CrowdStreet Investments: How It Works, Real Examples, Benefits, and Technology Insights (2025 Guide)

The world of real estate investing has changed dramatically with the rise of CrowdStreet Investments, a leading platform connecting accredited investors with institutional-quality real estate opportunities. Instead of requiring millions to buy or develop commercial property, CrowdStreet allows individuals to access a curated marketplace of deals once reserved for major institutions.

This guide dives deeply into how CrowdStreet works, the role of technology behind it, the benefits to investors, real examples of projects funded through the platform, and the practical use cases it solves. By the end, you’ll have a full understanding of how this platform fits into modern real estate investing.

Introduction to CrowdStreet Investments

CrowdStreet was founded in 2014 to open the doors of commercial real estate investment to individuals through online technology. Traditionally, this asset class was dominated by large institutions, private equity funds, and real estate developers who had the capital and networks to access exclusive deals. CrowdStreet bridges that gap by connecting investors directly with sponsors (developers and operators) via a transparent digital marketplace.

The platform focuses primarily on commercial real estate (CRE) projects such as multifamily apartments, industrial parks, offices, and mixed-use developments. Unlike fund-based platforms such as Fundrise or DiversyFund, CrowdStreet enables investors to select and invest directly in individual properties or in diversified funds managed by experienced sponsors.

How CrowdStreet Works

When an accredited investor registers on the platform, they gain access to a marketplace of vetted real estate deals. Each opportunity is presented with a detailed investment memorandum, sponsor background, financial model, projected returns, and risk factors. Investors can review these and decide which opportunities align with their strategy.

Once the investor commits capital, their investment is legally tied to the entity that owns the property—often a limited liability company (LLC) or limited partnership (LP). CrowdStreet facilitates the transaction digitally, manages communication between investor and sponsor, and provides ongoing performance updates through its dashboard.

Distributions, reports, and tax documents such as Schedule K-1s are delivered directly through the online portal. This digital ecosystem significantly simplifies what once was an opaque and paperwork-heavy process.

Example 1: A Multifamily Development Project

One of CrowdStreet’s notable investment categories is multifamily housing developments. These projects target the growing demand for rental apartments in urban and suburban markets.

For example, a past deal listed on CrowdStreet involved developing a luxury apartment complex in Austin, Texas. The sponsor, with decades of experience, sought capital to acquire land, construct units, and lease them upon completion.

Investors who joined this deal benefited from both potential rental income and property appreciation. CrowdStreet’s due diligence included a comprehensive market analysis, employment trends, rental demand, and comparable property data, helping investors understand risk and return potential.

This type of deal showcases how CrowdStreet allows individuals to participate in the same kind of institutional-grade real estate once available only to private equity firms.

Example 2: Industrial Logistics Park

Industrial real estate has surged in popularity due to e-commerce growth and supply chain shifts. CrowdStreet has featured multiple logistics and warehouse development projects that capitalize on this trend.

One project example was a logistics park near Atlanta, targeting the booming distribution hub for major retailers. The deal involved acquiring existing warehouse assets and adding new build-to-suit facilities.

Investors were drawn to this project because of the strong tenant demand and stable rental income from long-term leases. CrowdStreet’s technology platform provided performance updates, lease milestones, and capital progress, all viewable through investor dashboards.

This type of deal demonstrates how investors can gain exposure to essential infrastructure in the modern economy without owning or managing properties directly.

Example 3: Office-to-Residential Conversion

As hybrid work reshapes office demand, new opportunities arise to repurpose underutilized spaces. CrowdStreet has featured several office-to-residential conversion projects that transform outdated office towers into modern apartments or mixed-use spaces.

One such project involved a mid-sized downtown office building being converted into upscale residential units. Investors participated through equity shares, funding renovation cos, ts, and participating in future sales profits.

These adaptive reuse projects reflect how CrowdStreet’s platform supports forward-thinking sponsors and allows investors to tap into emerging real estate trends.

Example 4: Hospitality Redevelopment Project

CrowdStreet has also hosted hospitality deals such as boutique hotel acquisitions and redevelopments. One highlighted example was a mountain resort renovation where investors funded upgrades to increase nightly rates and occupancy.

The project’s financial model projected returns through both ongoing cash distributions and property value appreciation upon exit.

By enabling individuals to join hotel and resort investments, CrowdStreet offers diversification into sectors that respond dynamically to travel and leisure trends. This represents the growing flexibility investors now have across multiple real estate sectors.

The Role of Technology in CrowdStreet Investments

CrowdStreet’s success largely stems from its robust use of technology. The platform doesn’t merely digitize investment documents; it builds an intelligent ecosystem for discovery, transparency, and portfolio management.

Streamlined Digital Marketplace

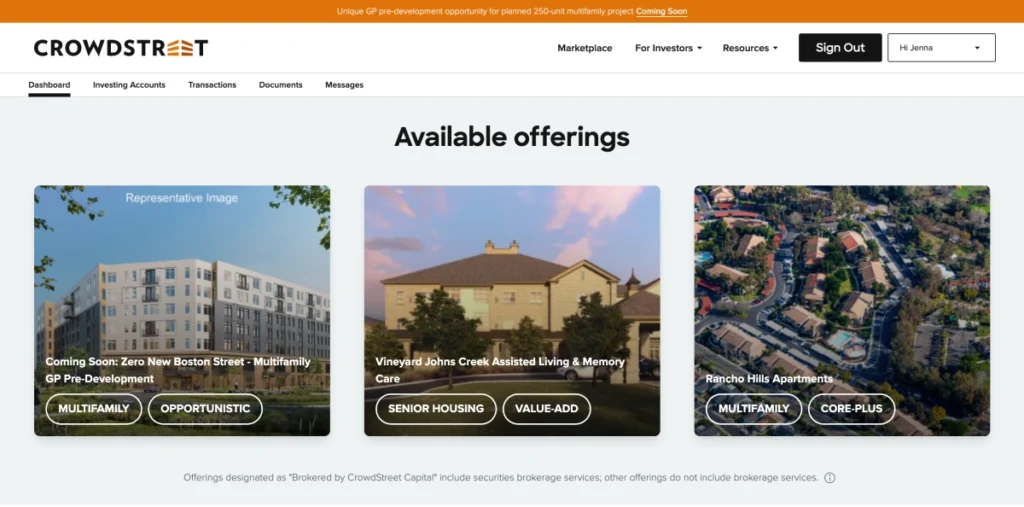

The platform curates investment opportunities and presents them in a user-friendly digital marketplace. Investors can filter by property type, location, return target, and sponsor experience, allowing for tailored decision-making.

This digital transparency replaces the traditional “insider” model of commercial real estate investing and democratizes access to information.

Data-Driven Due Diligence

CrowdStreet employs proprietary algorithms and data analytics to assess sponsor performance, financial models, and market data. Each deal undergoes a rigorous vetting process before being listed, which helps reduce asymmetry between investors and developers.

Secure and Automated Transactions

Smart contracts and digital escrow services streamline capital transfer, equity allocation, and reporting. Automation reduces human error and administrative delays, enhancing trust in every step of the investment process.

Real-Time Portfolio Tracking

Investors receive ongoing performance updates on occupancy rates, rent collections, and project milestones directly through their dashboards. This real-time access offers the kind of transparency previously impossible in private real estate investments.

Scalable and Efficient Investor Relations

By integrating communication tools, compliance features, and investor dashboards, CrowdStreet manages thousands of investors simultaneously, all while maintaining personalized communication. This scalability is one of its strongest technological advantages.

Benefits of CrowdStreet Investments

Access to Institutional-Grade Real Estate

CrowdStreet gives accredited investors access to commercial real estate deals that were once exclusive to institutional investors and private equity funds. This expands investment opportunities for individuals seeking portfolio diversification beyond stocks and bonds.

Transparency and Control

Unlike pooled real estate funds, where investors rely on fund managers to make all decisions, CrowdStreet allows participants to select individual deals. Each offering includes detailed financial projections and sponsor histories, giving investors control and clarity.

Potential for Attractive Returns

Commercial real estate can provide income through rent distributions and capital appreciation upon sale or refinancing. By investing in carefully vetted deals, investors can potentially capture above-average risk-adjusted returns.

Diversification Across Markets and Property Types

The platform offers projects across multifamily, industrial, hospitality, and office sectors throughout the U.S. This diversification helps spread risk and balance portfolio exposure.

Simplified Investor Experience

The technology-enabled dashboard reduces the administrative complexity of real estate ownership no property management, tenant handling, or maintenance required. Investors focus on financial outcomes rather than operational details.

Real-World Use Cases of CrowdStreet Investments

Use Case 1: Building a Passive Income Stream

An investor seeking passive income can allocate capital into stabilized apartment buildings through CrowdStreet. These assets generate regular cash distributions from tenant rent, providing a steady return without active involvement.

Use Case 2: Diversifying a Stock-Heavy Portfolio

A high-net-worth individual with a portfolio dominated by equities might invest in industrial real estate through CrowdStreet to reduce market volatility. This non-correlated asset class can provide balance during economic downturns.

Use Case 3: Participating in Market Transformations

As the real estate market evolves, e.g., the shift from offices to residential conversion, CrowdStreet investors can back innovative projects early. This allows participation in macroeconomic transformations that traditional REITs may miss.

Use Case 4: Long-Term Wealth Building

For investors focused on capital appreciation, development projects (like multifamily or mixed-use) offer long-term potential. CrowdStreet structures these opportunities to align with multi-year holding strategies for wealth accumulation.

Risks and Considerations

Despite its benefits, investors must recognize that CrowdStreet investments are not risk-free.

- Illiquidity: Most deals require holding periods of several years with limited early exit options.

- Market Volatility: Property values can decline with economic downturns or regional oversupply.

- Sponsor Performance Risk: Returns depend heavily on the sponsor’s experience and project execution.

- Accreditation Requirement: Only accredited investors (those meeting income or net worth thresholds) can participate in most CrowdStreet deals.

Thorough due diligence, diversification, and risk assessment are essential before committing capital.

Frequently Asked Questions

Q1: Who can invest in CrowdStreet?

CrowdStreet primarily serves accredited investors, those with an annual income of at least $200,000 (or $300,000 for couples) or a net worth exceeding $1 million excluding their primary residence. This aligns with SEC regulations governing private real estate offerings.

Q2: How long are CrowdStreet investments typically held?

Holding periods vary depending on the project. Most range between three to ten years. Development projects generally take longer to realize returns, while stabilized properties may generate earlier cash distributions.

Q3: Is CrowdStreet a good fit for beginners?

While the platform offers institutional-quality opportunities, it caters to experienced or accredited investors comfortable with long-term, illiquid investments. Beginners may explore educational resources and start with smaller allocations before scaling.