CrowdStreet Marketplace: In-Depth Guide to How It Works, Real Estate Investment Benefits, and Real Examples

The CrowdStreet Marketplace is a digital investment platform that connects accredited investors with institutional-quality commercial real estate opportunities. Traditionally, such investments were reserved for large institutions or wealthy family offices. However, CrowdStreet has changed this landscape by offering individuals access to real estate projects across the United States from multifamily housing and logistics centers to hotels and retail spaces.

At its core, CrowdStreet acts as a bridge between real estate sponsors (developers or operators seeking capital) and investors (individuals providing funds). The platform simplifies the process by handling project listings, sponsor vetting, documentation, and investor communication all within an online marketplace environment.

This article explores the inner workings of CrowdStreet Marketplace in detail how the platform functions, what technology powers it, its key benefits, real-world project examples, use cases, and what investors should know before participating.

How CrowdStreet Marketplace Works

The Platform’s Core Mission

CrowdStreet’s mission is simple yet transformative: to democratize access to institutional real estate investments. In the past, direct ownership of large-scale commercial properties was limited to institutional investors. CrowdStreet opens that door to accredited individuals who meet regulatory income or net worth requirements, giving them the opportunity to invest directly in vetted projects.

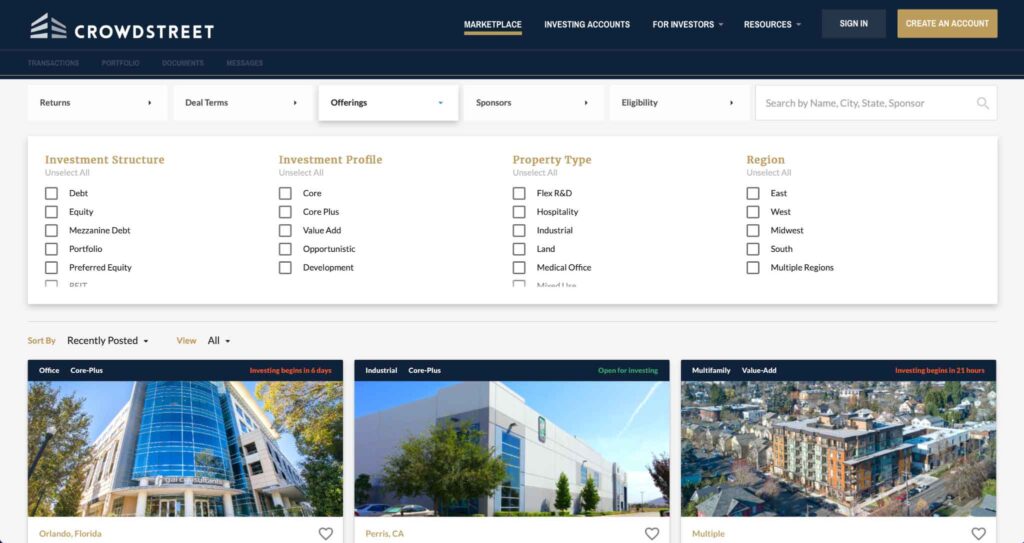

Through its digital marketplace, investors can browse active opportunities, review project materials, study sponsor profiles, and invest in offerings that align with their goals all through a secure online portal.

The Investment Process Step-by-Step

The process of investing through CrowdStreet typically follows these steps:

- Registration and Accreditation

Investors begin by registering on the platform and verifying their accredited status. Accreditation ensures investors meet financial thresholds required by U.S. securities regulations. - Reviewing Opportunities

Once verified, investors can browse available projects. Each listing includes a detailed business plan, projected returns, sponsor background, and financial models. - Engaging with Sponsors

Sponsors often host live webinars or Q&A sessions where potential investors can ask questions about project assumptions, local market trends, and exit strategies. - Investment and Funding

After reviewing documentation, investors can commit funds to a chosen project. Investment amounts vary, but minimum commitments generally start around tens of thousands of dollars. - Monitoring Performance

CrowdStreet provides investors with a comprehensive dashboard showing project updates, financial performance, and distribution reports. Investors receive periodic returns depending on the project structure. - Exit and Distribution

At the end of the investment period (often 3–7 years), sponsors execute an exit strategy selling, refinancing, or restructuring the property and return capital plus profits to investors.

Project Types and Investment Structures

CrowdStreet offers a variety of investment structures, most commonly:

- Equity: Investors take a direct ownership stake in the property. Profits come from rent income and property appreciation.

- Preferred Equity: Investors receive prioritized returns before common equity holders, often with capped upside.

- Debt: Investors lend capital to a project and earn fixed interest payments.

The types of properties featured include:

- Multifamily apartments

- Office buildings

- Industrial and logistics facilities

- Self-storage units

- Hotels and hospitality

- Retail centers

Each opportunity falls into an investment strategy category Core, Core-Plus, Value-Add, or Opportunistic representing different levels of risk and return potential. For instance, Core projects are stable and income-focused, while Value-Add or Opportunistic projects seek higher returns through property improvements or repositioning.

The Technology Behind CrowdStreet Marketplace

Digitization and Transparency

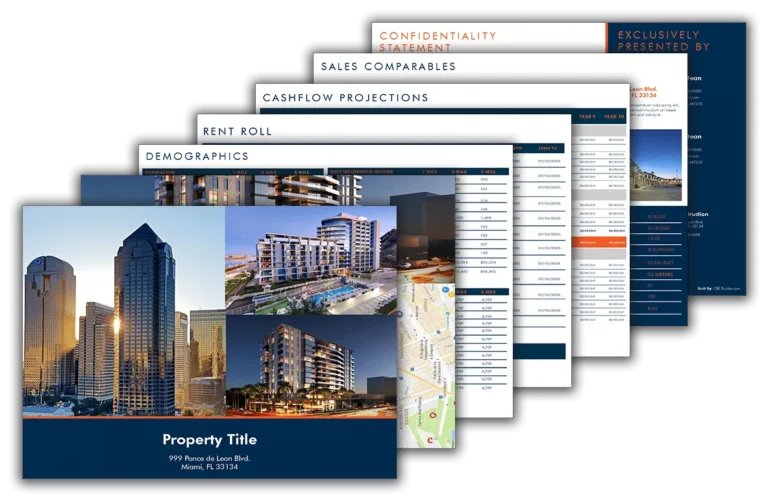

CrowdStreet’s success lies in how it leverages technology to create a transparent, data-rich ecosystem for investors. Instead of physical meetings, investors can evaluate deals entirely online, accessing:

- Market research data

- Cash flow projections

- Sponsor performance metrics

- Historical return records

- Legal and financial documents

All information is presented through an intuitive dashboard, making complex real estate analysis accessible to individual investors. This transparency builds confidence and enables smarter decision-making.

Intelligent Screening Algorithms

CrowdStreet uses a combination of manual due diligence and algorithmic screening to vet projects. Each sponsor must undergo a rigorous background check, financial verification, and project evaluation before listing.

Only a small percentage typically less than 5% of all submitted deals make it to the marketplace. The screening system analyzes key indicators such as:

- Sponsor track record and past performance

- Market conditions and location fundamentals

- Capital structure and leverage ratios

- Feasibility of exit strategies

Automation helps maintain high listing quality and consistency while reducing human error.

Portfolio Management Tools

Technology also enhances post-investment experience. Investors can track all their holdings in one place, analyze portfolio diversification, and monitor overall performance.

CrowdStreet offers “Blended Portfolios,” a technology-driven allocation system where an investor’s funds are automatically distributed across multiple projects to achieve sectoral and geographic diversification.

This feature is especially useful for those who prefer passive management or who want exposure to multiple property types without selecting individual deals manually.

Real-World Examples and Use Cases

Below are several real-world project examples and scenarios that illustrate how CrowdStreet operates in practice. Each case shows how the platform brings together sponsors, technology, and investors in meaningful ways.

Example 1: Flexible Office and R&D Complex

One notable project featured on CrowdStreet involved a flexible-use R&D complex located in a growing technology hub. The property combined office and light-industrial spaces suitable for innovation-driven tenants such as robotics startups, biotech companies, and engineering labs.

Investors had access to data on local employment growth, leasing terms, occupancy rates, and projected rent escalations. Because the tech sector in that region was expanding rapidly, this project offered strong long-term income potential.

By funding this project, investors effectively participated in the infrastructure growth behind a local innovation economy a type of opportunity that previously only institutional investors could access.

Example 2: Diversified Real Estate Portfolio

CrowdStreet also offers blended portfolio products, which combine multiple property types and locations into one investment package. For example, a diversified portfolio might allocate capital across 30 properties from multifamily housing in the Midwest to logistics centers on the West Coast and hospitality projects in tourist markets.

This approach minimizes single-asset exposure risk. If one project underperforms, others can offset the losses. It also provides investors with exposure to a variety of market cycles and geographic trends, making it ideal for those seeking balanced, long-term returns.

Example 3: Industrial and Logistics Facilities

Industrial properties and logistics hubs are among the most stable assets on the platform. A real-world example included funding a distribution center located near a major highway network and airport.

The project benefited from strong demand driven by e-commerce growth. Tenants required last-mile delivery infrastructure, ensuring long-term leases and predictable rent flows.

For investors, these industrial projects offered stable income with relatively lower operational risk compared to hotels or retail developments.

Example 4: Boutique Hospitality Property

Another example featured a boutique hotel development in a growing tourist destination. The project aimed to capitalize on post-pandemic travel recovery and local government incentives for hospitality expansion.

While hospitality investments tend to carry more risk due to seasonal demand and economic cycles, they can deliver substantial returns during market upswings. Investors could review RevPAR projections (Revenue per Available Room), occupancy forecasts, and management strategies before committing.

This case demonstrates how the marketplace accommodates diverse investor appetites from stable income-focused deals to high-risk, high-reward opportunities.

Key Benefits of CrowdStreet Marketplace

Access to Institutional-Grade Investments

CrowdStreet provides individuals access to projects that were previously limited to private equity firms and large funds. Investors can participate in commercial developments, multifamily complexes, or logistics centers without having to purchase entire properties or manage operations.

Diversification Across Sectors and Locations

Through the marketplace, investors can diversify their exposure across multiple property types, regions, and strategies. This reduces the impact of local market downturns and spreads risk effectively.

Data Transparency and Control

Every deal includes comprehensive documentation from financial models to sensitivity analyses and sponsor backgrounds. This level of transparency allows investors to make data-driven decisions and maintain full control over where their money goes.

Potential for Attractive Returns

Because CrowdStreet often features equity and value-add projects, return potential can exceed that of traditional investments such as stocks or bonds. While higher returns come with higher risk, successful projects can deliver significant capital appreciation and steady cash flow.

Passive Income Opportunities

Many projects provide periodic distributions from operating income, offering investors a passive cash flow stream. For individuals looking to diversify income sources beyond dividends or interest payments, real estate investments through CrowdStreet can fill that role.

Portfolio Analytics and Automation

CrowdStreet’s portfolio management tools help investors visualize risk exposure and track real-time performance. Automated features like Blended Portfolios simplify complex allocation strategies that would otherwise require expert-level financial knowledge.

Use Cases: Problems CrowdStreet Helps Solve

1. Expanding Investment Opportunities

CrowdStreet addresses a fundamental problem in private real estate investing access. Historically, individuals could not invest in large-scale commercial projects without millions in capital. The platform breaks down that barrier, allowing participation with smaller commitments.

2. Providing Capital to Real Estate Developers

For sponsors and developers, CrowdStreet serves as a new funding channel. Instead of relying solely on banks or institutional backers, sponsors can raise capital from a pool of accredited investors nationwide. This flexibility supports project scalability and innovation.

3. Diversification for High-Net-Worth Individuals

Investors with concentrated exposure to equities or fixed income can diversify through real estate without direct property management responsibilities. CrowdStreet’s offerings allow them to build a professionally managed, diversified portfolio.

4. Empowering Data-Driven Decision-Making

With every project accompanied by transparent data, investors gain the ability to evaluate deals like institutions do using financial modeling, market analysis, and sponsor history. This helps eliminate guesswork.

5. Supporting Long-Term Wealth Building

For individuals focused on generational wealth, commercial real estate provides both recurring income and long-term capital growth. CrowdStreet’s platform streamlines that process, making professional-grade real estate accessible from a laptop or mobile device.

Potential Risks and Challenges

Despite its strengths, CrowdStreet investments come with inherent risks. Understanding these risks is critical to making informed decisions.

- Illiquidity: Once invested, funds are typically locked until the project’s exit event. There is no secondary market to sell holdings early.

- Market Volatility: Real estate values fluctuate with broader economic conditions, interest rates, and local market health.

- Sponsor Performance: The success of each project heavily depends on the sponsor’s ability to manage, lease, and eventually sell the property.

- Projection Uncertainty: Financial forecasts are not guarantees. Unexpected delays or cost overruns can impact returns.

- High Minimums and Accreditation Requirements: Only accredited investors can participate, and minimum investments can be substantial.

- Fee Structures: Some projects involve management, acquisition, or performance fees that reduce net returns.

CrowdStreet performs vetting, but investors must conduct independent due diligence, reviewing assumptions and understanding potential downsides before committing funds.

How Investors Can Evaluate a Project

- Study Sponsor Track Records: Investigate prior projects and performance consistency.

- Review the Business Plan: Check for clarity on leasing, construction timelines, and market positioning.

- Understand Capital Structure: Evaluate debt-to-equity ratios and interest rate exposures.

- Analyze Exit Strategies: Determine if the sponsor has multiple pathways to liquidity.

- Diversify Investments: Spread capital across different sectors and geographies to mitigate risk.

- Follow Regular Updates: Use CrowdStreet’s dashboard to stay informed about project progress and distributions.

Summary: Why CrowdStreet Matters

CrowdStreet Marketplace represents a major evolution in real estate investing. It combines technology, transparency, and institutional-grade access into one streamlined platform that allows individual investors to participate in commercial real estate opportunities.

Through data-driven insights, online due diligence, and diversified options, the marketplace empowers investors to think and act like professional institutions all from the comfort of their homes.

While the opportunities are promising, investors should approach with realistic expectations, patience for long-term horizons, and an understanding of the risks associated with private market investments. When used wisely, CrowdStreet can be an effective tool for building a diversified and resilient investment portfolio.

Frequently Asked Questions

Q1: Who can invest in CrowdStreet Marketplace?

Only accredited investors can invest in CrowdStreet projects. Accreditation is based on income or net worth criteria established by regulatory authorities.

Q2: How long do investments typically last?

Most projects have a holding period between 3 to 7 years, depending on the property type and exit plan. Funds are generally illiquid until the sponsor executes an exit event.

Q3: What kind of returns can investors expect?

Returns vary by project, but many offerings target internal rates of return (IRR) between the high single digits and mid-teens. These are projections, not guarantees, and depend on project success and market conditions.