CrowdStreet Capital Explained: How It Works, Its Role, and What Investors Should Know

CrowdStreet has become one of the most recognized names in online real estate investing. It allows individuals to invest directly in commercial real estate projects that were once limited to large institutions or private funds. However, behind this marketplace sits a crucial legal and operational entity called CrowdStreet Capital and understanding its role is essential for anyone who invests on the platform.

This article provides a deep, easy-to-understand look at what CrowdStreet Capital is, how it functions, what benefits it offers to both investors and sponsors, and how it supports the broader CrowdStreet ecosystem. We’ll also cover practical use cases, risks, and FAQs to help you clearly grasp the full picture.

What Is CrowdStreet Capital?

CrowdStreet Capital is the broker-dealer subsidiary of the CrowdStreet platform. This means it’s the officially registered company that manages the legal and regulatory side of the investments offered on CrowdStreet.

In simple terms, while CrowdStreet is the online marketplace where investors browse and select real estate deals, CrowdStreet Capital is the licensed broker-dealer that ensures every investment transaction follows securities laws.

Because the investment opportunities on CrowdStreet involve selling shares or equity in real estate projects (which are considered securities), the U.S. Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) require a broker-dealer to handle those transactions.

That’s where CrowdStreet Capital comes in. It ensures all deals listed on the platform meet compliance requirements, manages investor verification, and facilitates the flow of capital safely and legally.

Why CrowdStreet Created Its Own Broker-Dealer

Operating a real estate crowdfunding marketplace without a broker-dealer license would make it impossible to legally sell securities. Instead of outsourcing that function to an external firm, CrowdStreet built its own CrowdStreet Capital LLC to manage compliance internally.

This decision allows CrowdStreet to:

- Maintain control over the entire investment process.

- Ensure that each offering meets federal and state legal standards.

- Keep a consistent investor experience without third-party brokers.

- Build trust by having an in-house regulated entity under FINRA supervision.

Essentially, CrowdStreet Capital is the legal backbone that makes the entire CrowdStreet marketplace possible.

How CrowdStreet Capital Fits Into the Larger Ecosystem

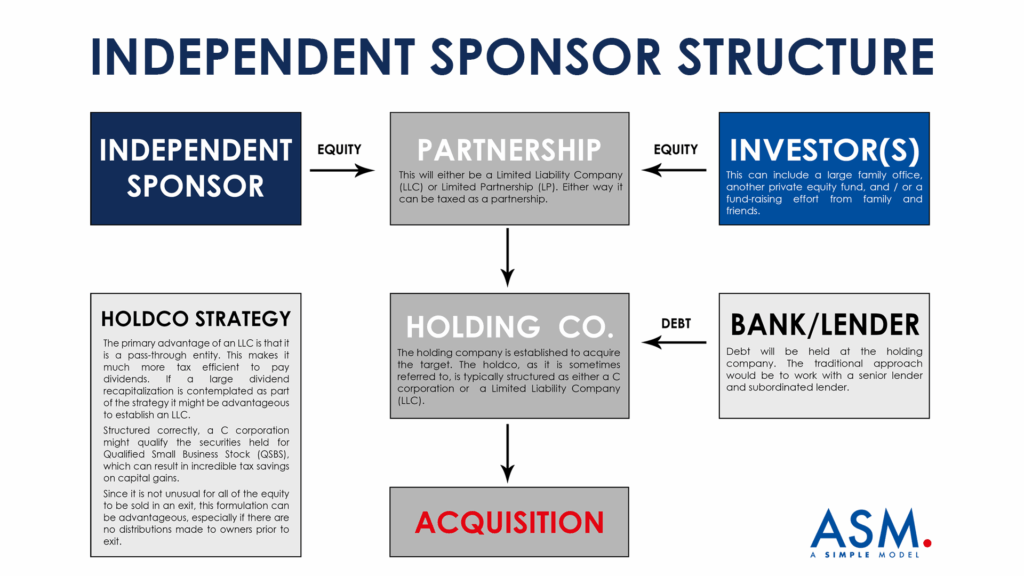

To understand the structure, imagine CrowdStreet as a three-part system:

- CrowdStreet Marketplace – the online platform that lists investment opportunities and connects investors with sponsors (real estate developers and operators).

- CrowdStreet Capital – the broker-dealer arm that manages securities transactions, investor qualifications, and regulatory compliance.

- CrowdStreet Advisors – the advisory branch that offers portfolio management and professional guidance for investors who want a managed approach.

Each of these parts plays a distinct role, but CrowdStreet Capital is the one that ensures all deals happen within the legal framework required for securities offerings.

How CrowdStreet Capital Impacts the Investor Experience

When you invest in a property or real estate fund through CrowdStreet, you may not notice CrowdStreet Capital working in the background but it’s active at every stage of the process.

Investor Accreditation

Because most CrowdStreet deals are offered under Regulation D (which requires investors to be accredited), CrowdStreet Capital verifies your accreditation status. This means confirming that you meet income or net worth thresholds before you can invest.

This process is necessary to comply with SEC regulations and to make sure that each investor understands the risks of private real estate deals.

Legal Documentation and Disclosures

Every investment listed on the platform must include detailed offering documents: business plans, financial projections, risk factors, fee breakdowns, and sponsor information. CrowdStreet Capital reviews these materials and ensures they meet broker-dealer disclosure requirements.

This provides investors with transparency and confidence that all necessary information is disclosed before they commit their funds.

Handling of Funds and Transactions

When an investor commits to a deal, CrowdStreet Capital helps manage the process of transferring funds into escrow, verifying legal documents, and finalizing the investment once all conditions are met.

Later, when the project generates returns, the broker-dealer ensures distributions are made according to the offering documents and that investors receive proper reporting and tax forms.

Compliance with Federal and State Laws

Real estate deals often cross multiple state boundaries, which means a patchwork of “blue sky” laws come into play. CrowdStreet Capital handles compliance for all these jurisdictions, making it possible for investors across the country to participate in deals seamlessly.

Benefits of Using a Broker-Dealer Structure Like CrowdStreet Capital

Having a regulated broker-dealer inside the CrowdStreet ecosystem provides important advantages for both investors and sponsors. Below are some of the most meaningful benefits explained clearly and practically.

1. Legal Compliance and Investor Protection

Because CrowdStreet Capital is a registered broker-dealer, it must follow strict SEC and FINRA rules. This ensures that each offering is reviewed, disclosures are complete, and investors are properly qualified.

It also adds a layer of accountability: CrowdStreet Capital must operate under ongoing oversight, regular audits, and compliance checks. That provides investors with more protection compared to unregulated or loosely structured crowdfunding platforms.

2. Consistency and Transparency

When investors view multiple offerings on CrowdStreet, they can expect consistent information and disclosures. That’s because CrowdStreet Capital enforces standardized reporting across all deals.

Transparency builds confidence investors can easily compare deal terms, projected returns, and sponsor performance because each offering must meet the same regulatory standards.

3. Efficiency and Simplicity

Without a broker-dealer, investors would need to handle much of the paperwork, verification, and compliance individually for each sponsor. CrowdStreet Capital streamlines everything.

The entire process from reviewing deals to completing investments happens inside one system. Investors can sign documents electronically, transfer funds, and track performance without leaving the platform.

4. Scalable Access to Nationwide Deals

Because CrowdStreet Capital manages legal registration and securities compliance across states, the platform can offer deals from different regions in the U.S. without requiring investors to navigate local laws themselves.

This allows investors to diversify geographically and participate in a wide range of asset types from apartment complexes to office developments all within one ecosystem.

5. Data and Reporting Accuracy

CrowdStreet Capital ensures that investor reporting, tax documents, and payment distributions are accurate and compliant. This means that when an investor receives returns, profit reports, or K-1 tax forms, they’re processed through a regulated system with oversight not just by the sponsors themselves.

Real-World Examples of CrowdStreet Capital in Action

To make these ideas more tangible, let’s explore how CrowdStreet Capital operates behind the scenes in real-world scenarios.

Example 1: Direct Equity Investment in an Apartment Building

A real estate developer wants to raise $10 million in equity for a 300-unit apartment project. After CrowdStreet’s team reviews the project, CrowdStreet Capital handles the offering.

Investors see the listing on the CrowdStreet Marketplace, review financial details and risks, and invest directly through the platform. CrowdStreet Capital manages the legal documentation, verifies accreditation, and oversees the fund transfer into escrow. Once the deal closes, it also handles reporting and distributions as the property generates returns.

This process makes it possible for hundreds of investors to legally invest in a large private project something that would otherwise be complex or inaccessible.

Example 2: Real Estate Fund Offering

CrowdStreet often lists real estate funds that invest in multiple properties instead of a single asset. For example, a fund might raise $50 million to acquire a mix of industrial and multifamily properties.

CrowdStreet Capital oversees the entire securities issuance, subscription process, and investor communication. It ensures the fund follows regulations while managing capital inflows and distributions efficiently.

This example shows how the broker-dealer model enables diversified, large-scale investments under a single regulated structure.

Example 3: Sponsor Capital Raise

Real estate sponsors developers and operators often use CrowdStreet to raise capital. CrowdStreet Capital facilitates this process, managing investor documentation, marketing materials, and compliance checks.

By handling these complex steps, the broker-dealer allows sponsors to focus on managing the actual project rather than navigating securities law. Investors benefit by getting access to more professionally structured deals.

Example 4: Follow-On Funding or Capital Calls

In some cases, projects require additional capital later in development for example, to handle construction cost increases or property improvements. CrowdStreet Capital allows sponsors to conduct follow-on capital raises within the same legal structure.

This flexibility helps investors and sponsors respond quickly to project needs while staying compliant with securities regulations.

Use Cases: Why Understanding CrowdStreet Capital Matters

Knowing how CrowdStreet Capital works gives investors an edge when evaluating deals. Here are practical situations where that knowledge makes a difference.

1. Assessing Fee Transparency

When comparing crowdfunding platforms, an investor who understands the broker-dealer model can better interpret how fees are structured. Broker-dealers must disclose all commissions, sponsor fees, and placement fees so investors have clearer visibility into the true costs.

2. Managing Regulatory Risk

Investing in real estate offerings without a registered broker-dealer increases regulatory risk. If the offering violates securities law, investors could face complications. With CrowdStreet Capital in place, investors can trust that deals are reviewed and structured according to established standards.

3. Participating in Multi-State Deals

Investors can easily invest in projects from different regions without worrying about whether those offerings are registered in their state. CrowdStreet Capital handles those legal complexities, simplifying diversification.

4. Handling Project Exits and Distributions

When a project is sold and profits are distributed, CrowdStreet Capital ensures that the funds are handled according to the offering documents and investor agreements. That structure helps prevent delays and ensures accountability.

5. Gaining Confidence in Sponsor Quality

Because CrowdStreet Capital reviews sponsor credentials, track records, and deal assumptions before listing them, investors can feel more confident that projects meet professional standards before appearing on the marketplace.

Potential Limitations and Risks

While the broker-dealer structure adds safety and organization, investors should remain aware of several important limitations:

- It does not eliminate investment risk. Projects can still fail due to poor management or market changes.

- Fees still exist. Although transparent, offerings often include management or sponsor fees that can affect returns.

- Limited liquidity. Investments through CrowdStreet are generally long-term and cannot be easily sold.

- Accredited investor requirement. Many deals are restricted to those who meet income or net worth qualifications.

- Platform dependency. While CrowdStreet Capital is regulated, the platform’s overall health and reputation still matter.

Understanding these limits helps investors make realistic decisions and perform proper due diligence.

Benefits of Technology in the CrowdStreet Capital System

Technology is central to how CrowdStreet Capital operates efficiently. The platform uses secure digital systems to handle everything from accreditation checks to capital transfers and investor communication.

Here’s how technology enhances the experience:

- Automation of compliance processes – Verification, document management, and investor tracking happen digitally, reducing manual errors.

- Real-time transparency – Investors can see the status of their deals, documents, and performance dashboards instantly.

- Data security – Financial and personal information is protected by encryption and regulatory standards.

- Scalability – Technology enables thousands of investors to participate in complex deals simultaneously without delays.

By combining regulatory structure with modern fintech tools, CrowdStreet Capital delivers a streamlined, reliable investing experience.

Key Takeaways for Investors

Understanding CrowdStreet Capital helps investors make more informed choices. Here are the most important lessons:

- CrowdStreet Capital is the legal broker-dealer that makes all securities offerings possible on the CrowdStreet platform.

- It ensures compliance with SEC and FINRA regulations, protecting investors and sponsors alike.

- It handles transactions, funds, and disclosures, simplifying the investing process.

- It adds credibility and oversight, which improves transparency and investor confidence.

- It does not remove investment risk, but it does provide a regulated environment where risks are better understood and managed.

Frequently Asked Questions

Q1: Is CrowdStreet Capital the same as CrowdStreet?

No. CrowdStreet is the online platform that lists real estate investment opportunities. CrowdStreet Capital is the licensed broker-dealer that legally manages the transactions and ensures compliance with securities regulations.

Q2: Does CrowdStreet Capital charge investors directly?

CrowdStreet Capital does not usually charge investors directly. Instead, any broker or placement fees are typically included in the project’s cost structure and disclosed within the offering documents.

Q3: Does the broker-dealer structure make investments safer?

It makes them more regulated and transparent, but not risk-free. Real estate investments still depend on market performance, sponsor management, and timing. The broker-dealer adds compliance and oversight, not guaranteed returns.