for long-term savings.

- Managed Portfolios – Automated investment portfolios where E*TRADE professionals or algorithms manage investments for you.

- Margin Accounts – Allow investors to borrow money to increase their purchasing power and leverage their investments.

Each of these accounts functions through the same core mechanism: they are securities accounts holding your investments in one place.

Key Features of an E*TRADE Securities Account

1. Commission-Free Trading

E*TRADE offers zero-commission trading on U.S.-listed stocks and ETFs. This is a major benefit for cost-conscious investors because it allows you to trade without worrying about paying a fee every time you buy or sell.

For options traders, there is typically a small per-contract fee, and other investments like mutual funds or bonds may have separate cost structures. Still, E*TRADE’s pricing model is transparent and easy to understand, helping you stay aware of what you pay.

2. Powerful Platforms and Trading Tools

E*TRADE provides multiple platforms to suit different experience levels:

- Power E*TRADE – A sophisticated trading platform for advanced users, featuring real-time data, advanced charting tools, and complex order execution options.

- Web Platform – Simplified yet comprehensive, suitable for casual investors who prefer browser-based trading.

- Mobile App – Allows you to trade, check performance, and receive market updates on the go.

These tools are designed for intuitive use, combining professional-grade analytics with a user-friendly interface that works seamlessly across devices.

3. Extensive Investment Choices

With an E*TRADE Securities Account, investors gain access to a wide range of asset classes, including:

- Stocks and ETFs

- Mutual funds

- Bonds and fixed-income securities

- Options and futures

- Managed portfolios

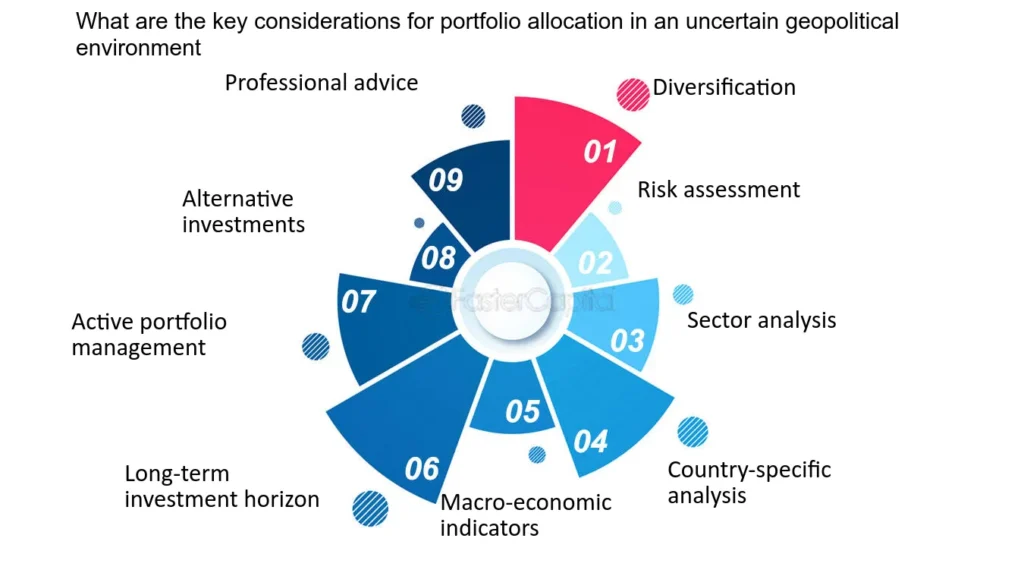

This variety makes it easy to diversify and build a portfolio aligned with your financial goals and risk tolerance.

4. Research and Education Resources

E*TRADE integrates a strong educational ecosystem. Investors can access stock screeners, analyst ratings, earnings data, and investment reports directly from their account. The platform also provides articles, videos, and tutorials to help beginners learn trading basics and experienced investors refine their strategies.

This focus on education is one of the reasons E*TRADE remains a trusted platform for both new and seasoned investors.

Benefits of Using an E*TRADE Securities Account

1. Easy Access to Global Markets

E*TRADE opens the door to global financial opportunities. You can invest in U.S. markets as well as access international ETFs and mutual funds. This gives investors broader exposure and allows for a more balanced portfolio.

2. Seamless Technology Integration

The E*TRADE platform is powered by advanced technology that ensures speed, security, and reliability. All trades, transfers, and account updates happen in real time, which gives investors an edge in fast-moving markets.

Automation features like dividend reinvestment, scheduled transfers, and portfolio alerts—enhance convenience while maintaining control.

3. Transparency and Security

E*TRADE is known for its transparency in pricing and strong account protection. Investors benefit from clear disclosures and robust security measures, including encryption and multi-factor authentication. Funds and securities are protected up to industry limits through SIPC insurance, providing an additional layer of safety.

4. Flexibility for Every Investor Type

Whether you’re a beginner who wants to buy index funds or a day trader looking to analyze technical charts, the E*TRADE Securities Account offers the flexibility to accommodate both. It evolves with your investing journey, supporting everything from long-term wealth building to short-term trading.

Real-World Examples and Use Cases

Below are some real-life examples of how different investors might use an E*TRADE Securities Account in practice.

Example 1: Building a Long-Term Stock Portfolio

A young investor may start with a few hundred dollars and buy shares of large, stable companies such as Microsoft or Coca-Cola. Through E*TRADE’s automated dividend reinvestment plan, they can continuously reinvest their dividends into more shares, compounding their growth over time.

By using the platform’s research tools, the investor can identify quality stocks with consistent earnings and low volatility, gradually building a diversified, long-term portfolio.

Example 2: Active Options Trading

An experienced trader might use E*TRADE’s Power platform for options strategies such as covered calls or spreads. The platform provides access to real-time options chains, implied volatility metrics, and customizable graphs that help traders manage risk.

Since the account supports fast execution and streaming quotes, active traders can capitalize on market movements efficiently while managing complex positions.

Example 3: Diversifying with Bonds and Fixed Income

Some investors prefer stability over volatility. They can use their E*TRADE Securities Account to build a laddered bond portfolio, purchasing bonds with staggered maturities. This helps them secure steady interest income and manage risk exposure over time.

E*TRADE’s bond tools allow users to search by yield, maturity, and rating, making it easier to build a fixed-income strategy aligned with individual goals.

Example 4: Retirement Investment through an IRA

An investor planning for retirement might open an E*TRADE IRA linked to a securities account. They could invest in index funds or ETFs that match their risk tolerance and time horizon. The platform provides performance tracking, tax-advantaged growth, and automatic contribution features, simplifying long-term planning.

Over time, the investor can rebalance the portfolio directly within the account to maintain an optimal asset mix as retirement approaches.

Example 5: Combining Managed and Self-Directed Strategies

Some investors start with a managed E*TRADE portfolio where professionals manage their investments and later transition into a self-directed account once they gain confidence. This hybrid approach allows them to learn investing principles while maintaining part of their wealth under expert management.

The E*TRADE system makes this transition seamless, letting investors move funds between managed and self-directed accounts without disruption.

Benefits of Using Technology in E*TRADE Accounts

Technology plays a crucial role in making the E*TRADE Securities Account efficient and easy to use.

1. Automation and Smart Tools

Investors can automate contributions, set price alerts, or use screeners to identify potential investments based on financial metrics. These tools simplify the decision-making process and allow for consistent investing habits.

2. Real-Time Data and Insights

The platform’s real-time market data, charts, and analytics enable faster and more informed decisions. Whether you’re buying for long-term growth or day trading, having immediate access to live information helps improve execution accuracy.

3. Seamless Integration with Mobile and Web

E*TRADE’s synchronization across web and mobile ensures that your portfolio updates instantly across devices. You can trade from your laptop during work hours and monitor your portfolio from your phone while traveling.

This cross-device continuity ensures you never lose track of market opportunities.

Practical Use Cases and Problem Solving

An E*TRADE Securities Account helps solve several common problems investors face today:

- Limited Market Access – E*TRADE provides a single platform where users can access stocks, ETFs, bonds, and options without needing multiple accounts.

- High Transaction Costs – The zero-commission model lowers barriers for beginners and encourages active participation.

- Lack of Financial Knowledge – The platform offers educational resources, webinars, and tutorials, helping users make informed investment decisions.

- Inefficient Portfolio Management – With E*TRADE’s technology, users can track performance, manage risks, and rebalance portfolios effortlessly.

- Fragmented Banking and Investing – E*TRADE integrates cash management and investment tools, simplifying financial organization in one platform.

These practical advantages make E*TRADE an effective solution for modern investors seeking convenience, efficiency, and control.

Risks and Considerations

While the E*TRADE Securities Account provides many benefits, investors should also consider the following:

- Market volatility can impact portfolio value.

- Margin trading amplifies both gains and losses.

- Complex strategies like options require careful risk management.

- Investment returns are not guaranteed; diversification reduces but does not eliminate risk.

Understanding these factors ensures you use the account responsibly and align it with your financial goals.

Conclusion

An E*TRADE Securities Account is more than just a place to hold investments it’s a gateway to smarter investing. Combining zero-commission trading, advanced technology, wide asset access, and excellent research tools, it caters to nearly every type of investor.

From long-term stock investors to active day traders, E*TRADE offers flexibility, transparency, and power in one integrated ecosystem. Real-world use cases like dividend investing, options trading, and retirement planning show just how versatile this account can be.

In the modern financial landscape, having a well-structured securities account isn’t just helpful—it’s essential. And with E*TRADE, that experience is intuitive, reliable, and backed by decades of expertise.

Frequently Asked Questions

1. What is an E*TRADE Securities Account used for?

It’s used to buy, sell, and hold various financial instruments like stocks, ETFs, mutual funds, bonds, and options. It acts as a digital brokerage hub that manages your investment portfolio.

2. Does E*TRADE charge trading fees?

E*TRADE offers commission-free trading on U.S.-listed stocks and ETFs. Other products like options and bonds may have small transaction costs, depending on trade type and volume.

3. Can I use margin in an E*TRADE Securities Account?

Yes. Eligible investors can borrow funds through a margin account to increase their buying power. However, margin trading carries higher risk and should be used with caution.