Fundrise Withdraw Guide: Timing, Rules, Penalties & Strategies You Should Know

As a real estate crowdfunding platform, Fundrise appeals to many investors seeking access to private real estate through diversified funds and eREITs. But one of the most common questions prospective and existing users ask is: “How do I withdraw my money from Fundrise?” Understanding the Fundrise withdrawal (liquidation/redemption) process is crucial before you commit capital, since real estate is inherently less liquid than public securities.

This article provides a detailed walkthrough: how withdrawals work at Fundrise, rules and limitations, penalties or restrictions, real-world user experiences, technology infrastructure that supports the process, benefits and trade-offs, use cases illustrating when a withdrawal is needed, and what to watch out for. By the end, you’ll have a clear mental model of how and when you might extract capital from Fundrise and how to strategize that carefully.

How Fundrise Withdrawals (Liquidations / Redemptions) Work

The Basics of Requesting a Fundrise Withdrawal

To get money out of your Fundrise investment, you must submit a liquidation request. That request signals your intention to redeem some or all of your shares in one or more Fundrise funds.

However, Fundrise does not process withdrawals on a continuous daily basis. Instead, they follow a quarterly review schedule. That means your request must be submitted by the last business day of a quarter to be considered in that quarter’s review. If you miss that cutoff, your request rolls into the next quarter’s cycle. (Fundrise states this in its help articles about liquidations.)

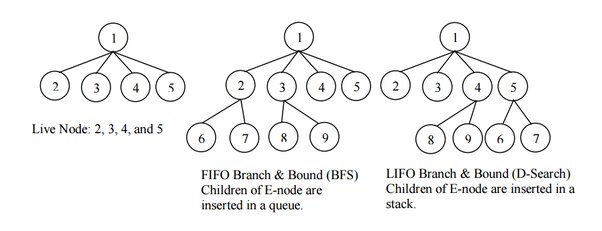

When your request is accepted, Fundrise will liquidate shares in a First In, First Out (FIFO) fashion. In other words, the shares you’ve held the longest will be redeemed first. This is designed to respect holding periods and possibly minimize tax/loss impacts. (Fundrise’s help article describes this “FIFO” liquidation rule.)

Timing, Processing & Status Updates

Once a liquidation request is submitted by the proper deadline, Fundrise reviews it at the end of that quarter. Processing may require certain administrative steps: validating your account, ensuring there is enough liquidity in the fund, calculating the value of shares, and scheduling transfers. (Fundrise’s “What is the status of my redemption request?” help page explains how requests are reviewed and queued.)

If a request arrives after a quarter’s business day cutoff, it is held for review in the next quarter. This means your access to capital may be delayed. For example, if you submit on the first day of the next quarter, it will still be processed only after review at quarter’s end.

Fundrise also imposes certain limitations: not all funds may accept withdrawals every period, and some requests may be prorated if total redemption demand exceeds the fund’s liquidity capacity. The fund’s offering documents and redemption policies define these constraints.

Penalties, Restrictions & Share Age Rules

While Fundrise allows withdrawals, there are penalty structures for early withdrawals under certain circumstances. For instance, if you hold eREIT or eFund shares for fewer than five years, a penalty may apply. This penalty is intended to discourage premature exits and to offset administrative or liquidity costs borne by other investors. (Fundrise’s liquidation help documentation mentions this five-year holding rule for some fund types.)

Additionally, not all shares can always be redeemed. Some classes of shares may have restrictions on redemptions or be illiquid at various times. This is especially the case in funds with less liquidity or more specialized real estate holdings.

Because real estate is inherently illiquid, Fundrise must maintain mechanisms to ensure the funds remain solvent and able to meet redemption requests without compromising fund operations. This leads to the built-in limitations and review windows.

Real-World Examples & User Experiences

Below are several real-world experiences and scenarios that illustrate how Fundrise withdrawals work in practice based on user reports and platform documentation.

Example 1: Reddit User’s Quarterly Withdrawal Experience

On a thread titled “Withdrawal process” in the Fundrise subreddit, one user described their experience: they requested a withdrawal during the prescribed period, and the disbursement was fulfilled on schedule in the following distribution cycle. Another commented that if your request arrives late in the quarter, it gets deferred to the next quarter. (One thread explicitly notes that withdrawal requests are reviewed in January, April, July, and October.)

These comments reflect what the official policy states: real investors experience the quarterly review schedule, and submission timing can meaningfully affect when funds arrive. It mirrors the published rules.

Example 2: Fundrise “FIFO” Share Liquidation in Practice

In its own documentation, Fundrise describes that in a liquidation request, the system will liquidate your oldest held shares first (FIFO). Suppose you have held 1,000 shares in a given fund over various purchase dates; if you request a withdrawal, maybe 300 shares will be redeemed, and those will come from your earliest lots.

This practice affects tax basis, performance calculations, and possibly penalty exposure (older shares may already be beyond penalty windows). Investors often must be mindful of which lots are redeemed and how that impacts their cost basis and capital gains reporting.

Example 3: Partial vs Full Liquidation Requests

Some users attempt partial redemptions requesting only a portion of their holdings. Fundrise supports that, but the same rules apply: you must submit by the quarter’s cutoff, and liquidation is performed FIFO. The remaining shares stay invested. Many users employ this strategy to maintain exposure while extracting cash.

Because partial liquidations are common, users should monitor how much of their portfolio is left, and how future redemption windows and liquidity constraints could affect remaining holdings.

How Technology Supports Fundrise Withdrawals

Automated Scheduling & Redemption Windows

Fundrise’s systems enforce submission deadlines (by the last business day of the quarter) automatically. The investor portal provides alerts, reminders, and scheduling guidance so that withdrawal requests align with required windows. This automation helps avoid human error in timing.

The platform likely uses automated funds and liquidity management algorithms to ensure that, when redemption requests arise, it can manage cash flows, asset sales (if needed), and avoid liquidity shortfalls. This kind of fund operations backbone is critical in real estate funds.

Digital Status Updates & Redemption Tracking

Once you submit a withdrawal request, you can monitor its status in real time via the platform’s dashboard. Fundrise’s help pages describe how investors can check the status of requests—to see whether it is queued, approved, or scheduled.

The digital interface may also show estimated disbursement dates, any applicable penalties, and the number of shares to be redeemed. This transparency helps investors plan cash flow and understand where their request stands.

Integration with Banking & Transfers

When a withdrawal is approved and processed, the system likely triggers an automated transfer to your linked bank account through ACH or similar methods. The back-end handles funds routing, accounting, and settlement.

This integration means that once a request is approved, you don’t need to manually reconcile, chase checks, or intervene technology handles the payout flow end-to-end.

Benefits of Understanding & Optimizing Fundrise Withdrawals

Better Timing & Financial Planning

By mastering how Fundrise withdraws function quarterly windows, FIFO liquidation, penalty thresholds you can align your requests around personal cash needs without disrupting investment strategies. Knowing the schedule helps avoid missing deadlines or being stuck waiting an extra quarter.

Minimizing Penalties & Maximizing Net Proceeds

If certain shares are eligible for a penalty when redeemed early, structuring which shares remain vs which you withdraw can optimize your net amount. For example, if you hold some shares beyond their penalty-exempt threshold, you might choose to redeem those first to avoid paying extra fees.

Maintaining Liquidity Buffer

Since Fundrise is not instantly liquid, understanding withdrawal rules allows you to maintain backup liquidity (e.g., cash or other assets) rather than relying solely on real estate redemptions. This hedges against forced selling or the inability to meet short-term cash needs.

Strategic Partial Withdrawals

You can use partial withdrawal requests to take out cash while leaving a core position intact. By leveraging FIFO rules and controlling how much is redeemed, you maintain real estate exposure while freeing capital as needed. This flexibility makes the platform more usable for real-life portfolio management.

Use Cases: When and Why to Withdraw from Fundrise

Use Case 1: Rebalancing a Portfolio

An investor might realize their real estate allocation has grown disproportionately. They request a withdrawal to rebalance toward other asset classes (e.g., equities, bonds) to maintain their target allocation. Fundrise withdrawal gives a way to reduce exposure without selling off entire holdings.

Use Case 2: Funding a Near-Term Obligation

Someone may have a short-term cash requirement—home renovation, medical bill, tuition, or emergency expense. If that need aligns with a redemption window, they pursue withdrawal to satisfy the obligation, timing their request ahead of the quarter’s cutoff.

Use Case 3: Reducing Exposure Before a Market Downturn

If an investor senses real estate may soften or interest rates might squeeze property fundamentals, they may partially redeem their Fundrise holdings to reduce downside risk exposure.

Use Case 4: Transitioning to Alternative Investments

An investor may want to shift some capital from Fundrise into other opportunities—perhaps into private real estate deals, stock portfolios, or alternative platforms. They withdraw funds to free up capital for deployment elsewhere.

Use Case 5: Retirement or Income Needs

For investors needing income (especially in retirement), withdrawals become part of their cash flow strategy. They can schedule redemptions in advance, aligning with expected living expenses or distributions elsewhere.

Challenges, Limitations & What to Watch Out For

- Missed Deadlines: If you submit a withdrawal request after the quarter’s cutoff, it’s deferred to the next period. That delay can impact liquidity planning.

- Liquidity & Proration: If many investors request redemptions at once, the fund may prorate approvals or deny full requests.

- Early Redemption Penalties: Redeeming shares held under minimum durations (e.g., less than five years) may incur penalties, reducing net proceeds.

- Valuation Lag: Since real estate valuations change slowly, you may not get the most up-to-date market price when redeeming shares.

- Tax Complexity: Proceeds may involve gains, dividends, and potential depreciation recapture, which complicate tax filing.

- Remaining Exposure: After withdrawal, your remaining shares are still subject to the same fund risks—market cycles, property performance, etc.

Because of these constraints, withdrawal decisions must be made with care and not assumed to be trivial.

Summary

With Fundrise withdrawal, you don’t just press “sell and cash out.” You must navigate quarterly redemption windows, FIFO liquidation rules, holding-period penalties, and fund liquidity constraints. Understanding the technical and procedural mechanics can make the difference between a smooth exit and a frustrating wait.

Technology supports this entire process—automated scheduling, status tracking, bank transfers—but the policies set the real constraints. Real-world users often share insights about meeting deadlines, partial withdrawals, and how those rules play out in practice.

Use withdrawal wisely: for cash needs, rebalancing, risk reduction, or portfolio transitions. But always plan around the timing, limitations, and tax implications. With the knowledge above, you’ll be better equipped to manage real estate exposure through Fundrise while maintaining comfort and flexibility in your broader financial plan.

FAQ

Q1: Can I withdraw from Fundrise at any time?

No. Withdrawals must be requested by the last business day of a quarter to be reviewed in that quarter. Requests submitted after that cutoff are deferred to the next quarter.

Q2: Will I be penalized for withdrawing early?

Yes—some fund share classes (especially eREITs or eFunds) impose penalties if redeemed before five years. Penalties help offset liquidity costs that other investors might bear.

Q3: What happens to the shares I don’t redeem?

Redeemed shares follow a First In, First Out model. Your remaining shares stay invested and are subject to the ongoing performance, risks, and future redemption rules of the Fundrise fund they belong to.