VentureCrowd Property: The Future of Real Estate Crowdfunding Investments

The rise of digital investment platforms has opened new pathways for individuals to access real estate projects once reserved for institutional investors. VentureCrowd Property is one of the most notable platforms in Australia that enables this transformation. It brings investors and developers together through technology-driven crowdfunding, offering opportunities to participate in real estate ventures ranging from residential developments to large-scale commercial projects.

This article provides a comprehensive look at VentureCrowd Property its structure, technology, benefits, real-world applications, and why it’s considered a game-changer in modern real estate investing.

Understanding VentureCrowd Property

What Is VentureCrowd Property?

VentureCrowd Property is a division of VentureCrowd, an Australian alternative investment platform that specializes in equity, debt, and property-based crowdfunding. It allows both accredited and retail investors to gain fractional access to high-quality property developments without needing to purchase entire assets or commit large sums of money.

The platform operates under Australian Financial Services License (AFSL) regulations, ensuring compliance, transparency, and investor protection. It connects investors directly with developers and manages the funding, legal, and administrative processes, allowing individuals to participate seamlessly in real estate projects.

Essentially, VentureCrowd Property simplifies what used to be a complex, capital-heavy process into an accessible and transparent online experience.

How VentureCrowd Property Works

The process of investing in VentureCrowd Property involves several key stages designed to balance accessibility with risk management:

- Project Sourcing and Vetting

VentureCrowd’s in-house team evaluates potential developments, analyzing feasibility, risk, location demand, and developer experience. Only projects that meet rigorous due diligence criteria are listed on the platform. - Digital Listing and Investor Access

Once a project is approved, it’s listed on the VentureCrowd platform. Each listing includes detailed financial projections, timelines, risk disclosures, and expected returns. Investors can review and choose projects that align with their preferences. - Funding and Development Phase

When enough capital is raised, the project proceeds into development or acquisition. VentureCrowd provides regular updates, including construction milestones, financial progress, and any variations from the original plan. - Exit and Return Distribution

After completion or sale, profits are distributed proportionally among investors, depending on their investment size and the project’s financial outcome. Returns may include both capital gains and periodic income, depending on the investment structure.

This streamlined model bridges the gap between developers seeking funding and investors seeking property exposure, all within a regulated and technology-enhanced framework.

The Technology Behind VentureCrowd Property

A Digital Platform for Real Estate Investment

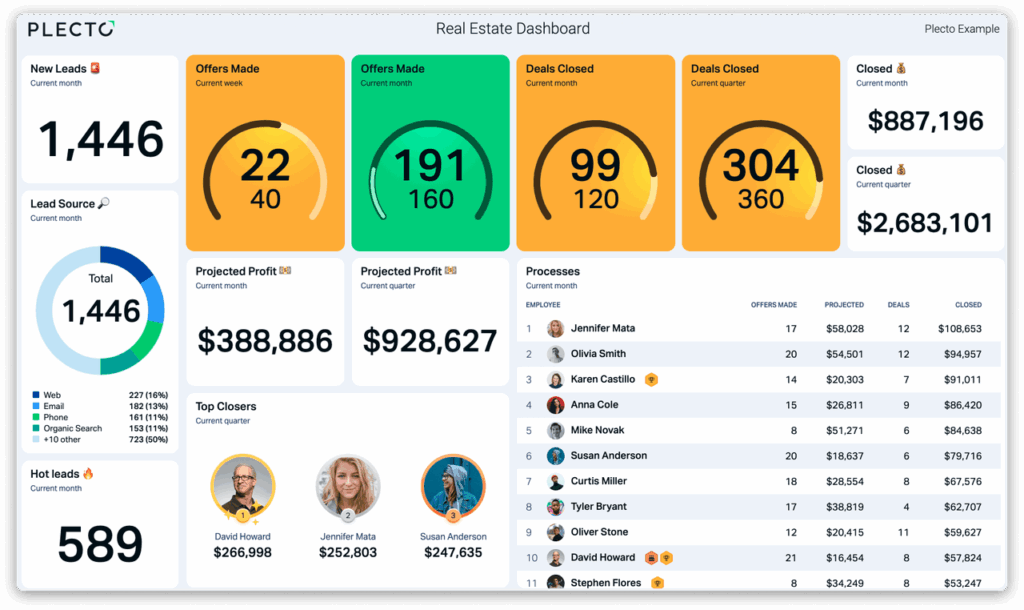

VentureCrowd Property’s technological foundation allows investors to manage their portfolios digitally. From project discovery to performance monitoring, all activities occur within a secure, data-driven platform. This not only increases accessibility but also introduces automation and transparency into processes that were once opaque.

The platform integrates financial modeling tools, secure payment gateways, and automated reporting features that simplify investor relations. For developers, it provides a streamlined capital-raising environment with access to a qualified pool of investors.

Data Transparency and Investor Protection

Technology also plays a key role in data transparency. VentureCrowd publishes detailed documentation for every investment opportunity including feasibility studies, independent valuations, and compliance documents.

Through its dashboard, investors can track project progress, receive updates, and access real-time analytics. This transparency ensures that investors make informed decisions, reducing information asymmetry and increasing trust a cornerstone of sustainable crowdfunding ecosystems.

Benefits of VentureCrowd Property

Democratizing Real Estate Investment

Traditionally, real estate investing required significant capital often millions of dollars making it inaccessible to average investors. VentureCrowd Property changes this dynamic by allowing participation with smaller investment amounts.

This democratization empowers more individuals to diversify their wealth through property, without the financial burden of sole ownership or the complexity of managing physical assets. It opens the door to passive income and long-term capital growth through fractional property ownership.

Diversification Across Property Sectors

Investors can diversify across multiple property types such as residential developments, commercial offices, mixed-use complexes, and industrial assets. Each project carries distinct risk and return profiles, giving investors flexibility to tailor portfolios that match their financial goals.

By spreading investments across several projects, individuals can mitigate exposure to localized market fluctuations and project-specific risks.

Transparency and Trust

Every listing on VentureCrowd Property undergoes strict due diligence and disclosure requirements. The platform publishes comprehensive documentation including project risk assessments, funding structures, and exit strategies.

This level of transparency builds trust between investors and developers, ensuring informed decision-making and responsible participation in real estate crowdfunding.

Reduced Administrative Burden

Investing in property typically involves complex legal and administrative processes — title registration, financial structuring, and tax documentation. VentureCrowd Property handles these processes on behalf of investors, simplifying what would otherwise be an intensive administrative task.

This automation allows investors to focus on evaluating opportunities rather than navigating regulatory hurdles.

Real-World Examples of VentureCrowd Property Projects

Below are detailed examples illustrating how VentureCrowd Property operates in practice and how different investors have benefited from the model.

Example 1: Residential Land Subdivision Project

A typical VentureCrowd property project involves residential land subdivision in suburban areas. Developers acquire large parcels of land and subdivide them into multiple plots for sale or construction.

Through VentureCrowd, investors contribute equity or mezzanine funding to support land acquisition and early-stage infrastructure. Once plots are developed and sold, profits are distributed based on pre-agreed terms.

This model offers investors exposure to the steady demand for housing while minimizing operational involvement.

Example 2: Mixed-Use Urban Development

Another project type is the mixed-use urban development, combining residential units with commercial spaces like retail outlets or co-working areas. Investors in these projects benefit from diversified revenue streams rental income from commercial tenants and long-term capital appreciation from residential properties.

VentureCrowd provides full transparency on construction phases, lease agreements, and projected yields. The multi-purpose nature of these developments makes them resilient to single-market downturns.

Example 3: Green Real Estate Projects

As sustainability becomes increasingly important, VentureCrowd has supported green property initiatives focused on energy-efficient and environmentally friendly developments.

Investors participating in such projects not only gain financial returns but also contribute to the broader goal of sustainable urbanization. Examples include apartment complexes with renewable energy systems, low-carbon materials, and smart-home technology integrations.

Example 4: Commercial Property Redevelopment

VentureCrowd also facilitates commercial property redevelopment projects, where existing buildings are repurposed or renovated for modern commercial use.

These projects typically offer investors exposure to stable rental income through long-term leases while revitalizing urban spaces. Redevelopment often provides quicker turnaround times compared to ground-up development, offering faster potential returns.

Use Cases and Real-Life Applications

Empowering Small Investors

VentureCrowd Property allows individuals with limited capital to participate in large-scale developments. For example, a retail investor can allocate a small amount into multiple property projects, gaining exposure that would otherwise require millions in direct ownership.

This solves a major problem in traditional real estate the high entry barrier. It turns property investment into an inclusive, technology-enabled experience.

Diversifying Investment Portfolios

For investors heavily focused on equities or fixed income, VentureCrowd Property provides an alternative asset class with different market dynamics. Property crowdfunding offers a hedge against stock market volatility and inflation while delivering tangible asset exposure.

Supporting Local Property Growth

Through VentureCrowd, investors can support developments in their own communities. Funding residential and commercial projects locally stimulates economic growth, creates jobs, and contributes to infrastructure improvement making property crowdfunding a socially impactful investment method.

Passive Income Generation

For individuals seeking consistent cash flow, debt or mezzanine tranches in VentureCrowd property projects offer regular interest or dividend payments. This provides passive income while allowing participation in tangible assets managed by experienced developers.

Practical Advantages of Using VentureCrowd Property

Streamlined Access to Property Markets

The digital model of VentureCrowd eliminates the traditional barriers of location, capital, and complexity. Investors can explore and fund multiple projects through a single online dashboard — effectively bringing the entire property market to their fingertips.

Regulatory Compliance and Security

VentureCrowd’s licensing under the Australian Financial Services framework provides confidence that all operations meet legal and ethical standards. Investor funds are managed through compliant structures, ensuring security and accountability.

Long-Term Wealth Building

By combining transparency, diversification, and accessibility, VentureCrowd Property helps investors build long-term wealth. The mix of income-generating and growth-oriented projects supports both short-term gains and sustained capital appreciation.

Challenges and Risks

While VentureCrowd Property offers unique advantages, it’s important to understand the inherent risks involved:

- Illiquidity: Investments are not easily tradable and may be tied up until project completion.

- Market Risk: Property values can fluctuate due to economic or regulatory changes.

- Development Risk: Delays, cost overruns, or planning issues can affect profitability.

- Sponsor Risk: Project success depends on the developer’s experience and financial stability.

- Regulatory Risk: Changes in laws or tax regulations may impact returns.

Mitigating these risks requires diversification, proper due diligence, and realistic return expectations.

Summary

VentureCrowd Property stands as a leading example of how technology can revolutionize traditional real estate investing. By combining digital efficiency, transparent governance, and inclusive participation, it empowers a broader audience to access property markets once dominated by institutions.

Investors can choose from a variety of projects, diversify portfolios, and enjoy the benefits of real estate ownership without operational complexities. As crowdfunding continues to evolve, platforms like VentureCrowd are redefining how people build wealth in the property sector.

Frequently Asked Questions

Q1: Who can invest in VentureCrowd Property projects?

VentureCrowd Property welcomes both retail and wholesale investors, depending on the project’s structure and regulatory classification. Retail investors may have capped investment limits to ensure financial safety.

Q2: What types of properties are available on VentureCrowd?

Projects vary from residential and mixed-use developments to commercial redevelopments and sustainable housing initiatives, offering broad diversification opportunities.

Q3: How does VentureCrowd ensure investor protection?

The platform operates under AFSL regulations, conducts due diligence on all listings, and maintains transparent reporting practices. Investors have access to detailed project documents and ongoing updates to ensure accountability.