Top Alternatives to Fundrise: Best Real Estate Investment Platforms Compared

Real estate crowdfunding has transformed how individuals invest in property. Among platforms, Fundrise is well known for its accessible entry, diversified eREITs, and reach into real estate for non-accredited investors. But it’s not the only option. Many investors search for alternatives to Fundrise platforms that offer different deal types, structures, risk/return tradeoffs, credit-based real estate, and perhaps access to more direct, commercial real estate opportunities.

In this article, we’ll dig deeply into what those alternatives are, how they differ from Fundrise, what advantages technology brings, real-world platform examples, use-case scenarios, benefits, and key criteria to evaluate. At the end, you’ll have a clearer sense of which real estate investing route might better match your goals.

What Makes a Platform a Viable Alternative

To understand alternatives, first, we need criteria. A strong alternative to Fundrise should:

- Offer real estate investment structures (equity, debt, REITs, funds)

- Provide access (ideally to accredited or non-accredited investors)

- Have transparent fee structures and reporting

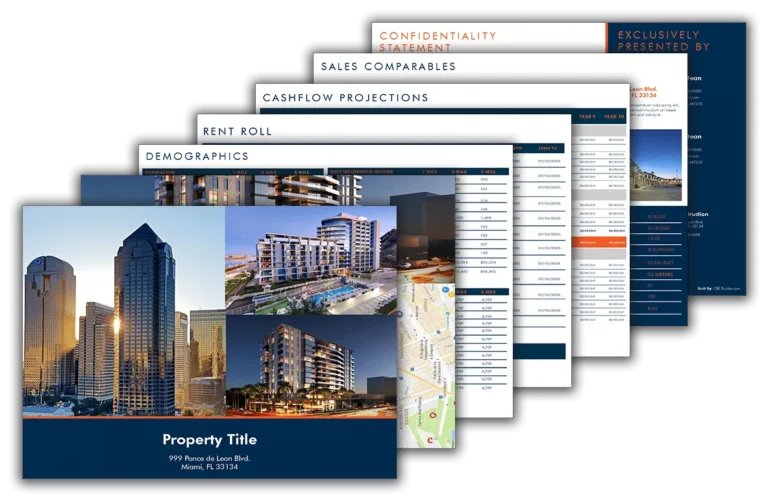

- Use technology for investor dashboards, analytics, and document access

- Enable diversification across assets or projects

- Have a track record, reputation, or regulatory compliance

Fundrise is popular because it combines low entry minimums, easy portfolio management, and diversified real estate exposure. Alternatives may shift emphasis, e.g., more direct deals, debt loans, commercial property focus, higher minimums, or different jurisdictions.

Let’s explore how alternatives differ, how technology supports them, and then go into specific platform examples.

How Alternatives Differ from Fundrise

Direct Deals vs. Aggregated Funds

One key difference is whether a platform allows investors to pick individual real estate deals (e.g. a particular apartment building or industrial property) versus investing in a pooled fund or eREIT structure. Some alternatives emphasize direct deal marketplaces for commercial real estate, giving investors greater control, though often requiring larger minimums and more diligence.

Debt / Loan-Based Structures

Fundrise primarily focuses on equity or fund-based real estate exposure (through eREITs, eFunds). Some alternatives specialize in real estate debt or lending (senior loans, mezzanine, bridge lending). These can offer fixed income-style return profiles, shorter lifespans, and different risk profiles (e.g., priority in capital structure).

Accreditation and Investor Type

While Fundrise allows non-accredited investors in many cases, some alternatives require accredited status, especially for larger or commercial deals. Others are open to all, but limit which deals non-accredited investors may access. The investor type eligibility shapes which alternatives are usable for you.

Geographic & Asset Focus

Alternative platforms may focus on certain asset types (industrial, hospitality, self-storage) or geographic markets (international, secondary U.S. markets) that differ from Fundrise’s broad residential and commercial mix. This can enable niche exposure or higher upside (with commensurate risk).

Liquidity and Lock-Up Terms

Fundrise has semi-liquid features via redemption windows in its funds. Alternatives may have fixed lock-up periods, no redemption options, or have secondary markets for trading positions. Understanding liquidity is crucial when choosing alternatives.

Fee Structures & Transparency

Differences in fees (management, acquisition, performance, structuring) are common between platforms. Some alternatives may have lower ongoing fees but higher upfront structuring fees, or vice versa. Transparency of how fees affect net returns is an important differentiator.

Benefits of Technology in Modern Real Estate Platforms

Technology plays a central role in making these alternatives viable. Here’s how it contributes:

- Investor Dashboards & Analytics: Platforms offer real-time access to performance data, cash flow projections, tenant metrics, occupancy, expense variances, and sensitivity scenarios.

- Automated Document and Data Rooms: All legal agreements, financials, appraisal reports, and audit documents are stored digitally for investor access.

- Deal Filtering & Matching: Algorithms help investors filter deals by geography, risk level, asset class, or minimum investment size.

- Automated Distributions & Accounting: Cash distributions, K-1 or tax documents, and tracking of capital contributions are handled digitally.

- Scalable Infrastructure: Platforms can host many offers concurrently, manage investor onboarding, perform compliance checks (KYC/AML), and reduce operational costs through automation.

- Secondary Trading & Liquidity Mechanisms: Some platforms can support secondary markets or peer trading, enabled by technology to match the supply/demand of stakes.

Because of these technological enablers, alternatives to Fundrise can scale, maintain transparency, and reduce friction in investor participation.

Real-World Platform Examples

Below are three real-world platforms that serve as meaningful alternatives to Fundrise. Each is described in depth: what they offer, how they differ, their strengths, and relevant details.

CrowdStreet

Overview & Specialization

CrowdStreet is a high-profile platform focusing on commercial real estate opportunities. It allows accredited investors to invest directly in specific deals (office, industrial, hospitality, multifamily) rather than in pooled funds alone.

How It Works & Differentiation

On CrowdStreet, investors can browse active projects and invest in individual deals. The platform vets sponsors, provides due diligence packages, and also operates a “Fund Marketplace” for more diversified options. Its minimum investments are typically higher (often $25,000 or more).

Because it emphasizes direct commercial real estate, CrowdStreet offers greater control, transparency, and potential upside (though with more risk) compared to Fundrise’s more aggregated model.

Strengths & Challenges

Strengths include a strong track record, seasoned sponsor vetting, diverse project offerings, and robust reporting. Challenges include higher capital requirements and limited access if not accredited. Many deals may also lock capital for longer periods.

Groundfloor

Overview & Debt-Focused Model

Groundfloor is a platform specializing in real estate debt investments and short-term loans for real estate development or renovation. Investors fund loans rather than equity. This provides a different risk/return profile: fixed returns, shorter terms, and capital priority in the loan structure.

How It Works & Differentiation

Investors can make relatively small investments in specific loan listings (minimums as low as $10). Each listing includes project details, loan terms, interest rates, and expected duration (often 6 to 18 months). Once the loan matures or the project pays off, investors receive a return of principal plus interest.

This model differs from Fundrise’s equity/fund orientation and offers more liquidity and shorter-term exposure.

Strengths & Challenges

Strengths: low minimums, shorter duration, predictable cash flows (if loans perform). Challenges: credit risk (borrowers default), platform default risk, and often lower upside than equity holdings in rising markets.

Arrived Homes

Overview & Rental Property Focus

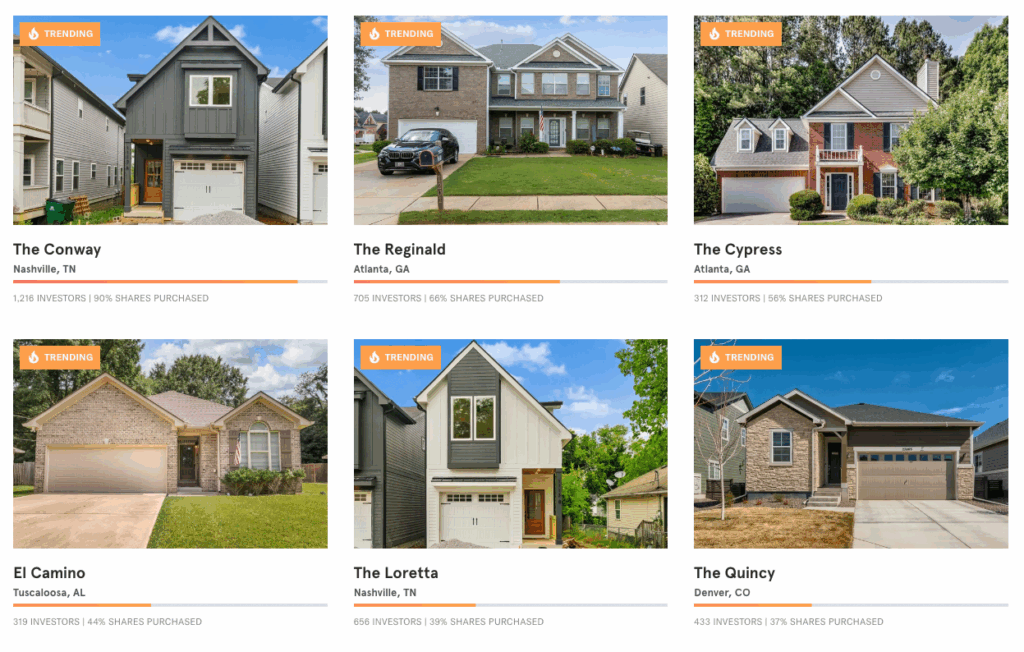

Arrived Homes is a platform that allows fractional ownership in residential rental properties and vacation homes. The model is oriented around income from rent rather than large commercial projects. It enables investors to own small shares of residential property portfolios.

How It Works & Differentiation

Investors can pick from residential rental property deals, often with modest minimums. The platform handles property management, tenant relations, maintenance, and distributions of net rent. The revenue depends on rental income and property appreciation.

This differs from Fundrise in that it focuses more on residential rental yields and possibly lower volatility than development or commercial deals.

Strengths & Challenges

Strengths include relatively stable rental income, being more accessible for smaller investors, and hands-off management. Challenges: performance depends heavily on local residential rental markets, vacancy risk, maintenance cost overruns, and less upside in rapidly rising commercial sectors.

Use Cases: Why Someone Might Choose Alternatives

Use Case 1: Accredited Investor Seeking Commercial Exposure

An investor with accredited status might find Fundrise too restrictive if their goal is to access high-potential commercial property deals (office towers, warehouses, hotels). They may prefer CrowdStreet’s direct commercial listings to capture more upside and control.

Use Case 2: Short-Term, Debt-Based Returns

If an investor prefers predictable returns over equity upside, they might lean toward Groundfloor’s short-term loan deals. Those who dislike long lock-ups may find the debt model attractive to “bridge capital” or diversify with shorter-term instruments.

Use Case 3: Residential Rental Income Focus

An investor aiming for rental yield and lower volatility may opt for something like Arrived Homes—fractional ownership in rental homes, with consistent cash flow from rent, less exposure to commercial cycles, and simpler property types.

Use Case 4: Diversification Away from Fundrise

Some investors may already have exposure via Fundrise and want to diversify across platforms to reduce platform risk. They may allocate capital to commercial-focused platforms, debt platforms, or residential rental platforms to avoid overdependence on Fundrise’s model.

Use Case 5: Geographic or Asset Niche Exposure

If one believes that niche markets (e.g.,l logistics student housing, short-term rentals in tourist zones) or specific geographies (international, secondary U.S. markets) have better returns ahead, they may choose platforms offering those niche deals that Fundrise doesn’t emphasize.

Benefits of Using Alternatives (Compared to Fundrise)

Access to More Specialized Deals

Alternatives often provide access to deals that Fundrise doesn’t emphasize commercial real estate, debt instruments, individual property investments, or niche assets. This variety allows investors to tailor allocations more precisely to their views.

Potential for Higher Upside (With Higher Risk)

By investing directly in commercial properties or equity, alternatives may offer greater upside than the more diversified, moderated returns of pooled funds. For aggressive investors, alternatives allow concentration where conviction lies.

Improved Control & Transparency

Direct-deal platforms give investors more visibility into the deal-level assumptions, pro forma cash flows, tenant composition, exit strategy, and risks. That level of granularity is often higher than typical Fundrise fund disclosures.

Flexibility in Investment Horizon

Debt platforms (like Groundfloor) often have shorter durations (6–18 months), giving investors more flexibility than long lock-ups typical in large real estate funds. This can help with liquidity planning.

Diversification Across Platform Risk

Using multiple platforms helps reduce “platform risk.” If Fundrise faces challenges or changes, investors still have exposure elsewhere. It prevents overconcentration in one provider’s ecosystem.

Enhanced Use of Technology

Many alternatives invest heavily in data, dashboards, real-time metrics, automated accounting, and secondary marketplaces. That improves investor experience, reduces friction, and keeps transparency high.

Risks and Considerations When Choosing Alternatives

- Greater due diligence burden: Direct deals require more analysis (market, tenants, debt structure, exit viability).

- Higher minimums: Some platforms require larger capital entries (e.g. $25,000 or more) compared to Fundrise’s low minimums.

- Liquidity constraints: Many deals have fixed lock-up periods or limited secondary liquidity.

- Platform reliability: Not all platforms last may face regulatory, operational, or financial failure, as seen in emerging real estate crowdfunding history.

- Fee complexity: Different platforms have varying structures of acquisition fees, performance fees, management fees, and structuring feeswh ich affect net returns.

- Market and property risk: Commercial property downturns, interest rate rises, vacancy issues, and cost overruns remain real threats.

Careful evaluation of sponsors, track records, transparency, exit plans, and platform reputation is essential.

How to Evaluate Platforms & Alternatives

- Review historical track record: How have past deals performed? How often have returns matched or missed projections?

- Examine sponsor credibility: What is the experience of the developer or operator? What is their track record in similar assets?

- Scrutinize fee structure and net return assumptions: Understand all fees and how they impact your returns.

- Check reporting and transparency: Does the platform provide regular reports, variance explanations, and document access?

- Understand liquidity constraints: What are lock-up periods? Are there secondary markets?

- Diversification options: Can you spread capital across multiple deals or sectors within the platform?

- Regulatory & legal compliance: Confirm that the offerings and the company operate under appropriate regulatory frameworks.

- Stress test assumptions: Consider downside scenarios, higher vacancy, cost inflation ,a nd slower,x it ,and whether your investment still looks viable.

Summary & Takeaways

“Alternatives to Fundrise” are not merely clones; they offer diverse models: direct commercial deals (CrowdStreet), debt lending (Groundfloor), fractional rental ownership (Arrived Homes), and more. These alternatives bring different risk/return tradeoffs, liquidity profiles, and levels of control.

Technology enables these platforms to offer scalable investor dashboards, document access, analytics, distribution automation, and filtering tools, allowing them to compete effectively against more aggregated, fund-based models.

When choosing among them, weigh your capital, risk tolerance, time horizon, desire for control, and willingness to perform due diligence. For many, a mixed approach, some allocation to Fundrise plus portions to alternatives, can help spread risk and capture upside across types.

Below are three FAQs to help clarify common questions.

FAQ

Q1: Which alternative is best if I want real estate exposure but lower minimum cost?

If your capital is modest, platforms like Groundfloor (for debt loans) or Arrived Homes (fractional residential properties) tend to have lower minimums than large commercial deal platforms. They allow you to get started with less capital while still participating in real estate.

Q2: Can I use multiple platforms simultaneously, and is that advisable?

Yes, using multiple platforms is often a wise strategy. It reduces platform risk (the chance a single provider underperforms or fails) and allows you to diversify across asset classes, property types, geography, and risk levels. However, ensure you can manage tracking, reporting, and understanding across them.

Q3: How do liquidity and lock-up periods compare across alternatives?

Alternatives vary widely. Debt-based platforms often have shorter durations (e.,g. 6–18 months). Property investment deals may lock capital for several years until exit. Some platforms offer secondary markets, but liquidity is not guaranteed. Always confirm lock-up terms and exit options before investing.